Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following specs for futures contracts on Ethanol traded on the Chicago Mer- cantile Exchange (CME): Contract Unit Trading Hours 29,000 gallons (approximately

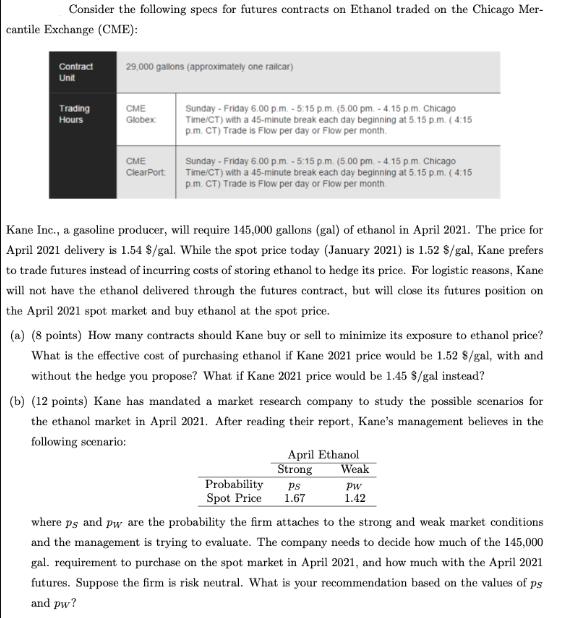

Consider the following specs for futures contracts on Ethanol traded on the Chicago Mer- cantile Exchange (CME): Contract Unit Trading Hours 29,000 gallons (approximately one railcar) CME Globex CME ClearPort Sunday - Friday 6.00p.m - 5:15 p.m. (5.00 pm - 4.15 p.m. Chicago Time/CT) with a 45-minute break each day beginning at 5.15 p.m. (4:15 p.m. CT) Trade is Flow per day or Flow per month. Sunday - Friday 6.00 pm - 5:15 pm (5.00 pm -4.15 pm. Chicago Time/CT) with a 45-minute break each day beginning at 5.15 p.m. (4:15 p.m. CT) Trade is Flow per day or Flow per month Kane Inc., a gasoline producer, will require 145,000 gallons (gal) of ethanol in April 2021. The price for April 2021 delivery is 1.54 $/gal. While the spot price today (January 2021) is 1.52 $/gal, Kane prefers to trade futures instead of incurring costs of storing ethanol to hedge its price. For logistic reasons, Kane will not have the ethanol delivered through the futures contract, but will close its futures position on the April 2021 spot market and buy ethanol at the spot price. (a) (8 points) How many contracts should Kane buy or sell to minimize its exposure to ethanol price? What is the effective cost of purchasing ethanol if Kane 2021 price would be 1.52 8/gal, with and without the hedge you propose? What if Kane 2021 price would be 1.45 $/gal instead? (b) (12 points) Kane has mandated a market research company to study the possible scenarios for the ethanol market in April 2021. After reading their report, Kane's management believes in the following scenario: Probability Spot Price April Ethanol Strong Ps 1.67 Weak pw 1.42 where ps and pw are the probability the firm attaches to the strong and weak market conditions and the management is trying to evaluate. The company needs to decide how much of the 145,000 gal. requirement to purchase on the spot market in April 2021, and how much with the April 2021 futures. Suppose the firm is risk neutral. What is your recommendation based on the values of ps and pw?

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a To minimize exposure to ethanol price Kane can use futures contracts to lock in the price for April 2021 delivery The goal is to use futures contrac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started