Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following investment strategies. a) Suppose you are to invest $100 into Bond A, which can default with 9% probability. If it defaults, you

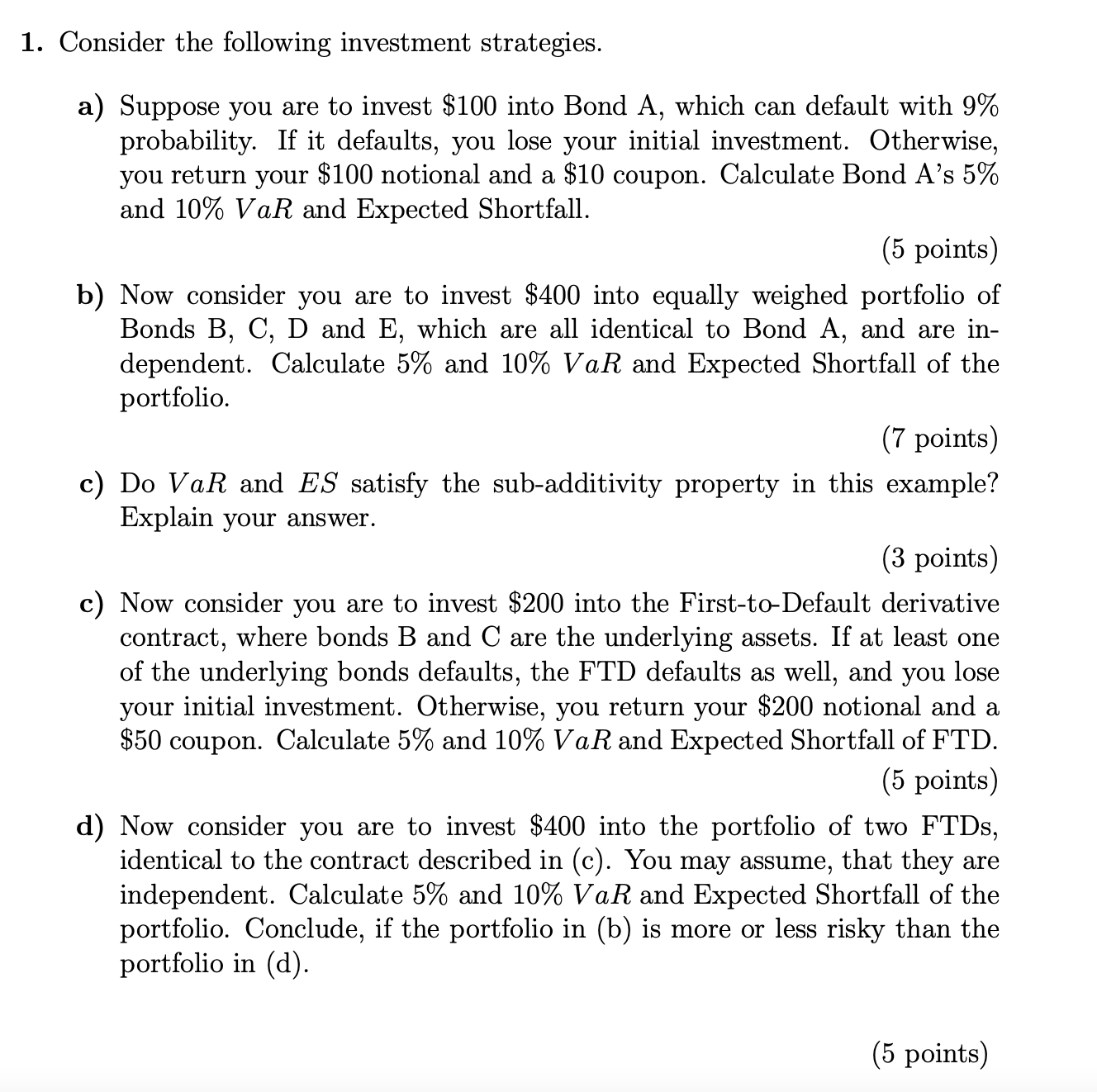

Consider the following investment strategies. a) Suppose you are to invest $100 into Bond A, which can default with 9% probability. If it defaults, you lose your initial investment. Otherwise, you return your $100 notional and a $10 coupon. Calculate Bond A's 5% and 10%VaR and Expected Shortfall. (5 points ) b) Now consider you are to invest $400 into equally weighed portfolio of Bonds B, C, D and E, which are all identical to Bond A, and are independent. Calculate 5% and 10%VaR and Expected Shortfall of the portfolio. (7 points) c) Do VaR and ES satisfy the sub-additivity property in this example? Explain your answer. (3 points ) c) Now consider you are to invest $200 into the First-to-Default derivative contract, where bonds B and C are the underlying assets. If at least one of the underlying bonds defaults, the FTD defaults as well, and you lose your initial investment. Otherwise, you return your $200 notional and a $50 coupon. Calculate 5% and 10%VaR and Expected Shortfall of FTD. (5 points ) d) Now consider you are to invest $400 into the portfolio of two FTDs, identical to the contract described in (c). You may assume, that they are independent. Calculate 5% and 10%VaR and Expected Shortfall of the portfolio. Conclude, if the portfolio in (b) is more or less risky than the portfolio in (d). (5 points) Consider the following investment strategies. a) Suppose you are to invest $100 into Bond A, which can default with 9% probability. If it defaults, you lose your initial investment. Otherwise, you return your $100 notional and a $10 coupon. Calculate Bond A's 5% and 10%VaR and Expected Shortfall. (5 points ) b) Now consider you are to invest $400 into equally weighed portfolio of Bonds B, C, D and E, which are all identical to Bond A, and are independent. Calculate 5% and 10%VaR and Expected Shortfall of the portfolio. (7 points) c) Do VaR and ES satisfy the sub-additivity property in this example? Explain your answer. (3 points ) c) Now consider you are to invest $200 into the First-to-Default derivative contract, where bonds B and C are the underlying assets. If at least one of the underlying bonds defaults, the FTD defaults as well, and you lose your initial investment. Otherwise, you return your $200 notional and a $50 coupon. Calculate 5% and 10%VaR and Expected Shortfall of FTD. (5 points ) d) Now consider you are to invest $400 into the portfolio of two FTDs, identical to the contract described in (c). You may assume, that they are independent. Calculate 5% and 10%VaR and Expected Shortfall of the portfolio. Conclude, if the portfolio in (b) is more or less risky than the portfolio in (d). (5 points)

Consider the following investment strategies. a) Suppose you are to invest $100 into Bond A, which can default with 9% probability. If it defaults, you lose your initial investment. Otherwise, you return your $100 notional and a $10 coupon. Calculate Bond A's 5% and 10%VaR and Expected Shortfall. (5 points ) b) Now consider you are to invest $400 into equally weighed portfolio of Bonds B, C, D and E, which are all identical to Bond A, and are independent. Calculate 5% and 10%VaR and Expected Shortfall of the portfolio. (7 points) c) Do VaR and ES satisfy the sub-additivity property in this example? Explain your answer. (3 points ) c) Now consider you are to invest $200 into the First-to-Default derivative contract, where bonds B and C are the underlying assets. If at least one of the underlying bonds defaults, the FTD defaults as well, and you lose your initial investment. Otherwise, you return your $200 notional and a $50 coupon. Calculate 5% and 10%VaR and Expected Shortfall of FTD. (5 points ) d) Now consider you are to invest $400 into the portfolio of two FTDs, identical to the contract described in (c). You may assume, that they are independent. Calculate 5% and 10%VaR and Expected Shortfall of the portfolio. Conclude, if the portfolio in (b) is more or less risky than the portfolio in (d). (5 points) Consider the following investment strategies. a) Suppose you are to invest $100 into Bond A, which can default with 9% probability. If it defaults, you lose your initial investment. Otherwise, you return your $100 notional and a $10 coupon. Calculate Bond A's 5% and 10%VaR and Expected Shortfall. (5 points ) b) Now consider you are to invest $400 into equally weighed portfolio of Bonds B, C, D and E, which are all identical to Bond A, and are independent. Calculate 5% and 10%VaR and Expected Shortfall of the portfolio. (7 points) c) Do VaR and ES satisfy the sub-additivity property in this example? Explain your answer. (3 points ) c) Now consider you are to invest $200 into the First-to-Default derivative contract, where bonds B and C are the underlying assets. If at least one of the underlying bonds defaults, the FTD defaults as well, and you lose your initial investment. Otherwise, you return your $200 notional and a $50 coupon. Calculate 5% and 10%VaR and Expected Shortfall of FTD. (5 points ) d) Now consider you are to invest $400 into the portfolio of two FTDs, identical to the contract described in (c). You may assume, that they are independent. Calculate 5% and 10%VaR and Expected Shortfall of the portfolio. Conclude, if the portfolio in (b) is more or less risky than the portfolio in (d). (5 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started