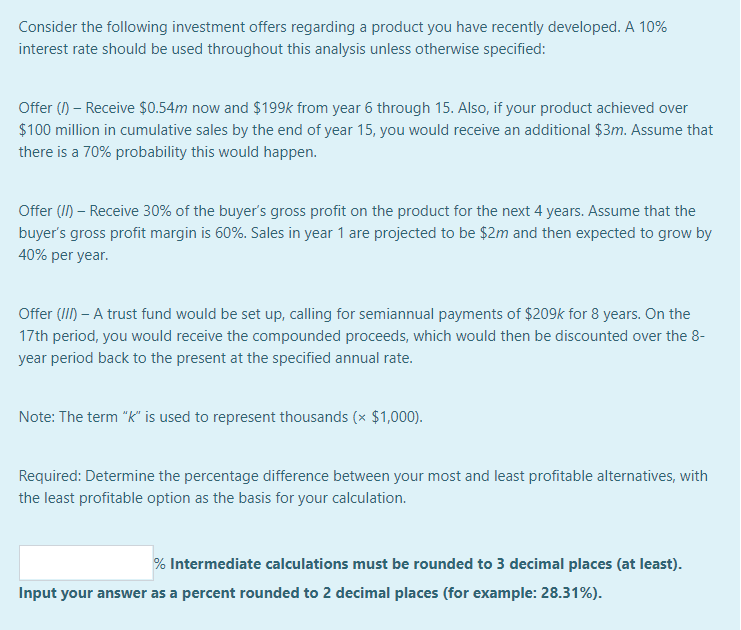

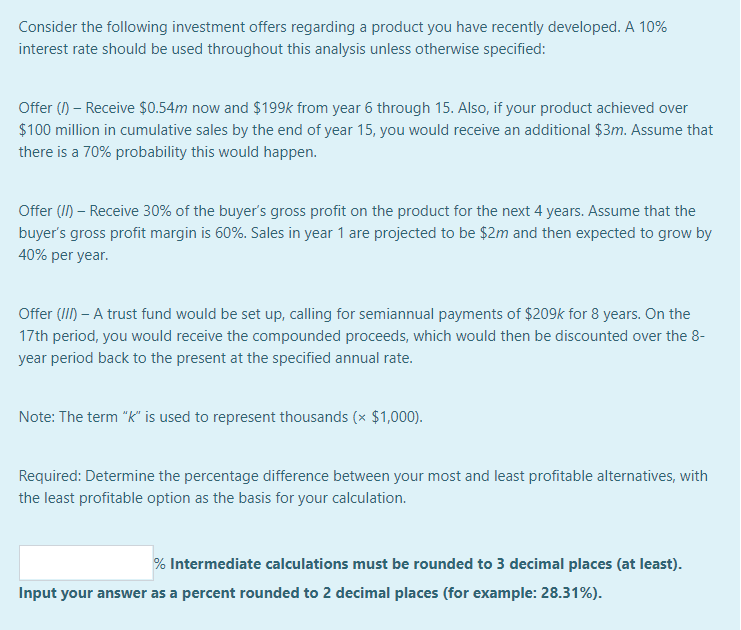

Consider the following investment offers regarding a product you have recently developed. A 10% interest rate should be used throughout this analysis unless otherwise specified: Offer (I) Receive $0.54m now and $199k from year 6 through 15. Also, if your product achieved over $100 million in cumulative sales by the end of year 15, you would receive an additional $3m. Assume that there is a 70% probability this would happen. Offer (II) Receive 30% of the buyers gross profit on the product for the next 4 years. Assume that the buyers gross profit margin is 60%. Sales in year 1 are projected to be $2m and then expected to grow by 40% per year. Offer (III) A trust fund would be set up, calling for semiannual payments of $209k for 8 years. On the 17th period, you would receive the compounded proceeds, which would then be discounted over the 8-year period back to the present at the specified annual rate. Note: The term k is used to represent thousands ( $1,000). Required: Determine the percentage difference between your most and least profitable alternatives, with the least profitable option as the basis for your calculation

please give me the final answer and highlight it :).

Consider the following investment offers regarding a product you have recently developed. A 10% interest rate should be used throughout this analysis unless otherwise specified: Offer (1) - Receive $0.54m now and $199k from year 6 through 15. Also, if your product achieved over $100 million in cumulative sales by the end of year 15, you would receive an additional $3m. Assume that there is a 70% probability this would happen. Offer (II) Receive 30% of the buyer's gross profit on the product for the next 4 years. Assume that the buyer's gross profit margin is 60%. Sales in year 1 are projected to be $2m and then expected to grow by 40% per year. Offer (II) A trust fund would be set up, calling for semiannual payments of $209k for 8 years. On the 17th period, you would receive the compounded proceeds, which would then be discounted over the 8- year period back to the present at the specified annual rate. Note: The term "K" is used to represent thousands (* $1,000). Required: Determine the percentage difference between your most and least profitable alternatives, with the least profitable option as the basis for your calculation. % Intermediate calculations must be rounded to 3 decimal places (at least). Input your answer as a percent rounded to 2 decimal places (for example: 28.31%). Consider the following investment offers regarding a product you have recently developed. A 10% interest rate should be used throughout this analysis unless otherwise specified: Offer (1) - Receive $0.54m now and $199k from year 6 through 15. Also, if your product achieved over $100 million in cumulative sales by the end of year 15, you would receive an additional $3m. Assume that there is a 70% probability this would happen. Offer (II) Receive 30% of the buyer's gross profit on the product for the next 4 years. Assume that the buyer's gross profit margin is 60%. Sales in year 1 are projected to be $2m and then expected to grow by 40% per year. Offer (II) A trust fund would be set up, calling for semiannual payments of $209k for 8 years. On the 17th period, you would receive the compounded proceeds, which would then be discounted over the 8- year period back to the present at the specified annual rate. Note: The term "K" is used to represent thousands (* $1,000). Required: Determine the percentage difference between your most and least profitable alternatives, with the least profitable option as the basis for your calculation. % Intermediate calculations must be rounded to 3 decimal places (at least). Input your answer as a percent rounded to 2 decimal places (for example: 28.31%)