Question

Consider the following scenarios and answer all questions asked. 1. Alison Richards earned $100,000 gross pay in 2021. How much will be deducted from

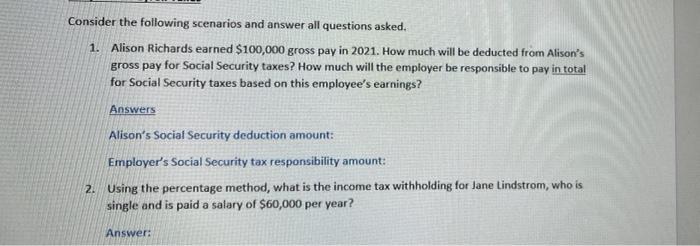

Consider the following scenarios and answer all questions asked. 1. Alison Richards earned $100,000 gross pay in 2021. How much will be deducted from Alison's gross pay for Social Security taxes? How much will the employer be responsible to pay in total for Social Security taxes based on this employee's earnings? Answers Alison's Social Security deduction amount: Employer's Social Security tax responsibility amount: 2. Using the percentage method, what is the income tax withholding for Jane Lindstrom, who is single and is paid a salary of $60,000 per year? Answer:

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information available in the question we can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Finance

Authors: Jeff Madura

5th edition

132994348, 978-0132994347

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App