Question

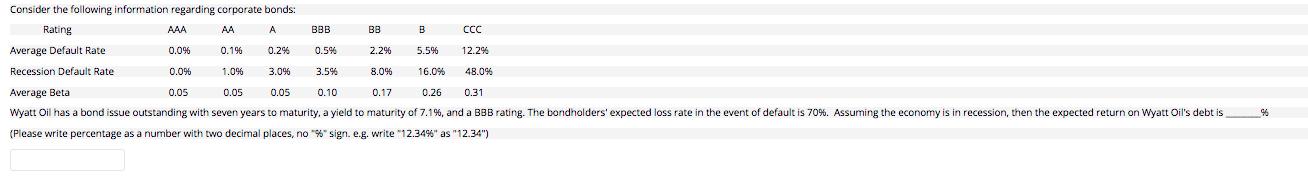

Consider the following information regarding corporate bonds: Rating AA A BB B CCC 0.5% 5.5% 12.2% 0.196 1.0% 0.2% 3.0% 2.2% 8.0% 3.5% 16.0%

Consider the following information regarding corporate bonds: Rating AA A BB B CCC 0.5% 5.5% 12.2% 0.196 1.0% 0.2% 3.0% 2.2% 8.0% 3.5% 16.0% 48.0% Average Beta 0.05 0.05 0.10 0.17 0.26 0.31 Wyatt Oil has a bond issue outstanding with seven years to maturity, a yield to maturity of 7.1% , and a BBB rating. The bondholders' expected loss rate in the event of default is 70% . Assuming the economy is in recession, then the expected return on Wyatt Oil's debt is (Please write percentage as a number with two decimal places, no "%" sign. e.g. write "12.34%" as "12.34") Average Default Rate Recession Default Rate AAA 0.0% 0.0% 0.05 BBB

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Wyatt Oils bond has a BBB rating From the table the recessi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Understanding Basic Statistics

Authors: Charles Henry Brase, Corrinne Pellillo Brase

6th Edition

978-1133525097, 1133525091, 1111827028, 978-1133110316, 1133110312, 978-1111827021

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App