Answered step by step

Verified Expert Solution

Question

1 Approved Answer

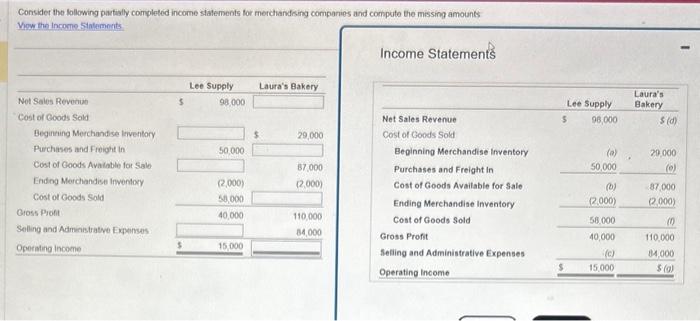

Consider the following partially completed income statements for merchandising companies and compute the missing amounts View the Income Statements Net Sales Revenue Cost of

Consider the following partially completed income statements for merchandising companies and compute the missing amounts View the Income Statements Net Sales Revenue Cost of Goods Sold Beginning Merchandise Inventory Purchases and Freight in Cost of Goods Available for Sale Ending Merchandise Inventory Cost of Goods Sold Gross Profit Selling and Administrative Expenses Operating Income $ $ Lee Supply 98,000 50,000 (2,000) 58,000 40,000 15,000 Laura's Bakery $ 29,000 87,000 (2,000) 110,000 84,000 Income Statements Net Sales Revenue Cost of Goods Sold Beginning Merchandise Inventory Purchases and Freight in Cost of Goods Available for Sale Ending Merchandise Inventory Cost of Goods Sold Gross Profit Selling and Administrative Expenses Operating Income Lee Supply $ 96,000 (a) 50,000 (b) (2.000) 58,000 40,000 (c) 15,000 Laura's Bakery $(d) 29,000 (0) 87,000 (2.000) (1) 110,000 84,000 $ (g) 1

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement An income statement is prepared by the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started