Answered step by step

Verified Expert Solution

Question

1 Approved Answer

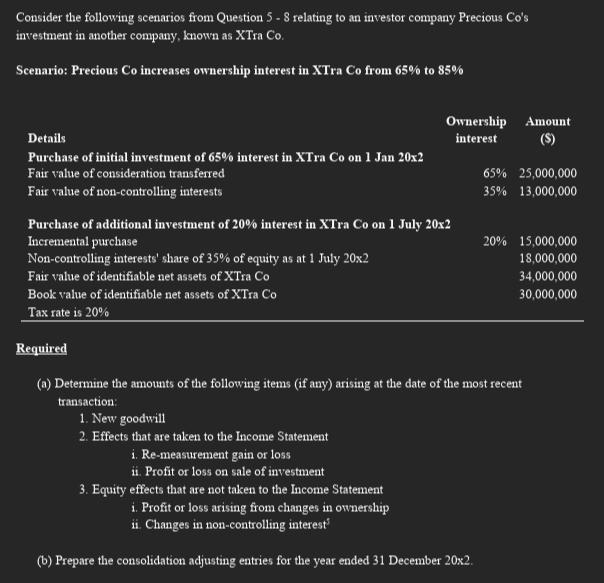

Consider the following scenarios from Question 5 - 8 relating to an investor company Precious Co's investment in another company, known as XTra Co.

Consider the following scenarios from Question 5 - 8 relating to an investor company Precious Co's investment in another company, known as XTra Co. Scenario: Precious Co increases ownership interest in XTra Co from 65% to 85% Details Purchase of initial investment of 65% interest in XTra Co on 1 Jan 20x2 Fair value of consideration transferred Fair value of non-controlling interests Purchase of additional investment of 20% interest in XTra Co on 1 July 20x2 Incremental purchase Non-controlling interests' share of 35% of equity as at 1 July 20x2 Fair value of identifiable net assets of XTra Co Book value of identifiable net assets of XTra Co Tax rate is 20% Ownership Amount interest (S) 1. New goodwill 2. Effects that are taken to the Income Statement i. Re-measurement gain or loss ii. Profit or loss on sale of investment 3. Equity effects that are not taken to the Income Statement Required (a) Determine the amounts of the following items (if any) arising at the date of the most recent transaction: 65% 25,000,000 35% 13,000,000 i. Profit or loss arising from changes in ownership ii. Changes in non-controlling interest (b) Prepare the consolidation adjusting entries for the year ended 31 December 20x2. 20% 15,000,000 18,000,000 34,000,000 30,000,000

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a 1 New Goodwill New goodwill arising from the increase in ownership interest will be the difference between the fair value of consideration transferr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started