Answered step by step

Verified Expert Solution

Question

1 Approved Answer

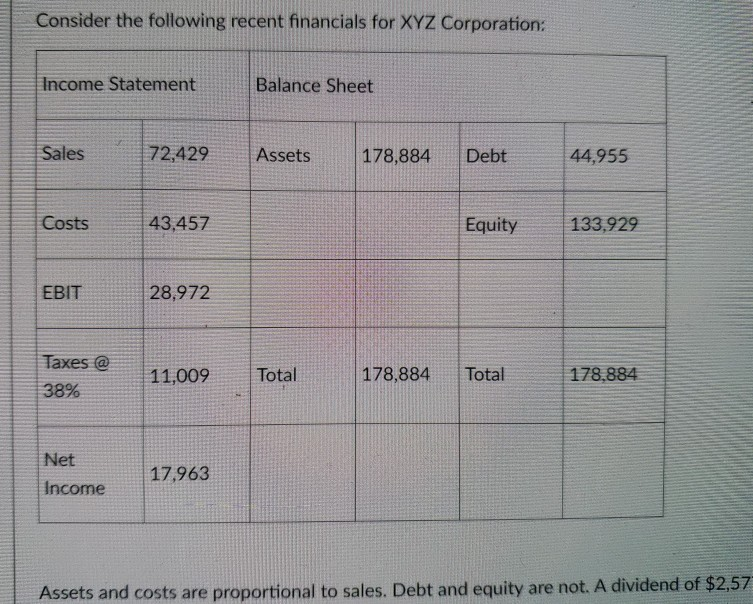

Consider the following recent financials for XYZ Corporation: Income Statement Balance Sheet Sales 72,429Assets 178,884 Debt 44,955 Costs 43,457 Equity 133,929 EBIT 28,972 Taxes @

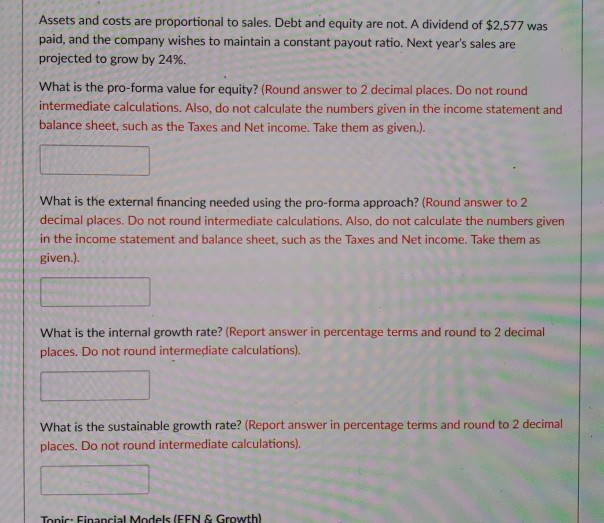

Consider the following recent financials for XYZ Corporation: Income Statement Balance Sheet Sales 72,429Assets 178,884 Debt 44,955 Costs 43,457 Equity 133,929 EBIT 28,972 Taxes @ 38% 11,009 Total 178,884Total 178,884 Net income|17963 Assets and costs are proportional to sales. Debt and equity are not. A dividend of $2.57 Assets and costs are proportional to sales. Debt and equity are not. A dividend of $2,577 was paid, and the company wishes to maintain a constant payout ratio. Next year's sales are projected to grow by 24%. What is the pro-forma value for equity? (Round answer to 2 decimal places. Do not round intermediate calculations. Also, do not calculate the numbers given in the income statement and balance sheet, such as the Taxes and Net income. Take them as given.). What is the external financing needed using the pro-forma approach? (Round answer to 2 decimal places. Do not round intermediate calculations. Also, do not calculate the numbers given in the income statement and balance sheet, such as the Taxes and Net income. Take them as given.). What is the internal growth rate? (Report answer in percentage terms and round to 2 decimal places. Do not round intermediate calculations). What is the sustainable growth rate? (Report answer in percentage terms and round to 2 decimal places. Do not round intermediate calculations). Tonic: Financial Models (EFN & Growthl

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started