Question

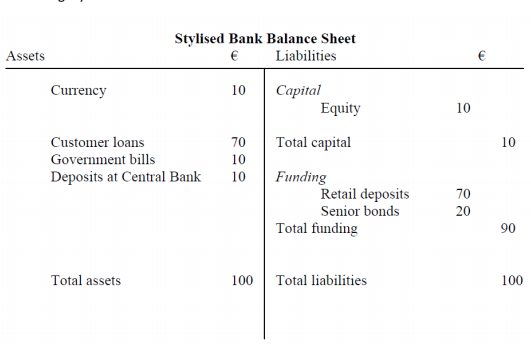

Consider the following stylised commercial banks balance sheet. Under the so-called Additional Credit Claims (ACC) initiative, the European Central Bank (ECB) may accept pools of

Consider the following stylised commercial banks balance sheet. Under the so-called Additional Credit Claims (ACC) initiative, the European Central Bank (ECB) may accept pools of secured (including mortgages, residential and commercial) and unsecured credit claims as collateral for Eurosystem credit operations. On 18 March 2020, the Governing Council of the ECB decided to expand the scope of ACC to include claims related to the financing of the corporate sector. If the stylised commercial bank above were to borrow funds from the ECB under the ACC programme, how would the commercial banks balance sheet change

Stylised Bank Balance Sheet Liabilities Assets Currency Capital Equity Total capital Customer loans Government bills Deposits at Central Bank 10 Funding Retail deposits Senior bonds Total funding Total assets 100 Total liabilities Stylised Bank Balance Sheet Liabilities Assets Currency Capital Equity Total capital Customer loans Government bills Deposits at Central Bank 10 Funding Retail deposits Senior bonds Total funding Total assets 100 Total liabilitiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started