Question

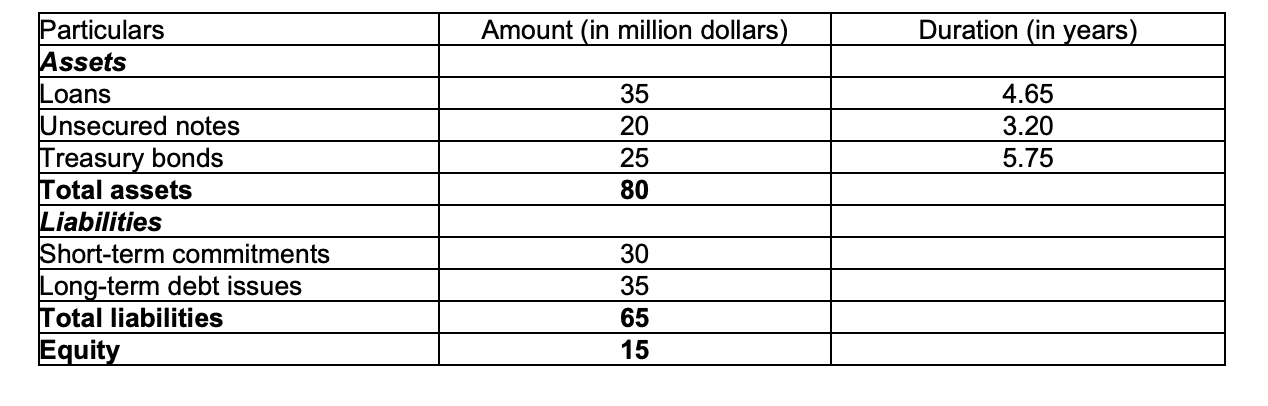

Consider the following simplified balance sheet of BKM Bank: Tina Shelby, the portfolio manager at BKM, predicts that there would be a general rise in

Consider the following simplified balance sheet of BKM Bank:

Tina Shelby, the portfolio manager at BKM, predicts that there would be a general rise in interest rates from the current average of 8% per annum to 9% per annum. It is given that the duration of the total liabilities portfolio is 2.52.

Requirements: (i) Considering the durations of total asset and total liabilities portfolio, what impact will this increase in interest rate have on the equity value of BKM? Show the detailed calculations. [3 marks] (ii) Report the adjusted balance sheet after the increase of interest rate (show only total assets, total liabilities and equity). [2 marks] (iii) After the increase in interest rate what happens to the risk profile of BKM Bank? [2 marks]

Amount (in million dollars) Duration (in years Particulars Assets Loans Unsecured notes Treasury bonds Total assets Liabilities Short-term commitments Long-term debt issues Total liabilities Equity 35 20 25 80 4.65 3.20 5.75 30 35 65 15 Amount (in million dollars) Duration (in years Particulars Assets Loans Unsecured notes Treasury bonds Total assets Liabilities Short-term commitments Long-term debt issues Total liabilities Equity 35 20 25 80 4.65 3.20 5.75 30 35 65 15Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started