Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reliance Ltd. has a machine with an additional life of 5 years which costs Rs. 10,00,000 and has a book value of Rs. 4,00,000.

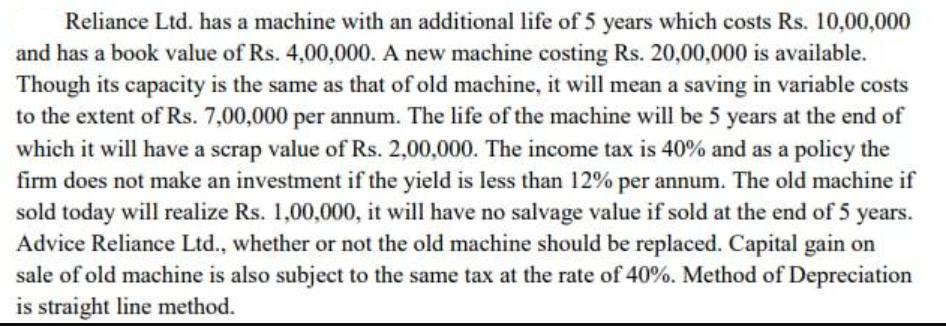

Reliance Ltd. has a machine with an additional life of 5 years which costs Rs. 10,00,000 and has a book value of Rs. 4,00,000. A new machine costing Rs. 20,00,000 is available. Though its capacity is the same as that of old machine, it will mean a saving in variable costs to the extent of Rs. 7,00,000 per annum. The life of the machine will be 5 years at the end of which it will have a scrap value of Rs. 2,00,000. The income tax is 40% and as a policy the firm does not make an investment if the yield is less than 12% per annum. The old machine if sold today will realize Rs. 1,00,000, it will have no salvage value if sold at the end of 5 years. Advice Reliance Ltd., whether or not the old machine should be replaced. Capital gain on sale of old machine is also subject to the same tax at the rate of 40%. Method of Depreciation is straight line method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine whether Reliance Ltd should replace the old machine with a new one we need to calculate the net present value NPV of both options and com...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started