Answered step by step

Verified Expert Solution

Question

1 Approved Answer

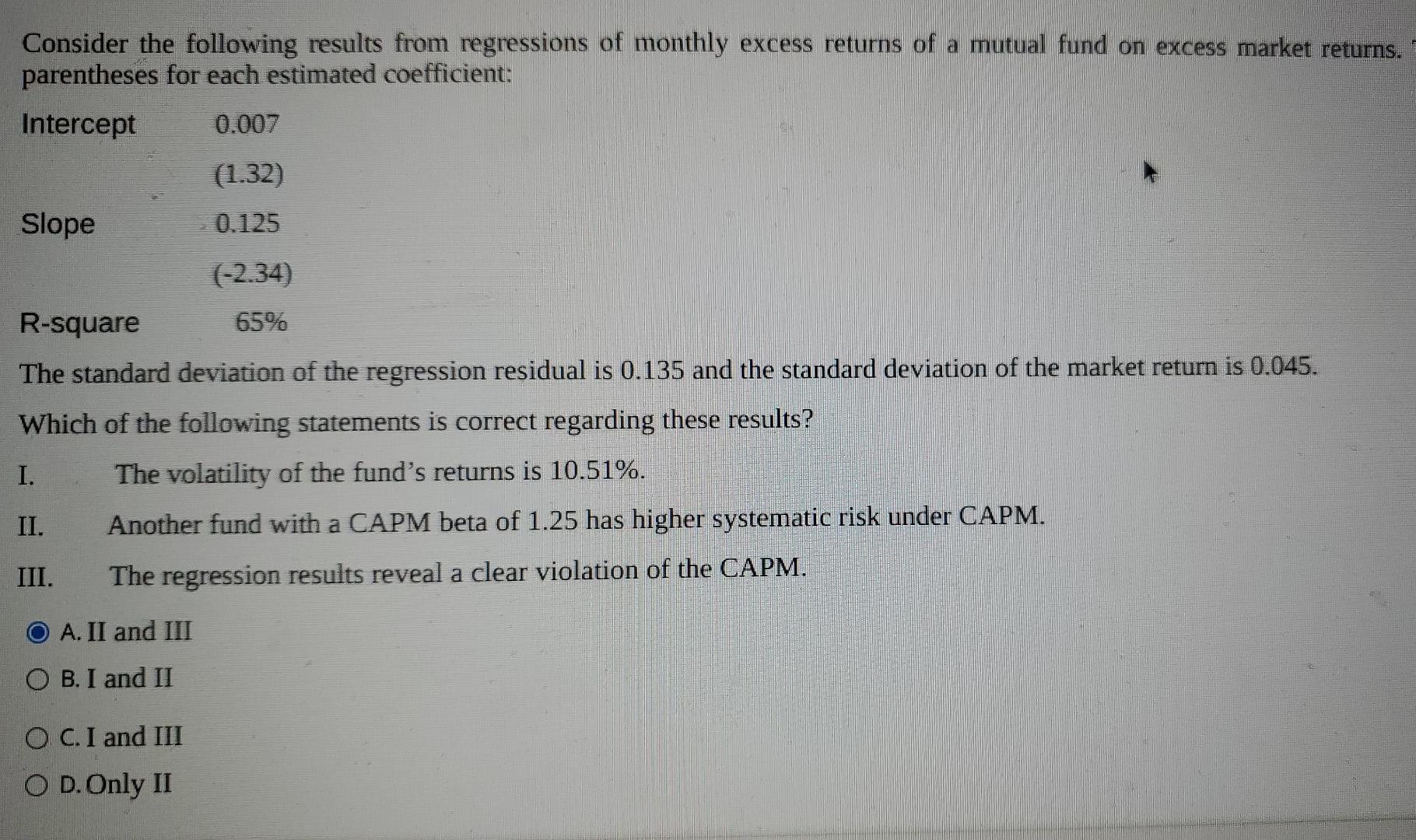

Consider the following results from regressions of monthly excess returns of a mutual fund on excess market returns. parentheses for each estimated coefficient: Intercept 0.007

Consider the following results from regressions of monthly excess returns of a mutual fund on excess market returns. parentheses for each estimated coefficient: Intercept 0.007 (1.32) Slope 0.125 (-2.34) R-square 65% The standard deviation of the regression residual is 0.135 and the standard deviation of the market return is 0.045. Which of the following statements is correct regarding these results? I. The volatility of the fund's returns is 10.51%. Another fund with a CAPM beta of 1.25 has higher systematic risk under CAPM. III. The regression results reveal a clear violation of the CAPM. II. A. II and III O B. I and II O C. I and III O D.Only

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started