Question

Consider the following problem: Suppose that you hold a 1 million portfolio of 5-year maturity bonds with modified duration 4.5 years and desire to hedge

Consider the following problem:

Suppose that you hold a 1 million portfolio of 5-year maturity bonds with modified duration 4.5 years and desire to hedge your interest rate exposure with Treasury-bond futures. Treasury-bond futures have 20 years to maturity and modified duration 9 years and are currently sold at F0 =90. The futures contract size is 100,000 par value. Suppose that all bonds in the bond and futures markets have 100 par value.

(i) You estimate that the yield on 20-year bond changes by 10 basis points for every 15-basis-point move in the yield on 5-year bonds. How many futures contracts should you sell?

(ii) How would your answer to question (i) change if the yield on 20-year bond changes by 10 basis points for every 10-basis-point move in the yield on 5-year bonds?

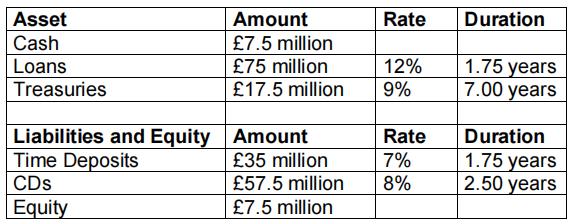

(b) The following information is the balance sheet of Bank A. All interest rates are fixed and paid annually.

Calculate the net interest margin. How is the bank exposed to interest rate increases or decreases? Explain why.

Amount 7.5 million 75 million 17.5 million Asset Cash Loans Treasuries Liabilities and Equity Amount Time Deposits 35 million 57.5 million CDs Equity 7.5 million Rate 12% 9% Rate 7% 8% Duration 1.75 years 7.00 years Duration 1.75 years 2.50 years Amount 7.5 million 75 million 17.5 million Asset Cash Loans Treasuries Liabilities and Equity Amount Time Deposits 35 million 57.5 million CDs Equity 7.5 million Rate 12% 9% Rate 7% 8% Duration 1.75 years 7.00 years Duration 1.75 years 2.50 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started