Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following segment information in relation to Little Angle Limited. For internal purposes, the chief operating decision maker reviews four components of the company

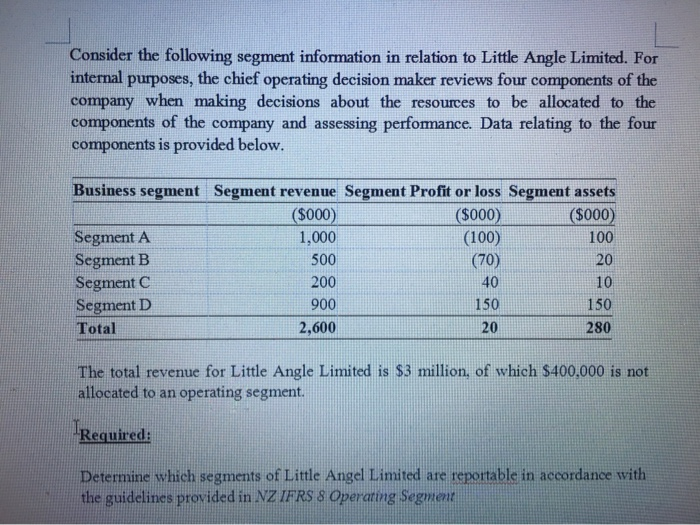

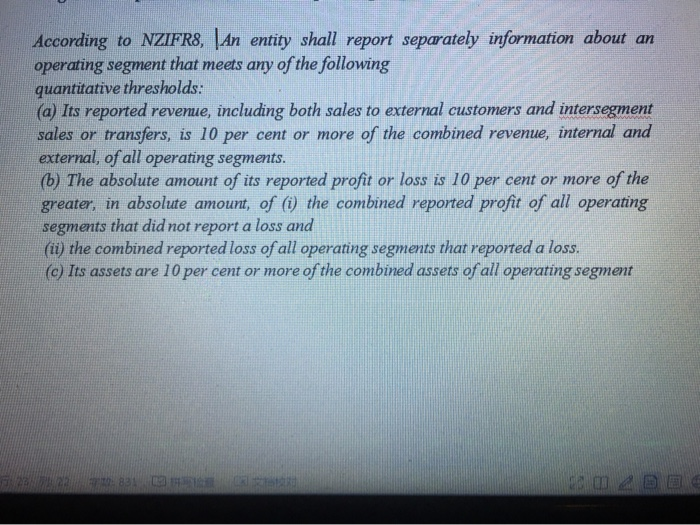

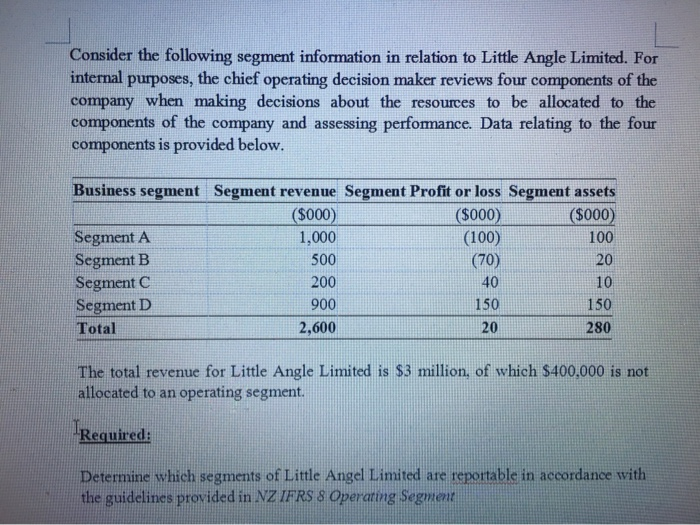

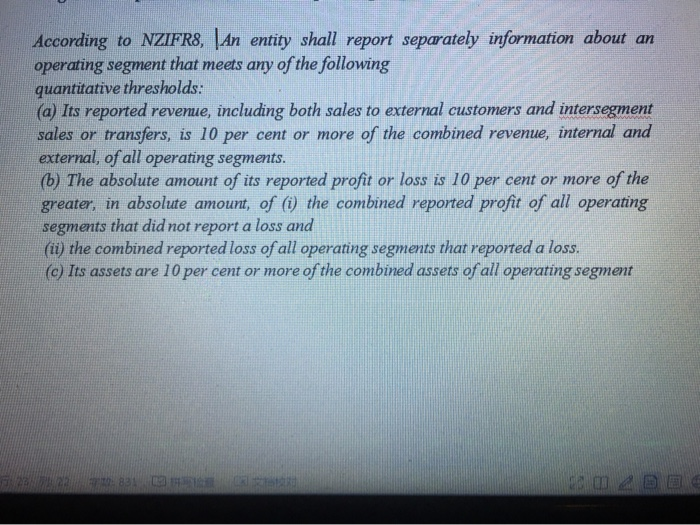

Consider the following segment information in relation to Little Angle Limited. For internal purposes, the chief operating decision maker reviews four components of the company when making decisions about the resources to be allocated to the components of the company and assessing performance. Data relating to the four components is provided below. Business segment Segment revenue Segment Profit or loss Segment assets ($000) ($000) ($000) Segment A 1,000 (100) 100 Segment B 500 (70) 20 Segment C 200 40 10 Segment D 900 150 150 Total 2,600 20 280 The total revenue for Little Angle Limited is $3 million, of which $400,000 is not allocated to an operating segment. Required: Determine which segments of Little Angel Limited are reportable in accordance with the guidelines provided in NZ IFRS 8 Operating Segment According to NZIFR8, |An entity shall report separately information about an operating segment that meets any of the following quantitative thresholds: (a) Its reported revenue, including both sales to external customers and intersegment sales or transfers, is 10 per cent or more of the combined revenue, internal and external, of all operating segments. (b) The absolute amount of its reported profit or loss is 10 per cent or more of the greater, in absolute amount, of (i) the combined reported profit of all operating segments that did not report a loss and (ii) the combined reported loss of all operating segments that reported a loss. (c) Its assets are 10 per cent or more of the combined assets of all operating segment FM 8:00

Consider the following segment information in relation to Little Angle Limited. For internal purposes, the chief operating decision maker reviews four components of the company when making decisions about the resources to be allocated to the components of the company and assessing performance. Data relating to the four components is provided below. Business segment Segment revenue Segment Profit or loss Segment assets ($000) ($000) ($000) Segment A 1,000 (100) 100 Segment B 500 (70) 20 Segment C 200 40 10 Segment D 900 150 150 Total 2,600 20 280 The total revenue for Little Angle Limited is $3 million, of which $400,000 is not allocated to an operating segment. Required: Determine which segments of Little Angel Limited are reportable in accordance with the guidelines provided in NZ IFRS 8 Operating Segment According to NZIFR8, |An entity shall report separately information about an operating segment that meets any of the following quantitative thresholds: (a) Its reported revenue, including both sales to external customers and intersegment sales or transfers, is 10 per cent or more of the combined revenue, internal and external, of all operating segments. (b) The absolute amount of its reported profit or loss is 10 per cent or more of the greater, in absolute amount, of (i) the combined reported profit of all operating segments that did not report a loss and (ii) the combined reported loss of all operating segments that reported a loss. (c) Its assets are 10 per cent or more of the combined assets of all operating segment FM 8:00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started