Question

Consider the following table with EBITDA projections for J Corporation (numbers are in millions): 2020 2021 2022 EBITDA $14 $23 $18 If the firms EBITDA

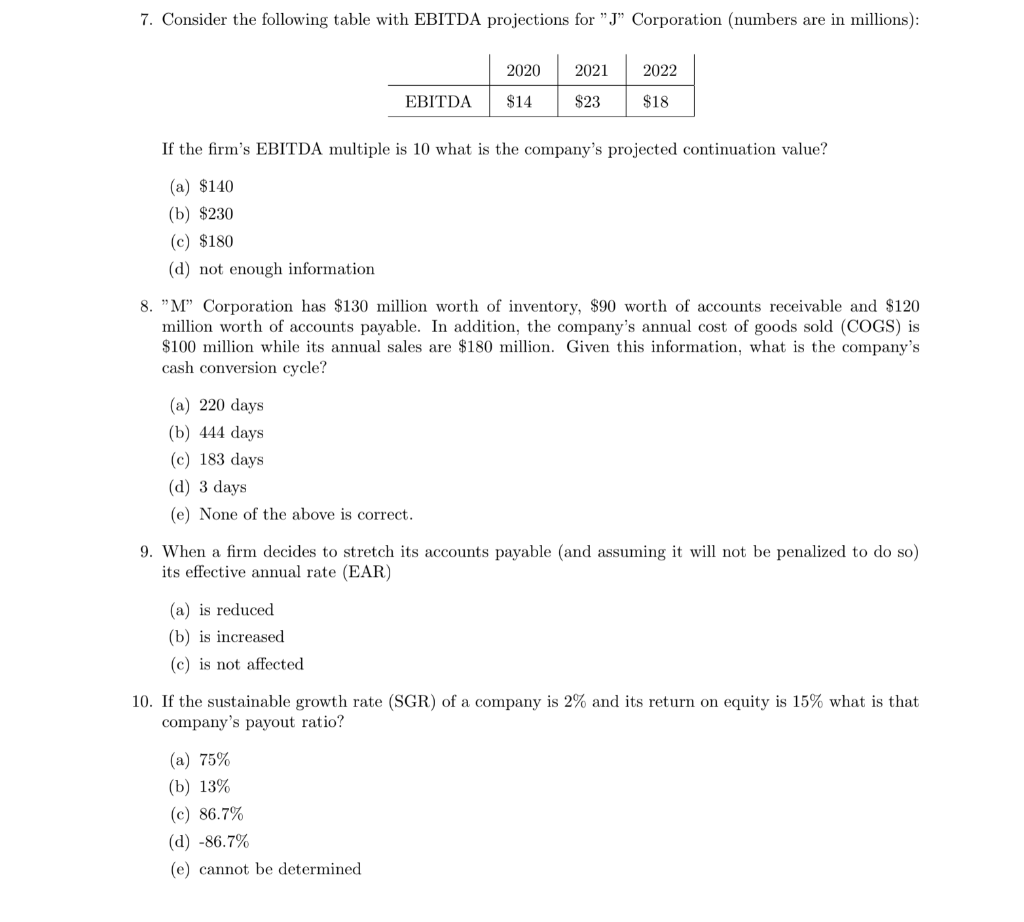

Consider the following table with EBITDA projections for J Corporation (numbers are in millions):

2020 2021 2022

EBITDA $14 $23 $18

If the firms EBITDA multiple is 10 what is the companys projected continuation value?

(a) $140

(b) $230

(c) $180

(d) not enough information

8. M Corporation has $130 million worth of inventory, $90 worth of accounts receivable and $120

million worth of accounts payable. In addition, the companys annual cost of goods sold (COGS) is

$100 million while its annual sales are $180 million. Given this information, what is the companys

cash conversion cycle?

(a) 220 days

(b) 444 days

(c) 183 days

(d) 3 days

(e) None of the above is correct.

9. When a firm decides to stretch its accounts payable (and assuming it will not be penalized to do so)

its effective annual rate (EAR)

(a) is reduced

(b) is increased

(c) is not affected

10. If the sustainable growth rate (SGR) of a company is 2% and its return on equity is 15% what is that

companys payout ratio?

(a) 75%

(b) 13%

(c) 86.7%

(d) -86.7%

(e) cannot be determined

7. Consider the following table with EBITDA projections for "J" Corporation (numbers are in millions): 2020 2021 2022 EBITDA $14 $23 If the firm's EBITDA multiple is 10 what is the company's projected continuation value? (a) $140 (b) $230 (c) $180 (d) not enough information 8. "M" Corporation has $130 million worth of inventory, $90 worth of accounts receivable and $120 million worth of accounts payable. In addition, the company's annual cost of goods sold (COGS) is $100 million while its annual sales are $180 million. Given this information, what is the company's cash conversion cycle? (a) 220 days (b) 444 days (c) 183 days (d) 3 days (e) None of the above is correct. 9. When a firm decides to stretch its accounts payable (and assuming it will not be penalized to do so) its effective annual rate (EAR) (a) is reduced (b) is increased (c) is not affected 10. If the sustainable growth rate (SGR) of a company is 2% and its return on equity is 15% what is that company's payout ratio? (a) 75% (b) 13% (c) 86.7% (d) -86.7% (e) cannot be determinedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started