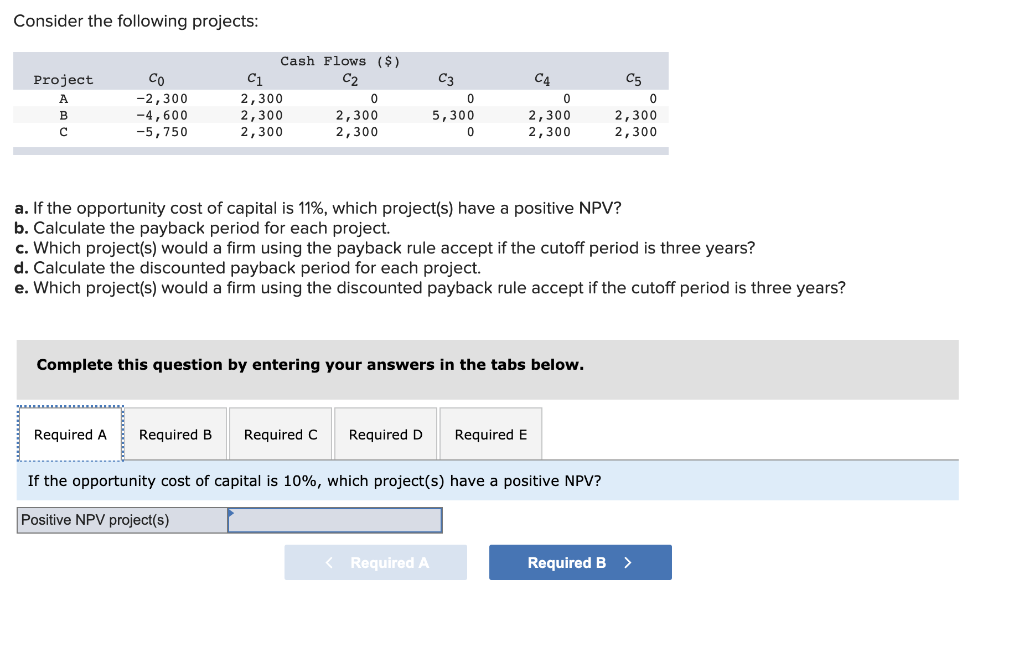

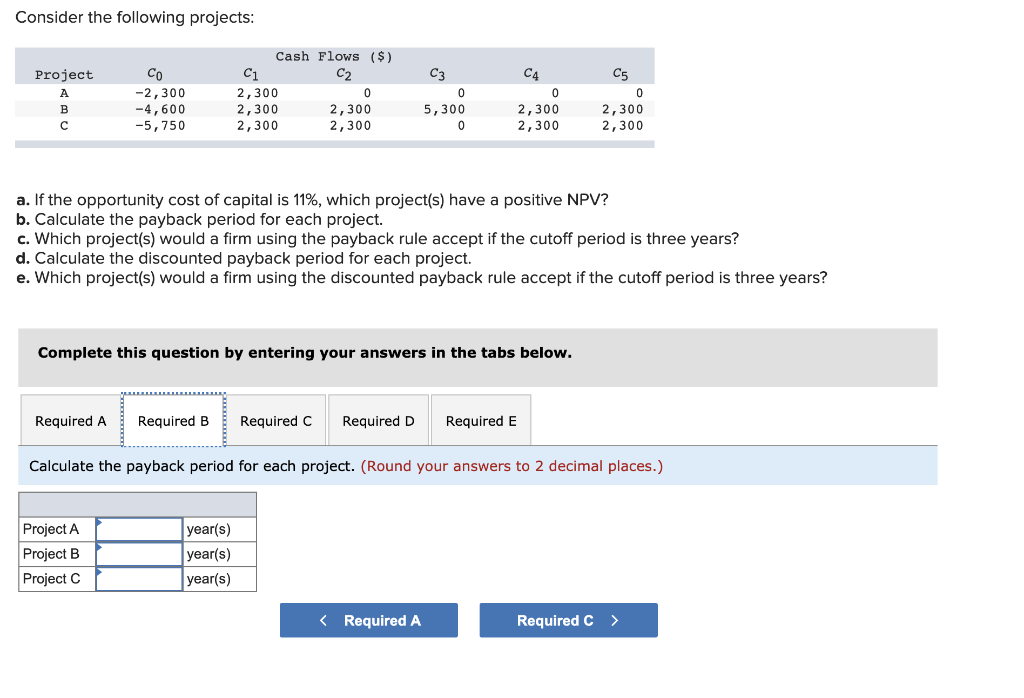

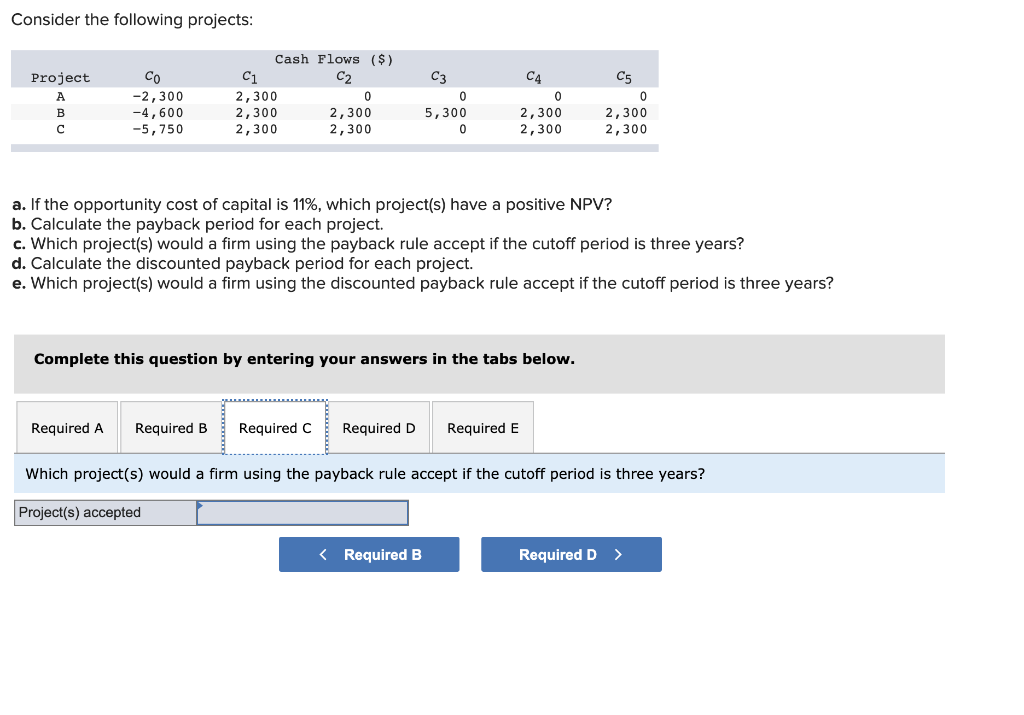

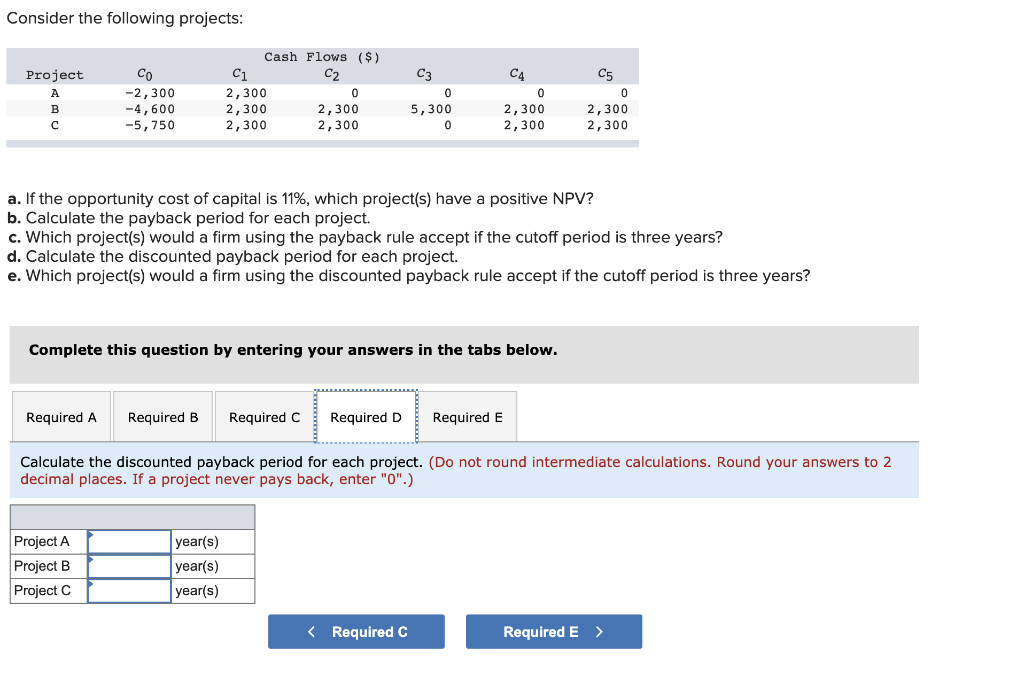

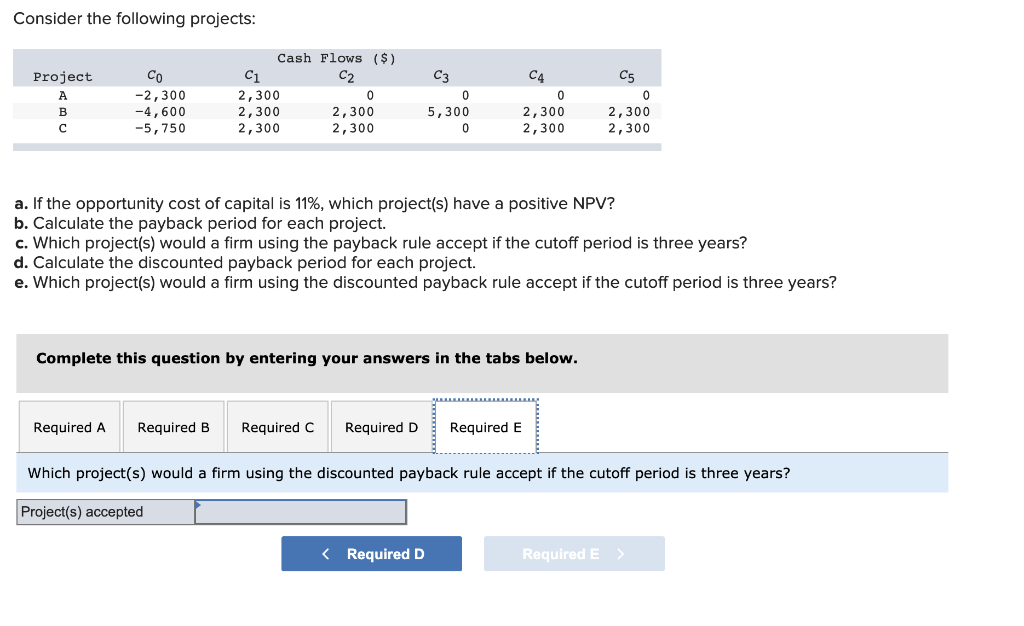

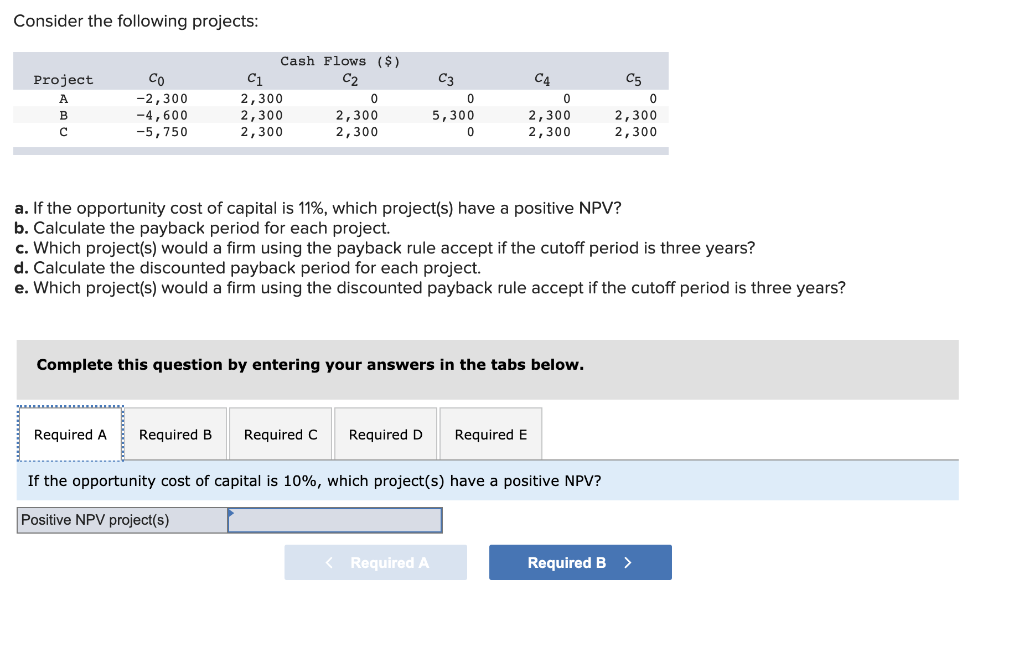

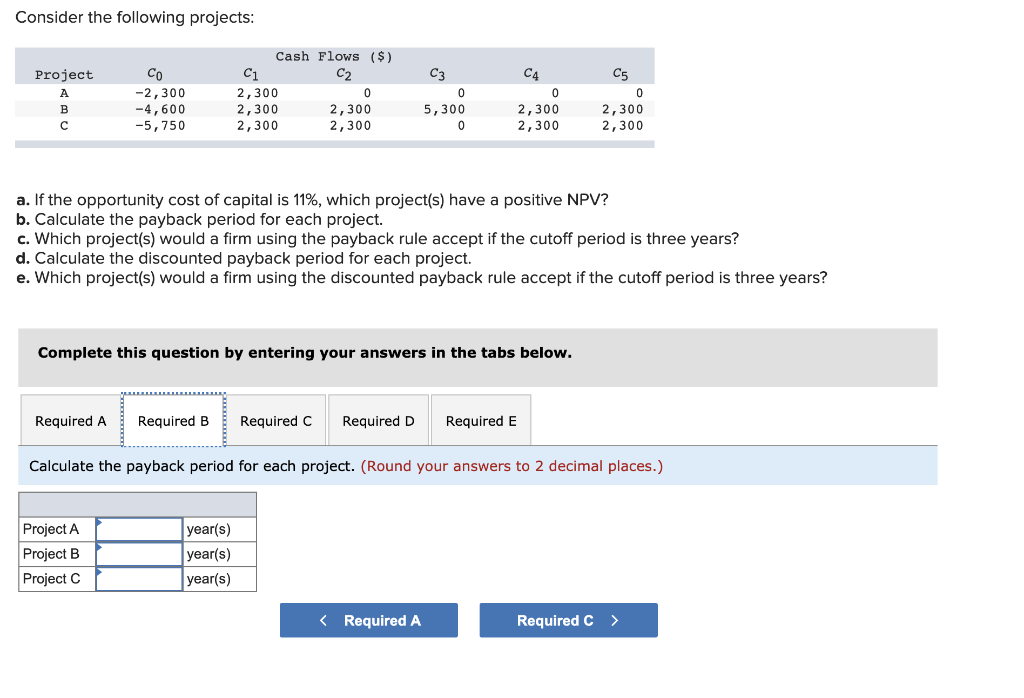

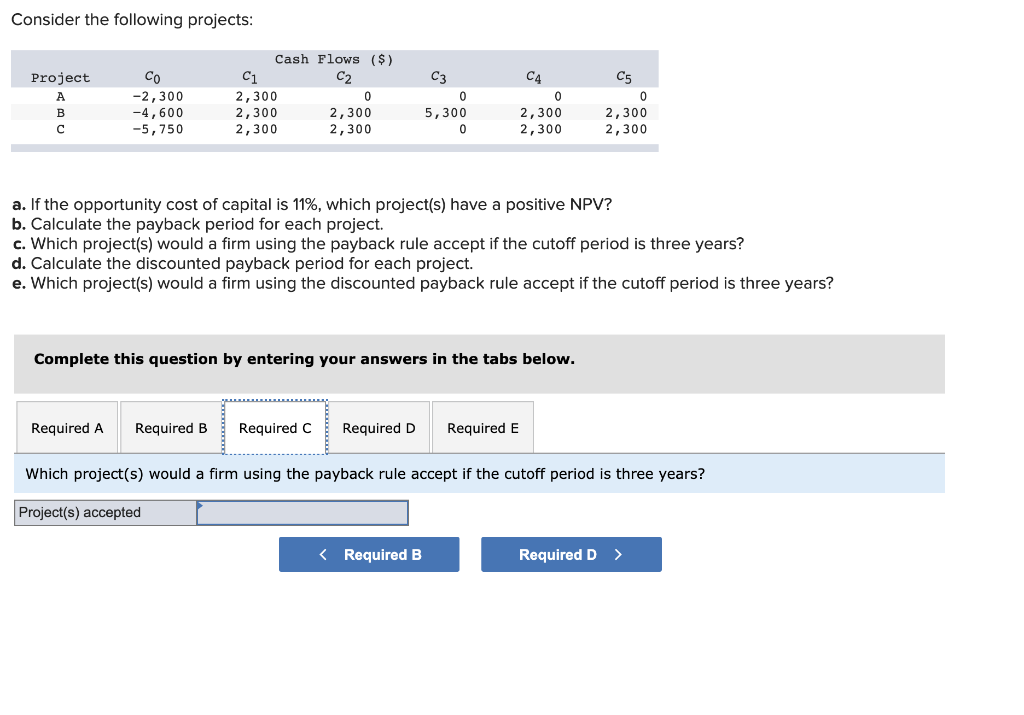

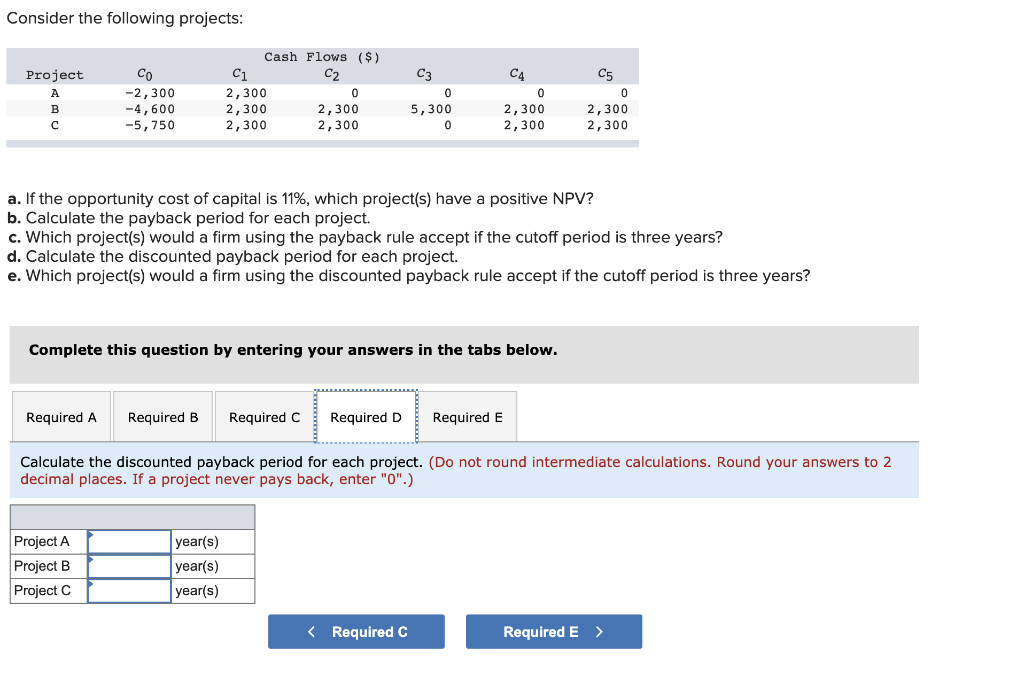

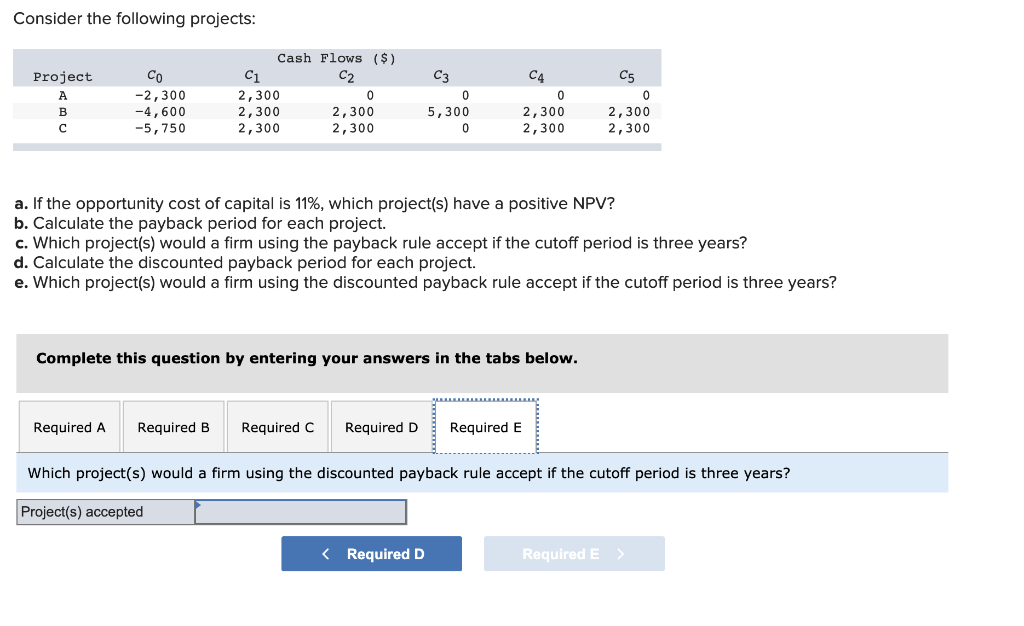

Consider the following projects: Project A B -2,300 -4,600 -5,750 Cash Flows ($) C1 C2 2,300 0 2,300 2,300 2,300 2,300 C3 0 5,300 0 C4 0 2,300 2,300 C5 0 2,300 2,300 a. If the opportunity cost of capital is 11%, which project(s) have a positive NPV? b. Calculate the payback period for each project. c. Which project(s) would a firm using the payback rule accept if the cutoff period is three years? d. Calculate the discounted payback period for each project. e. Which project(s) would a firm using the discounted payback rule accept if the cutoff period is three years? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E If the opportunity cost of capital is 10%, which project(s) have a positive NPV? Positive NPV project(s) Consider the following projects: Project A B -2,300 -4,600 -5,750 Cash Flows ($) C1 C2 2,300 0 2,300 2,300 2,300 2,300 C3 0 5,300 0 C4 0 2,300 2,300 C5 0 2,300 2,300 a. If the opportunity cost of capital is 11%, which project(s) have a positive NPV? b. Calculate the payback period for each project. c. Which project(s) would a firm using the payback rule accept if the cutoff period is three years? d. Calculate the discounted payback period for each project. e. Which project(s) would a firm using the discounted payback rule accept if the cutoff period is three years? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Calculate the payback period for each project. (Round your answers to 2 decimal places.) Project A Project B Project C year(s) year(s) year(s) Consider the following projects: C4 Project A B Co -2,300 -4,600 -5,750 Cash Flows ($) C1 C2 2,300 0 2,300 2,300 2,300 2,300 0 C3 0 5,300 C5 0 2,300 2,300 2,300 2,300 a. If the opportunity cost of capital is 11%, which project(s) have a positive NPV? b. Calculate the payback period for each project. c. Which project(s) would a firm using the payback rule accept if the cutoff period is three years? d. Calculate the discounted payback period for each project. e. Which project(s) would a firm using the discounted payback rule accept if the cutoff period is three years? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Which project(s) would a firm using the payback rule accept if the cutoff period is three years? Project(s) accepted Consider the following projects: Project B -2,300 -4,600 -5,750 Cash Flows ($) Ci C2 2,300 0 2,300 2,300 2,300 2,300 C3 0 5,300 0 C4 0 2,300 2,300 C5 0 2,300 2,300 a. If the opportunity cost of capital is 11%, which project(s) have a positive NPV? b. Calculate the payback period for each project. c. Which project(s) would a firm using the payback rule accept if the cutoff period is three years? d. Calculate the discounted payback period for each project. e. Which project(s) would a firm using the discounted payback rule accept if the cutoff period is three years? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E t round intermediate calculations. Round your to 2 Calculate the discounted payback period for each project. decimal places. If a project never pays back, enter "0".) Project A Project B Project C year(s) year(s) year(s) Consider the following projects: Project A B -2,300 -4,600 -5,750 Cash Flows ($) C C2 2,300 0 2,300 2,300 2,300 2,300 C3 0 5,300 0 C4 0 2,300 2,300 C5 0 2,300 2,300 a. If the opportunity cost of capital is 11%, which project(s) have a positive NPV? b. Calculate the payback period for each project. c. Which project(s) would a firm using the payback rule accept if the cutoff period is three years? d. Calculate the discounted payback period for each project. e. Which project(s) would a firm using the discounted payback rule accept if the cutoff period is three years? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Which project(s) would a firm using the discounted payback rule accept if the cutoff period is three years? Project(s) accepted