Answered step by step

Verified Expert Solution

Question

1 Approved Answer

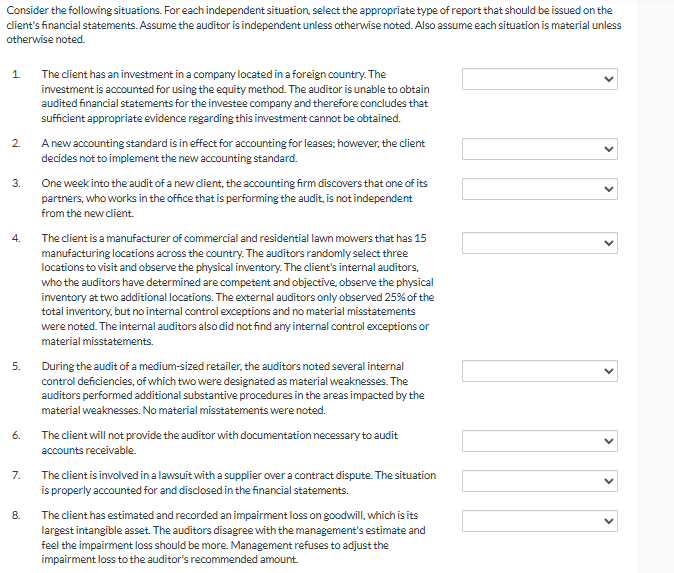

Consider the following situations. For each independent situation, select the appropriate type of report that should be issued on the client's financial statements. Assume the

Consider the following situations. For each independent situation, select the appropriate type of report that should be issued on the

client's financial statements. Assume the auditor is independent unless otherwise noted. Also assume each situation is material unless

otherwise noted.

The client has an investment in a company located in a foreign country. The

investment is accounted for using the equity method. The auditor is unable to obtain

audited financial statements for the investee company and therefore concludes that

sufficient appropriate evidence regarding this investment cannot be obtained.

A new accounting standard is in effect for accounting for leases; however, the client

decides not to implement the new accounting standard.

One week into the audit of a new client, the accounting firm discovers that one of its

partners, who works in the office that is performing the audit, is not independent

from the new client.

The client is a manufacturer of commercial and residential lawn mowers that has

manufacturing locations across the country. The auditors randomly select three

locations to visit and observe the physical inventory. The client's internal auditors,

who the auditors have determined are competent and objective, observe the physical

inventory at two additional locations. The external auditors only observed of the

total inventory, but no internal control exceptions and no material misstatements

were noted. The internal auditors also did not find any internal control exceptions or

material misstatements.

During the audit of a mediumsized retailer, the auditors noted several internal

control deficiencies, of which two were designated as material weaknesses. The

auditors performed additional substantive procedures in the areas impacted by the

material weaknesses. No material misstatements were noted.

The client will not provide the auditor with documentation necessary to audit

accounts receivable.

The client is involved in a lawsuit with a supplier over a contract dispute. The situation

is properly accounted for and disclosed in the financial statements.

The client has estimated and recorded an impairment loss on goodwill, which is its

largest intangible asset. The auditors disagree with the management's estimate and

feel the impairment loss should be more. Management refuses to adjust the

impairment loss to the auditor's recommended amount.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started