Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following structured transaction: Asset Pool: WAC = 12.33% WAM = 60 months (what is the average life where the pool is amortizing over

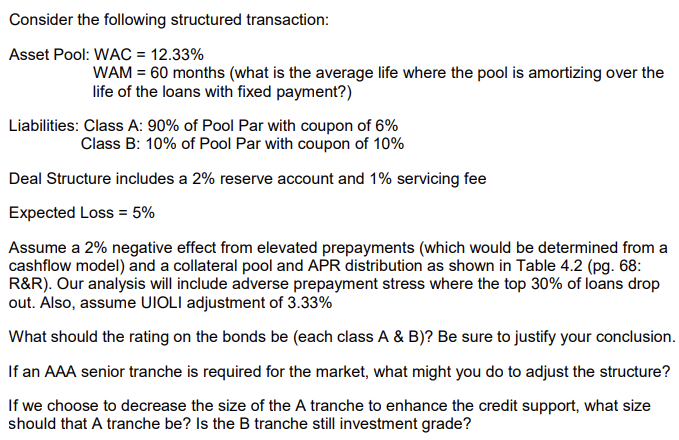

Consider the following structured transaction: Asset Pool: WAC = 12.33% WAM = 60 months (what is the average life where the pool is amortizing over the life of the loans with fixed payment?) Liabilities: Class A: 90% of Pool Par with coupon of 6% Class B: 10% of Pool Par with coupon of 10% Deal Structure includes a 2% reserve account and 1% servicing fee Expected Loss = 5% Assume a 2% negative effect from elevated prepayments (which would be determined from a cashflow model) and a collateral pool and APR distribution as shown in Table 4.2 (pg. 68: R&R). Our analysis will include adverse prepayment stress where the top 30% of loans drop out. Also, assume UIOLI adjustment of 3.33% What should the rating on the bonds be (each class A & B)? Be sure to justify your conclusion. If an AAA senior tranche is required for the market, what might you do to adjust the structure? If we choose to decrease the size of the A tranche to enhance the credit support, what size should that A tranche be? Is the B tranche still investment grade? Consider the following structured transaction: Asset Pool: WAC = 12.33% WAM = 60 months (what is the average life where the pool is amortizing over the life of the loans with fixed payment?) Liabilities: Class A: 90% of Pool Par with coupon of 6% Class B: 10% of Pool Par with coupon of 10% Deal Structure includes a 2% reserve account and 1% servicing fee Expected Loss = 5% Assume a 2% negative effect from elevated prepayments (which would be determined from a cashflow model) and a collateral pool and APR distribution as shown in Table 4.2 (pg. 68: R&R). Our analysis will include adverse prepayment stress where the top 30% of loans drop out. Also, assume UIOLI adjustment of 3.33% What should the rating on the bonds be (each class A & B)? Be sure to justify your conclusion. If an AAA senior tranche is required for the market, what might you do to adjust the structure? If we choose to decrease the size of the A tranche to enhance the credit support, what size should that A tranche be? Is the B tranche still investment grade

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started