Answered step by step

Verified Expert Solution

Question

1 Approved Answer

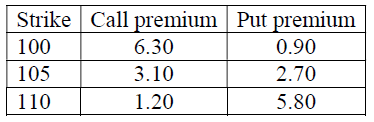

Consider the following options for a stock that is currently trading at 105. a. Construct a call bear spread based on the above table b.

Consider the following options for a stock that is currently trading at 105.

a. Construct a call bear spread based on the above table b. Construct a put bear spread based on the above table c. Do the spreads in the above questions achieve the same objective? Why/Why not? d. Draw the gross and net payoff diagrams corresponding to your answers for (a) and (b) above.

Strike Call premium Put premium 100 6.30 0.90 105 3.10 2.70 110 1.20 5.80Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started