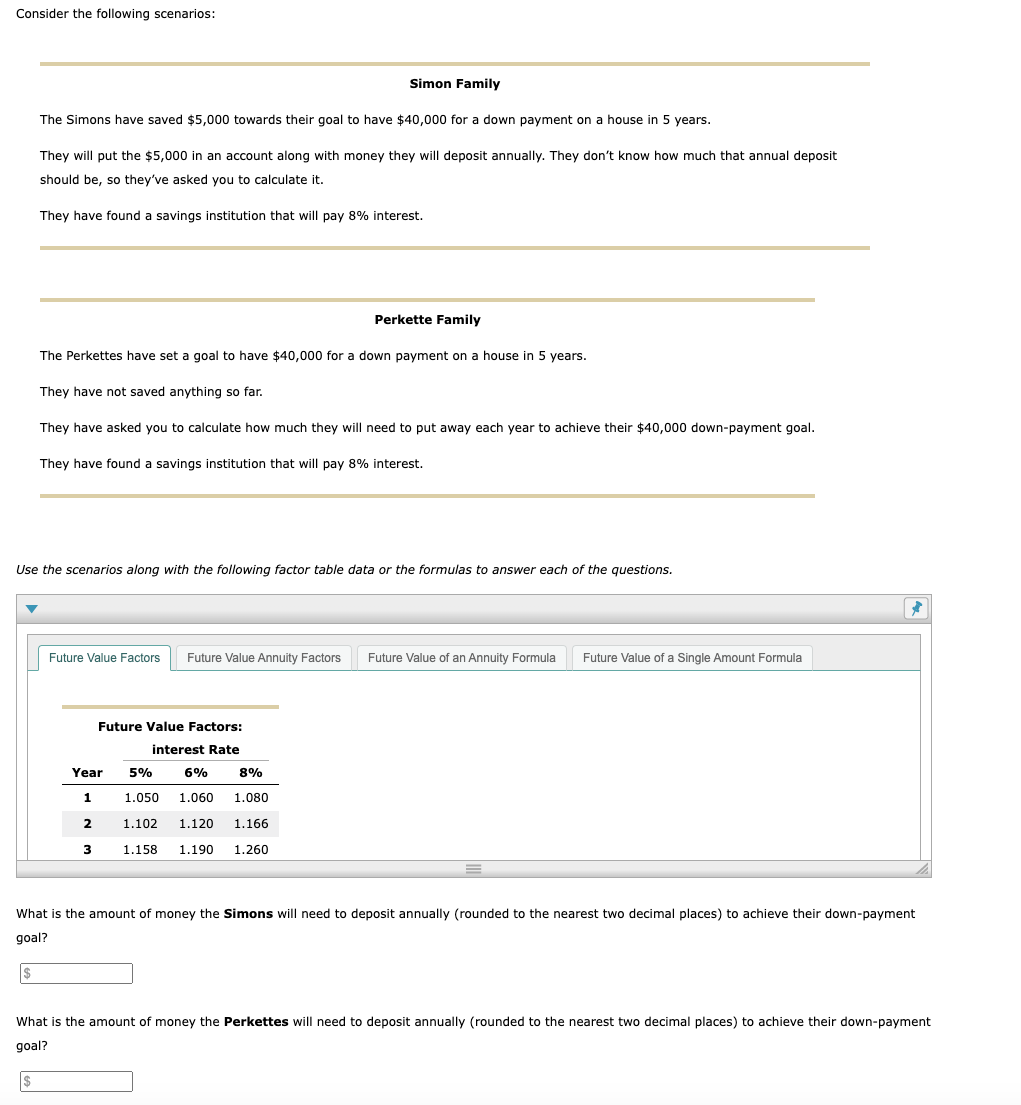

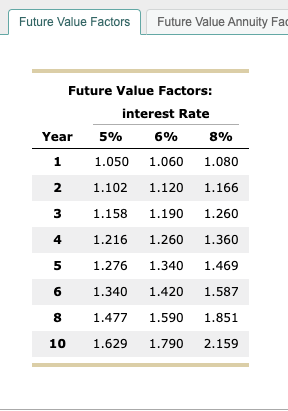

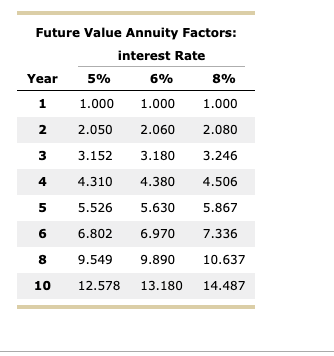

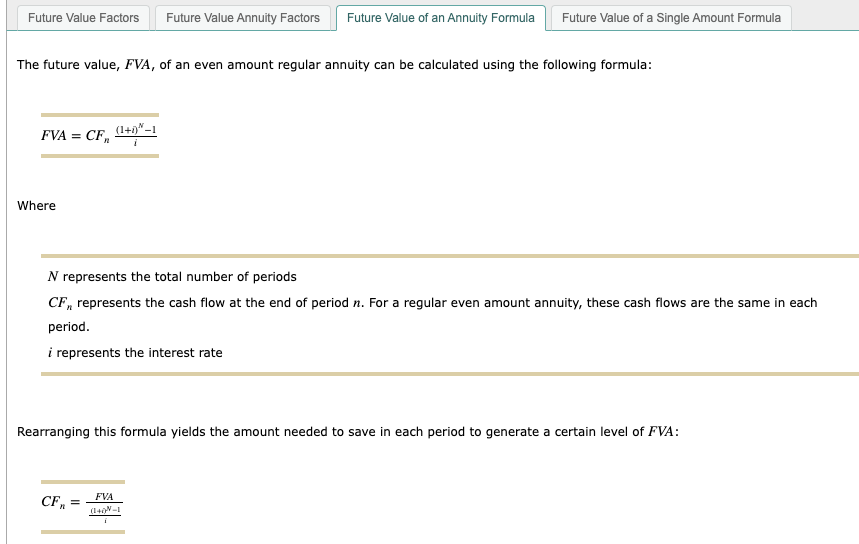

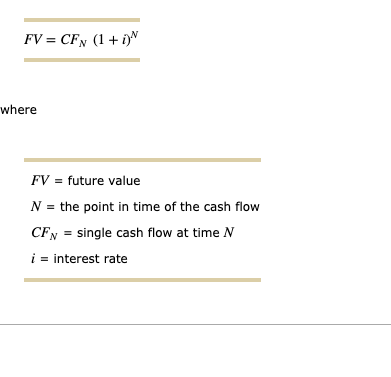

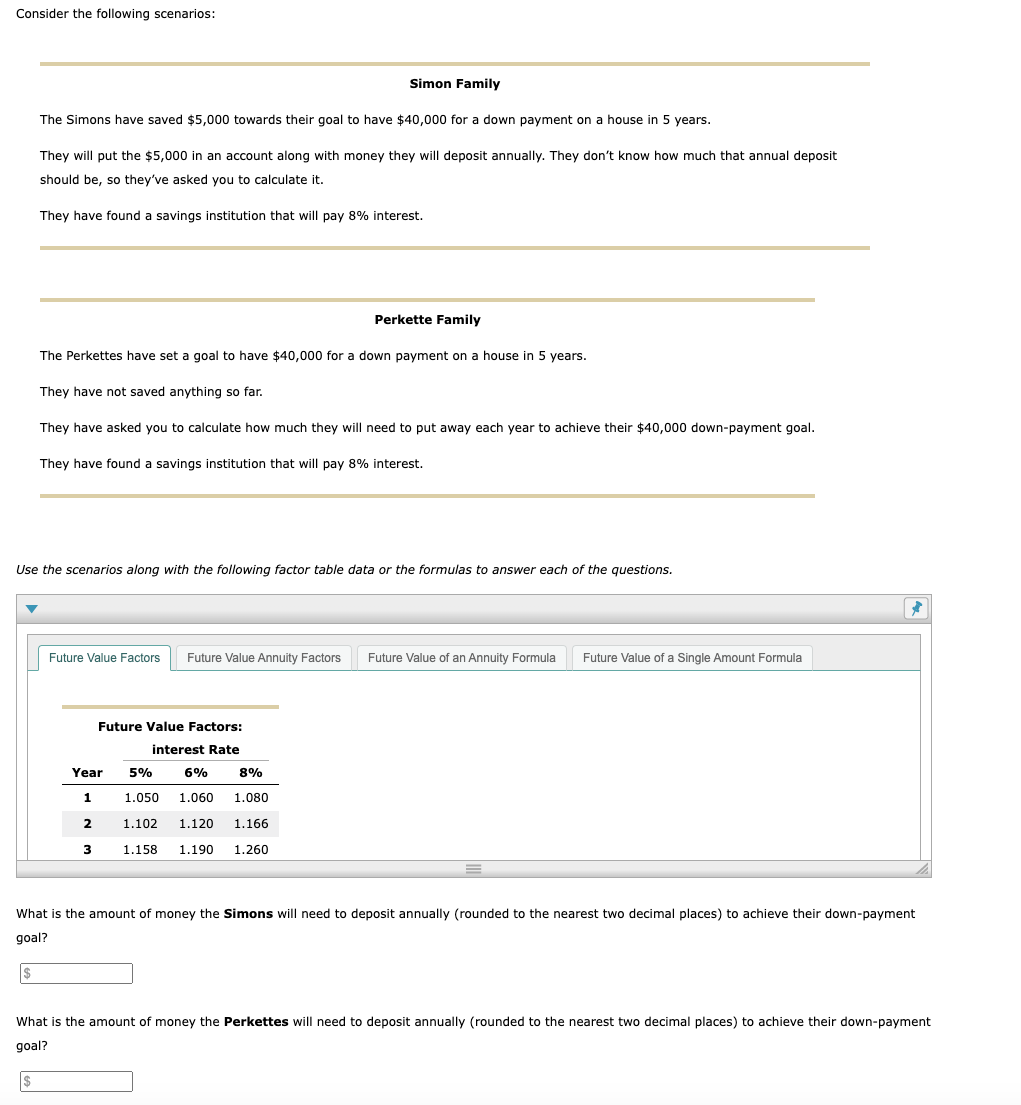

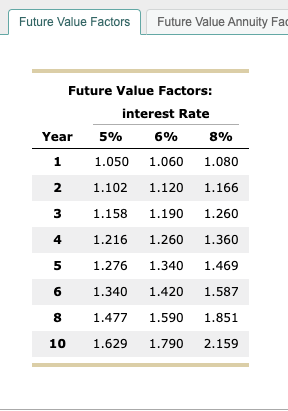

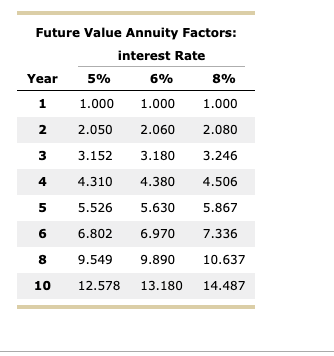

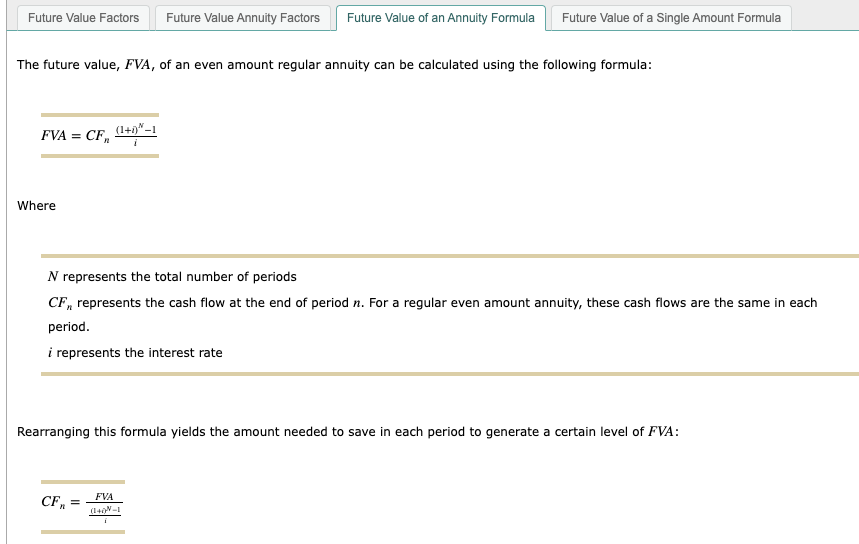

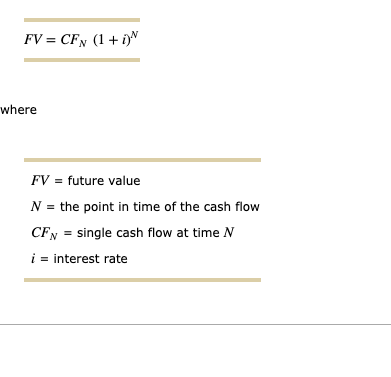

Consider the following scenarios: Simon Family The Simons have saved $5,000 towards their goal to have $40,000 for a down payment on a house in 5 years. They will put the $5,000 in an account along with money they will deposit annually. They don't know how much that annual deposit should be, so they've asked you to calculate it. They have found a savings institution that will pay 8% interest. Perkette Family The Perkettes have set a goal to have $40,000 for a down payment on a house in 5 years. They have not saved anything so far. They have asked you to calculate how much they will need to put away each year to achieve their $40,000 down-payment goal. They have found a savings institution that will pay 8% interest. Use the scenarios along with the following factor table data or the formulas to answer each of the questions. Future Value Factors Future Value Annuity Factors Future Value of an Annuity Formula Future Value of a Single Amount Formula Future Value Factors: interest Rate Year 5% 6% 8% 1 1.050 1.060 1.080 2 1.102 1.120 1.166 3 1.158 1.190 1.260 What is the amount of money the Simons will need to deposit annually (rounded to the nearest two decimal places) to achieve their down-payment goal? $ What is the amount of money the Perkettes will need to deposit annually (rounded to the nearest two decimal places) to achieve their down-payment goal? $ Future Value Factors Future Value Annuity Fac Future Value Factors: interest Rate 5% 6% 8% 1.050 1.060 1.080 1.102 1.120 1.166 1.158 1.190 1.260 1.216 1.260 1.360 1.276 1.340 1.469 1.340 1.420 1.587 1.477 1.590 1.851 1.629 1.790 2.159 Year 1 2 3 4 5 6 8 10 Future Value Annuity Factors: interest Rate Year 5% 6% 8% 1 1.000 1.000 1.000 2 2.050 2.060 2.080 3 3.152 3.180 3.246 4 4.310 4.380 4.506 5 5.526 5.630 5.867 6 6.802 6.970 7.336 8 9.549 9.890 10.637 10 12.578 13.180 14.487 Future Value Factors Future Value Annuity Factors Future Value of an Annuity Formula Future Value of a Single Amount Formula The future value, FVA, of an even amount regular annuity can be calculated using the following formula: FVA = CF (1+i) i N represents the total number of periods CF, represents the cash flow at the end of period n. For a regular even amount annuity, these cash flows are the same in each period. i represents the interest rate Rearranging this formula yields the amount needed to save in each period to generate a certain level of FVA: CFR = FVA (140-1 i Where FV = CFN (1 + i) FV = future value N = the point in time of the cash flow CFN = single cash flow at time N i interest rate where Consider the following scenarios: Simon Family The Simons have saved $5,000 towards their goal to have $40,000 for a down payment on a house in 5 years. They will put the $5,000 in an account along with money they will deposit annually. They don't know how much that annual deposit should be, so they've asked you to calculate it. They have found a savings institution that will pay 8% interest. Perkette Family The Perkettes have set a goal to have $40,000 for a down payment on a house in 5 years. They have not saved anything so far. They have asked you to calculate how much they will need to put away each year to achieve their $40,000 down-payment goal. They have found a savings institution that will pay 8% interest. Use the scenarios along with the following factor table data or the formulas to answer each of the questions. Future Value Factors Future Value Annuity Factors Future Value of an Annuity Formula Future Value of a Single Amount Formula Future Value Factors: interest Rate Year 5% 6% 8% 1 1.050 1.060 1.080 2 1.102 1.120 1.166 3 1.158 1.190 1.260 What is the amount of money the Simons will need to deposit annually (rounded to the nearest two decimal places) to achieve their down-payment goal? $ What is the amount of money the Perkettes will need to deposit annually (rounded to the nearest two decimal places) to achieve their down-payment goal? $ Future Value Factors Future Value Annuity Fac Future Value Factors: interest Rate 5% 6% 8% 1.050 1.060 1.080 1.102 1.120 1.166 1.158 1.190 1.260 1.216 1.260 1.360 1.276 1.340 1.469 1.340 1.420 1.587 1.477 1.590 1.851 1.629 1.790 2.159 Year 1 2 3 4 5 6 8 10 Future Value Annuity Factors: interest Rate Year 5% 6% 8% 1 1.000 1.000 1.000 2 2.050 2.060 2.080 3 3.152 3.180 3.246 4 4.310 4.380 4.506 5 5.526 5.630 5.867 6 6.802 6.970 7.336 8 9.549 9.890 10.637 10 12.578 13.180 14.487 Future Value Factors Future Value Annuity Factors Future Value of an Annuity Formula Future Value of a Single Amount Formula The future value, FVA, of an even amount regular annuity can be calculated using the following formula: FVA = CF (1+i) i N represents the total number of periods CF, represents the cash flow at the end of period n. For a regular even amount annuity, these cash flows are the same in each period. i represents the interest rate Rearranging this formula yields the amount needed to save in each period to generate a certain level of FVA: CFR = FVA (140-1 i Where FV = CFN (1 + i) FV = future value N = the point in time of the cash flow CFN = single cash flow at time N i interest rate where