Answered step by step

Verified Expert Solution

Question

1 Approved Answer

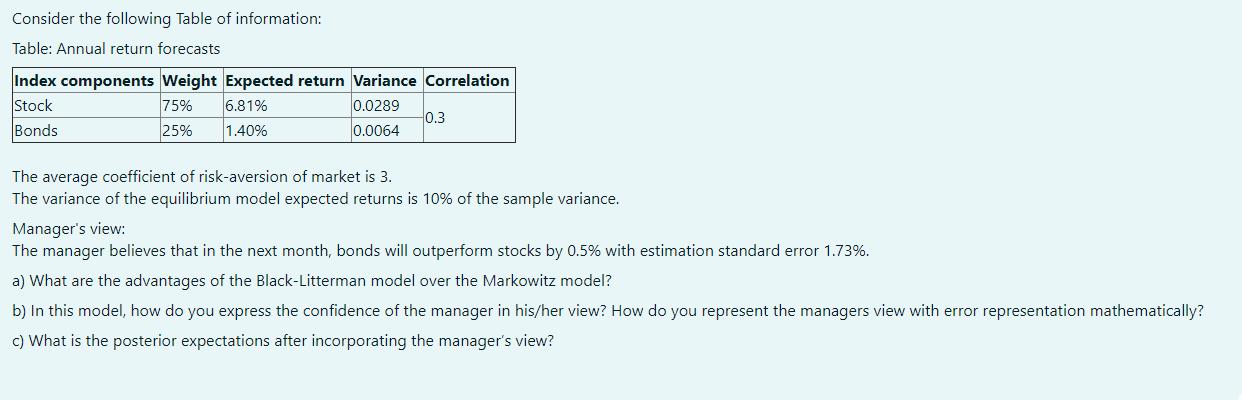

Consider the following Table of information: Table: Annual return forecasts Index components Weight Expected return Variance Correlation Stock 75% 6.81% 0.0289 Bonds 25% 1.40%

Consider the following Table of information: Table: Annual return forecasts Index components Weight Expected return Variance Correlation Stock 75% 6.81% 0.0289 Bonds 25% 1.40% 0.0064 0.3 The average coefficient of risk-aversion of market is 3. The variance of the equilibrium model expected returns is 10% of the sample variance. Manager's view: The manager believes that in the next month, bonds will outperform stocks by 0.5% with estimation standard error 1.73%. a) What are the advantages of the Black-Litterman model over the Markowitz model? b) In this model, how do you express the confidence of the manager in his/her view? How do you represent the managers view with error representation mathematically? c) What is the posterior expectations after incorporating the manager's view?

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Advantages of BlackLitterman model over Markowitz model Incorporates views of investorsmanagers by ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started