Answered step by step

Verified Expert Solution

Question

1 Approved Answer

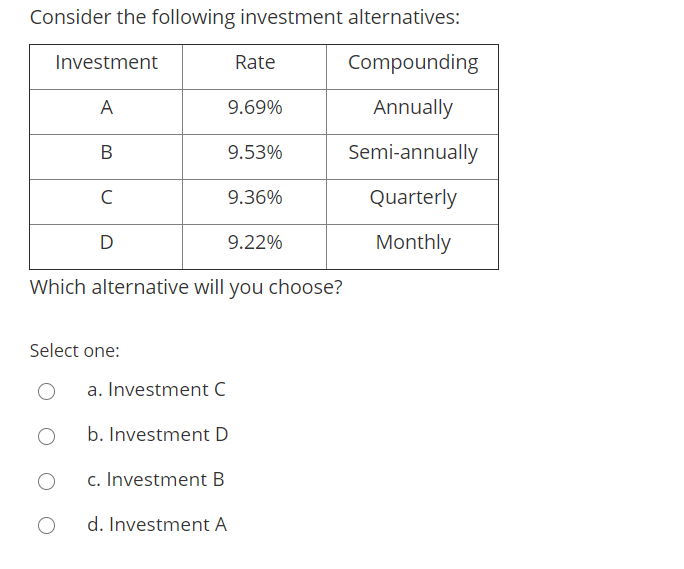

Consider the following investment alternatives: Investment Rate Compounding A 9.69% Annually B 9.53% Semi-annually 9.36% Quarterly D 9.22% Monthly Which alternative will you choose? Select

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started