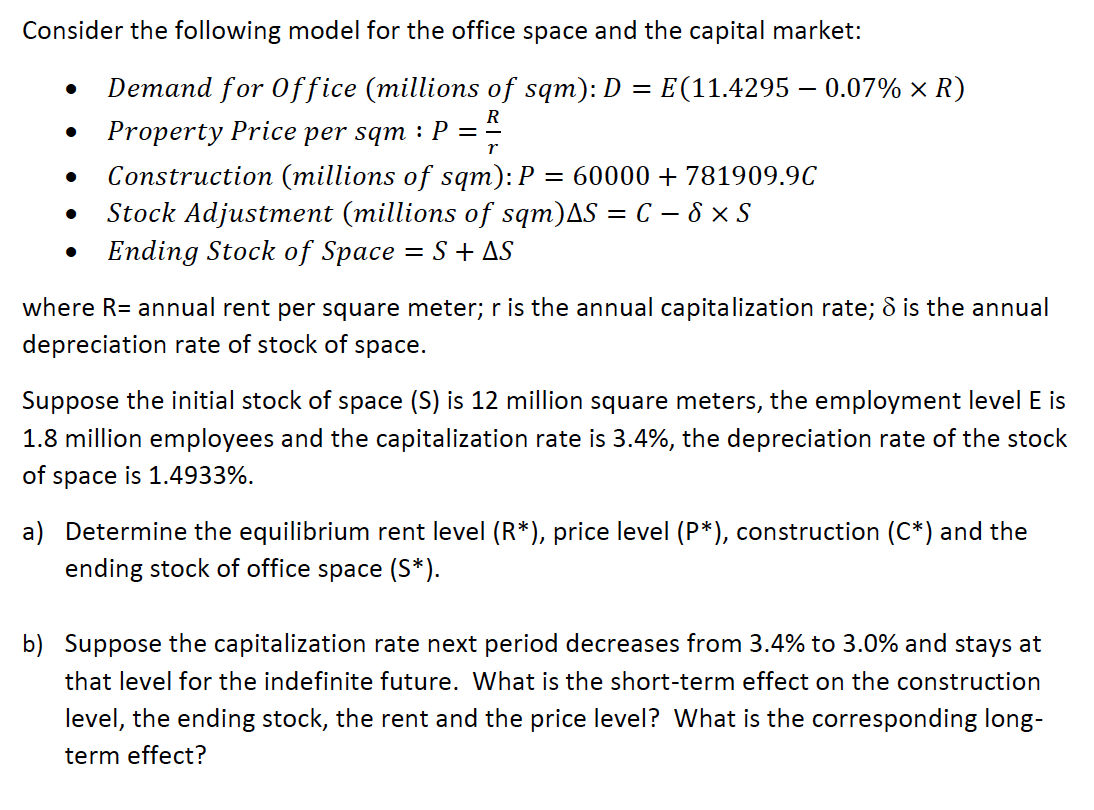

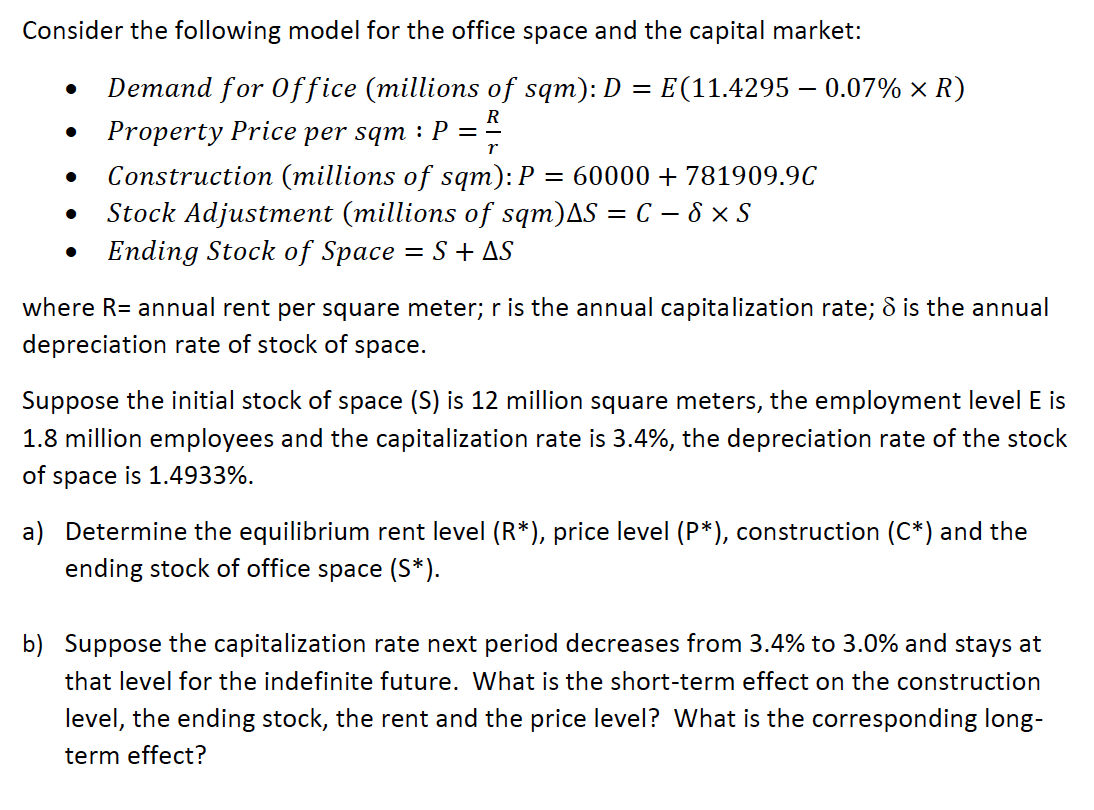

Consider the following model for the office space and the capital market: R r Demand for Office (millions of sqm): D = E(11.4295 0.07% * R) Property Price per sqm : P Construction (millions of sqm): P = 60000 + 781909.90 Stock Adjustment (millions of sqm) S = (-8xS Ending Stock of Space = S +AS . . where R= annual rent per square meter; r is the annual capitalization rate; & is the annual depreciation rate of stock of space. Suppose the initial stock of space (S) is 12 million square meters, the employment level E is 1.8 million employees and the capitalization rate is 3.4%, the depreciation rate of the stock of space is 1.4933%. a) Determine the equilibrium rent level (R*), price level (P*), construction (C*) and the ending stock of office space (S*). b) Suppose the capitalization rate next period decreases from 3.4% to 3.0% and stays at that level for the indefinite future. What is the short-term effect on the construction level, the ending stock, the rent and the price level? What is the corresponding long- term effect? Consider the following model for the office space and the capital market: R r Demand for Office (millions of sqm): D = E(11.4295 0.07% * R) Property Price per sqm : P Construction (millions of sqm): P = 60000 + 781909.90 Stock Adjustment (millions of sqm) S = (-8xS Ending Stock of Space = S +AS . . where R= annual rent per square meter; r is the annual capitalization rate; & is the annual depreciation rate of stock of space. Suppose the initial stock of space (S) is 12 million square meters, the employment level E is 1.8 million employees and the capitalization rate is 3.4%, the depreciation rate of the stock of space is 1.4933%. a) Determine the equilibrium rent level (R*), price level (P*), construction (C*) and the ending stock of office space (S*). b) Suppose the capitalization rate next period decreases from 3.4% to 3.0% and stays at that level for the indefinite future. What is the short-term effect on the construction level, the ending stock, the rent and the price level? What is the corresponding long- term effect