Answered step by step

Verified Expert Solution

Question

1 Approved Answer

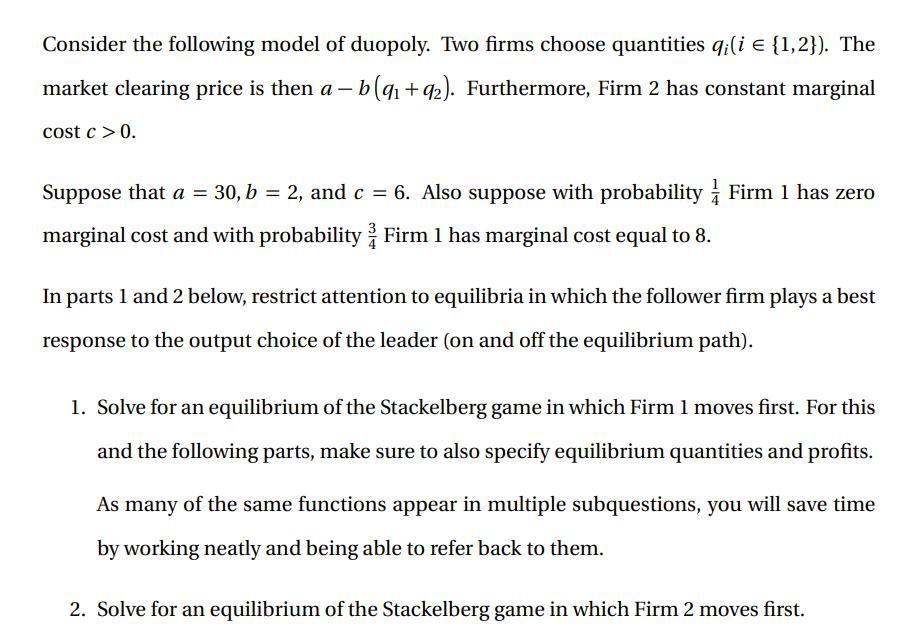

Consider the following model of duopoly. Two firms choose quantities qi(i = {1,2}). The market clearing price is then a b (q+92). Furthermore, Firm

Consider the following model of duopoly. Two firms choose quantities qi(i = {1,2}). The market clearing price is then a b (q+92). Furthermore, Firm 2 has constant marginal cost c > 0. - Suppose that a = 30, b = 2, and c = 6. Also suppose with probability Firm 1 has zero marginal cost and with probability / Firm 1 has marginal cost equal to 8. In parts 1 and 2 below, restrict attention to equilibria in which the follower firm plays a best response to the output choice of the leader (on and off the equilibrium path). 1. Solve for an equilibrium of the Stackelberg game in which Firm 1 moves first. For this and the following parts, make sure to also specify equilibrium quantities and profits. As many of the same functions appear in multiple subquestions, you will save time by working neatly and being able to refer back to them. 2. Solve for an equilibrium of the Stackelberg game in which Firm 2 moves first. 3. Solve for a Bayesian Nash equilibrium (BNE) of the simultaneous move game.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started