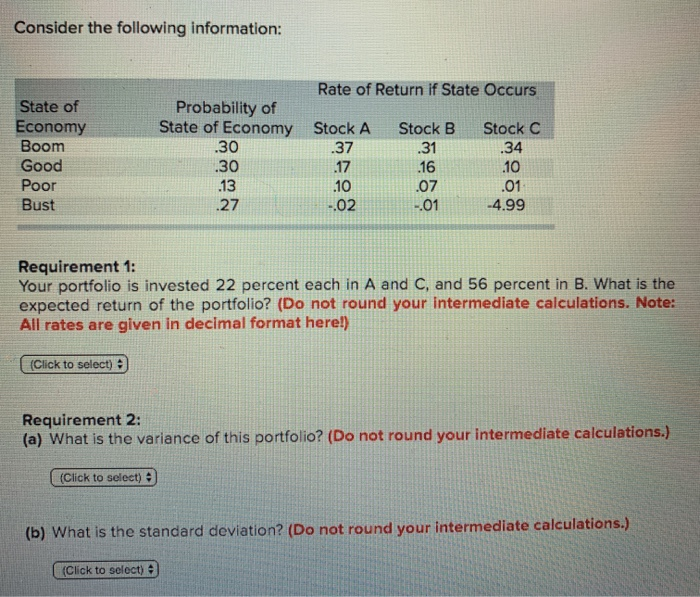

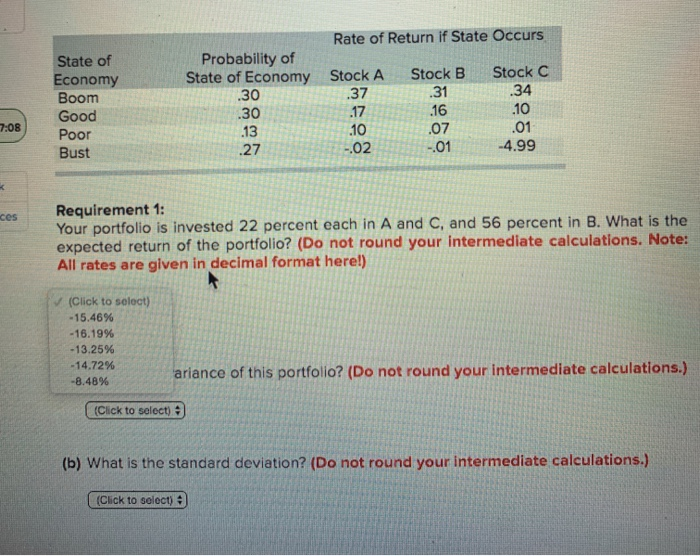

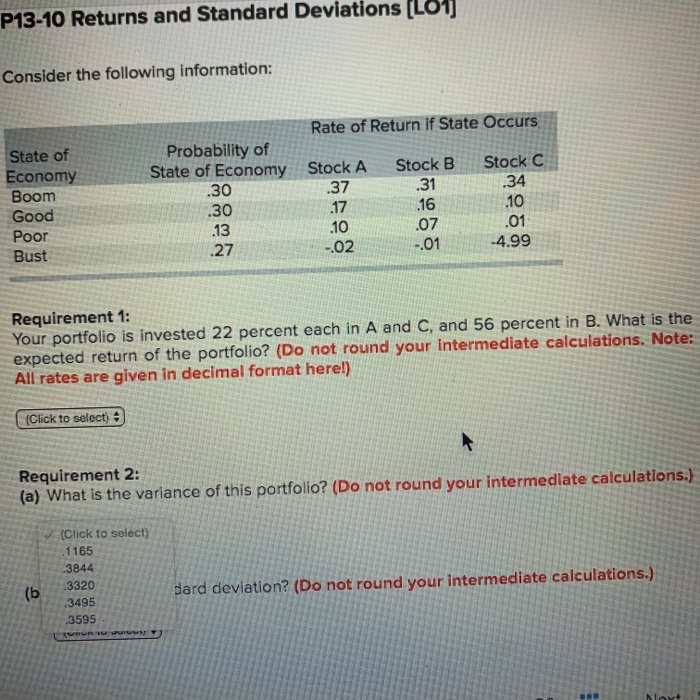

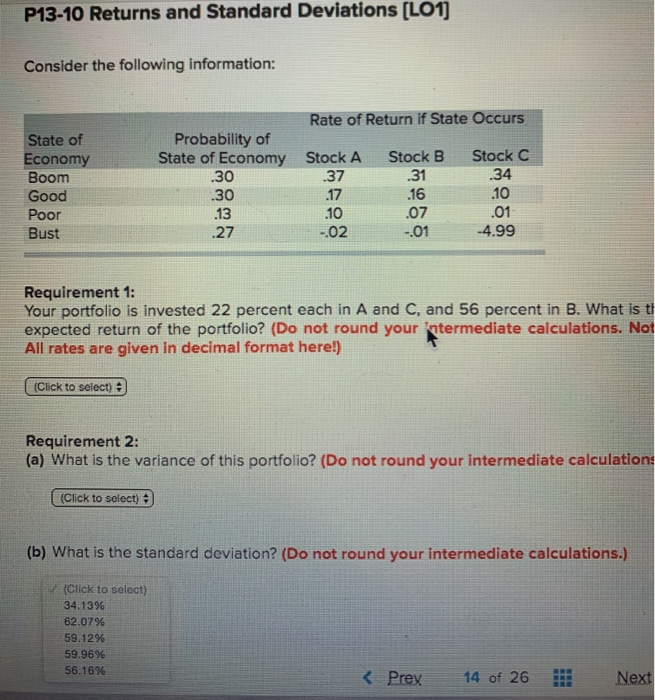

Consider the following information: State of Economy Boom Good Poor Bust Rate of Return if State Occurs Probability of State of Economy Stock A Stock B Stock C .37 .30 .07 -.01 -4.99 .30 04 Requirement 1: Your portfolio is invested 22 percent each in A and C, and 56 percent in B. What is the expected return of the portfolio? (Do not round your intermediate calculations. Note: All rates are given in decimal format here!) (Click to select) Requirement 2: (a) What is the variance of this portfolio? (Do not round your intermediate calculations.) (Click to select) (b) What is the standard deviation? (Do not round your intermediate calculations.) (Click to select) Rate of Return if State Occurs Probability of State of Economy .30 Stock A Stock B .31 Stock C 34 .37 State of Economy Boom Good Poor Bust -4.99 ces Requirement 1: Your portfolio is invested 22 percent each in A and C, and 56 percent in B. What is the expected return of the portfolio? (Do not round your intermediate calculations. Note: All rates are given in decimal format here!) (Click to select) -15.46% -16.19% -13.25% - 14.72% -8.48% 'ariance of this portfolio? (Do not round your intermediate calculations.) (Click to select) (b) What is the standard deviation? (Do not round your intermediate calculations.) (Click to select) P13-10 Returns and Standard Deviations (L01J Consider the following information: State of Economy Boom Good Poor Bust Rate of Return if State Occurs Probability of State of Economy Stock A Stock B Stock C .30 .16 10 .07 -4.99 01 Requirement 1: Your portfolio is invested 22 percent each in A and C, and 56 percent in B. What is the expected return of the portfolio? (Do not round your intermediate calculations. Note: All rates are given in decimal format here!) (Click to select) 9 Requirement 2: (a) What is the variance of this portfolio? (Do not round your intermediate calculations.) (Click to select) 1165 3844 3320 .3495 3595 H uru (b dard deviation? (Do not round your intermediate calculations.) P13-10 Returns and Standard Deviations (L01] Consider the following information: Rate of Return if State Occurs Probability of State of Economy Stock A Stock B Stock C .30 .37 .31 .34 State of Economy Boom Good Poor Bust -.01 01 -4.99 Requirement 1: Your portfolio is invested 22 percent each in A and C, and 56 percent in B. What is ti expected return of the portfolio? (Do not round your intermediate calculations. Not All rates are given in decimal format here!) (Click to select) Requirement 2: (a) What is the variance of this portfolio? (Do not round your intermediate calculation: (Click to select) (b) What is the standard deviation? (Do not round your intermediate calculations.) (Click to select) 34.13% 62.07% 59.12% 59.96% 56.16%