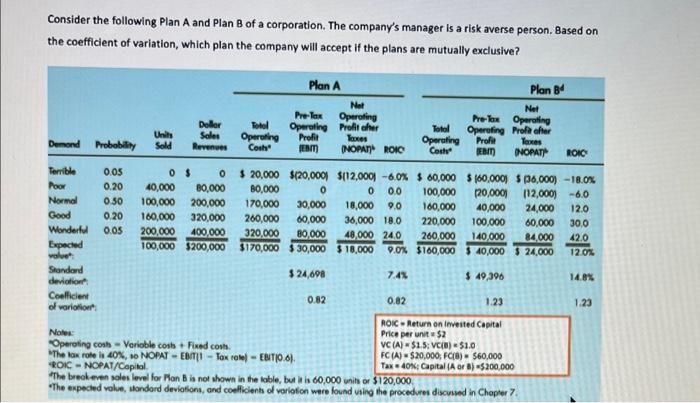

Consider the following Plan A and Plan B of a corporation. The company's manager is a risk averse person. Based on the coefficient of variation, which plan the company will accept if the plans are mutually exclusive? Plan A Net Pre-Tex Operating Operating Profit cher Profil Taxes Em [NOPAT ROIC Doller Sales Revenues Plan B Net Pre-fox Operating Operating Profesor Prole Taxes EBIT INOMAT ROIC Total Operating Cost Units Sold Demand Probability Total Operating Costy Terrible 0.05 0 $ 0 $ 20,000 $420,000 $112,000 -60% $ 60,000 $160,000 $ 36,000) - 18.0% Poor 0.20 40,000 80,000 80,000 o 0 0.0 100,000 (20,000) 112,000) -6.0 Normal 0.50 100,000 200,000 170,000 30,000 18.000 9.0 160,000 40,000 24,000 12.0 Good 0.20 160,000 320,000 200,000 60,000 36,000 18.0 220,000 100,000 60,000 30,0 Wonderful 0.05 200,000 400,000 320,000 80,000 48,000 240 260,000 140.000 84,000 42.0 Expected 100,000 $200,000 $170,000 $30,000 $18,000 0.0% $160,000 $40,000 $ 24,000 12.0% valve Standard $ 24,608 7.4% $ 49,596 14.8% deviation Coelficient 0.82 0.82 1.23 1.23 of various ROIC - Return on invested Capital Notes Price per unit $2 Operating comh-Verloble costs + Fixed costs VC (A) $13: VID) $1.0 The fox role is 40%, 10 NOPAT-E-Tox role - ENT|0.6). FC (A) $20,000, FC) - 560,000 ROK - NOPAT/Capital Tax 40%: Capital (Ard) $200,000 The break even soles level for Mon Bis not shown in the table, but it is 60,000 units of $120,000 "The expected volun, Hordord deviations, and coefficient of variation were found using the procedure discussed in Chapter 7. 12.0% 14.8% 1.23 Expected 100,000 $200,000 $170,000 $30,000 $18,000 0.0% $160,000 $40,000 $ 24,000 valve: Standard $ 24,698 7.4% $ 49,396 deviation Coelficient 0.82 0.82 1.23 of variation ROIC - Return on invested Capital Notes: Price per units $2 VC (A) $1.5; VCB) - $1.0 Operating costs - Variable costs + Fixed costs. The tax role is 40%, 10 NOPAT - EBIT|1 - Tax role) - EBIT10,6). FCIA) $20,000 FCB) - 560,000 ROIC-NOPAT/Copilul Tax. 40%, Capital (A or B) $200.000 "The break even soles level for Plan B is not shown in the table, but it is 60,000 units or $120,000 "The expected volue, Mandard deviations, and coefficients of variation were found using the procedures discussed in Chapter 7. Both Plan A and Plan B Plan B Neither Plan A nor Plan B Plan A