Question

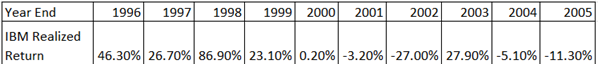

Consider the following realized annual returns: The variance of the returns on IBM from 1996 to 2005 is closest to: A) .3145 B) .0990 C)

Consider the following realized annual returns:

The variance of the returns on IBM from 1996 to 2005 is closest to:

A) .3145

B) .0990

C) .1100

D) .9890

The standard deviation of the returns on IBM from 1996 to 2005 is closest to:

A) 33.2%

B) 16.4%

C) 31.5%

D) 11.0%

Suppose that you want to use the 10 year historical average return on IBM to forecast the expected future return on IBM. The standard error of your estimate of the expect return is closest to:

A) 16.4%

B) 10.50%

C) 3.15%

D) 33.20%

Suppose that you want to use the 10 year historical average return on IBM to forecast the expected future return on IBM. The 95% confidence interval for your estimate of the expect return is closest to:

A) 13.2% to 19.5%

B) -4.5% to 37.4%

C) 6.5% to 26.3%

D) -15.1% to 47.8%

\begin{tabular}{|l|r|r|r|r|r|r|r|r|r|r|} \hline Year End & 1996 & 1997 & 1998 & 1999 & 2000 & 2001 & 2002 & 2003 & 2004 & 2005 \\ \hline IBM Realized & & & & & & & & & \\ Return & 46.30% & 26.70% & 86.90% & 23.10% & 0.20% & 3.20% & 27.00% & 27.90% & 5.10% & 11.30% \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started