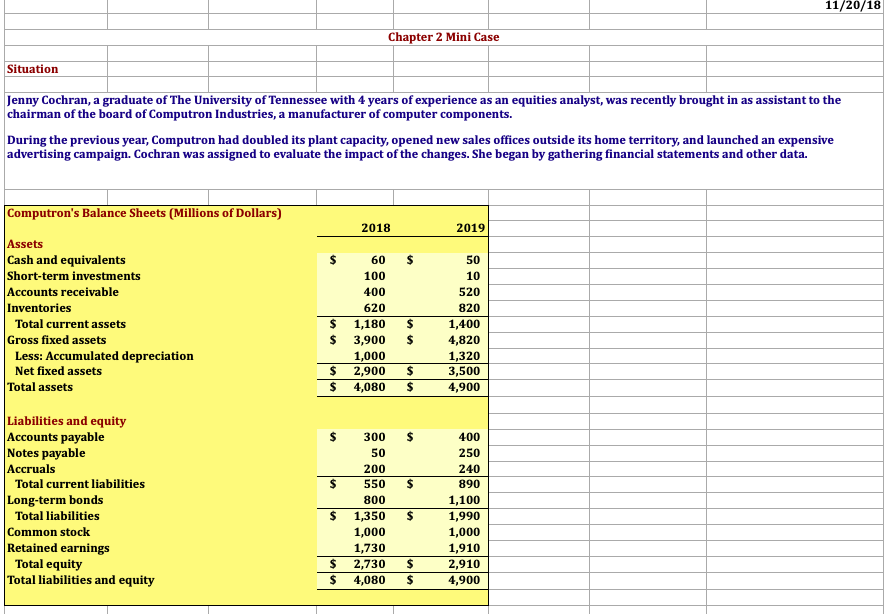

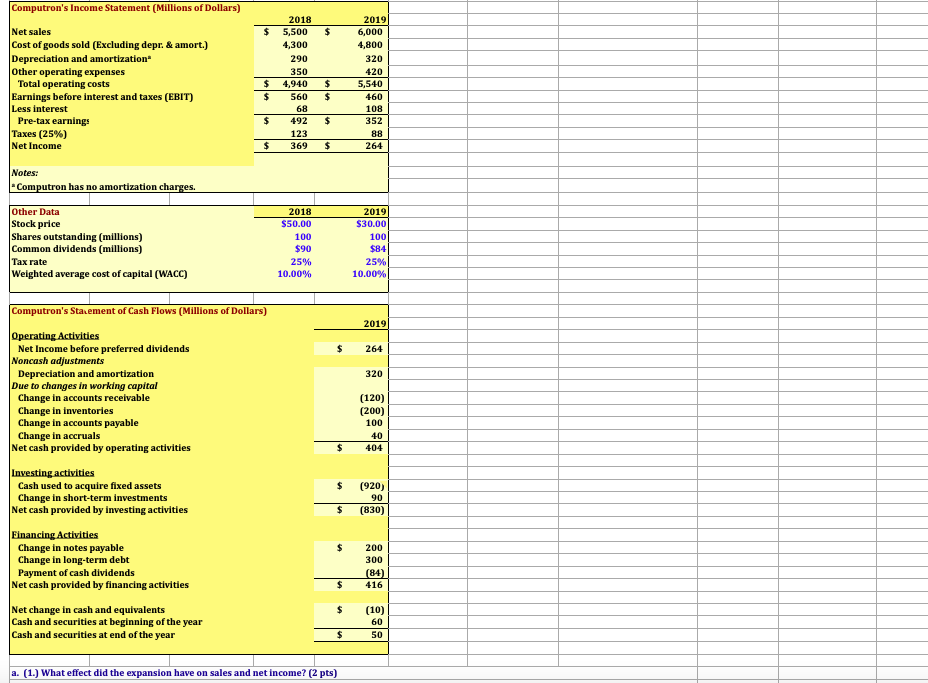

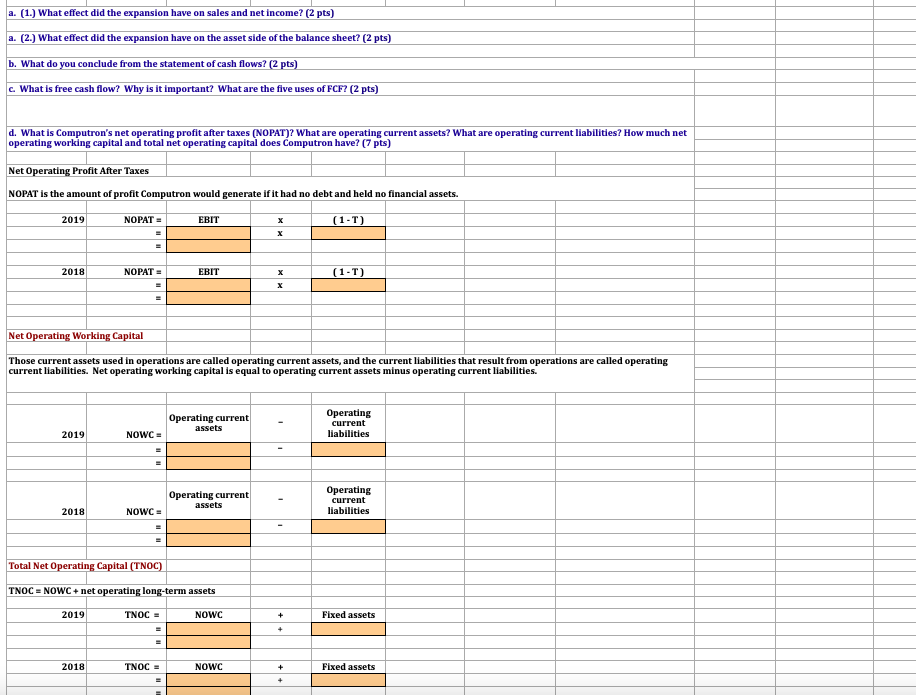

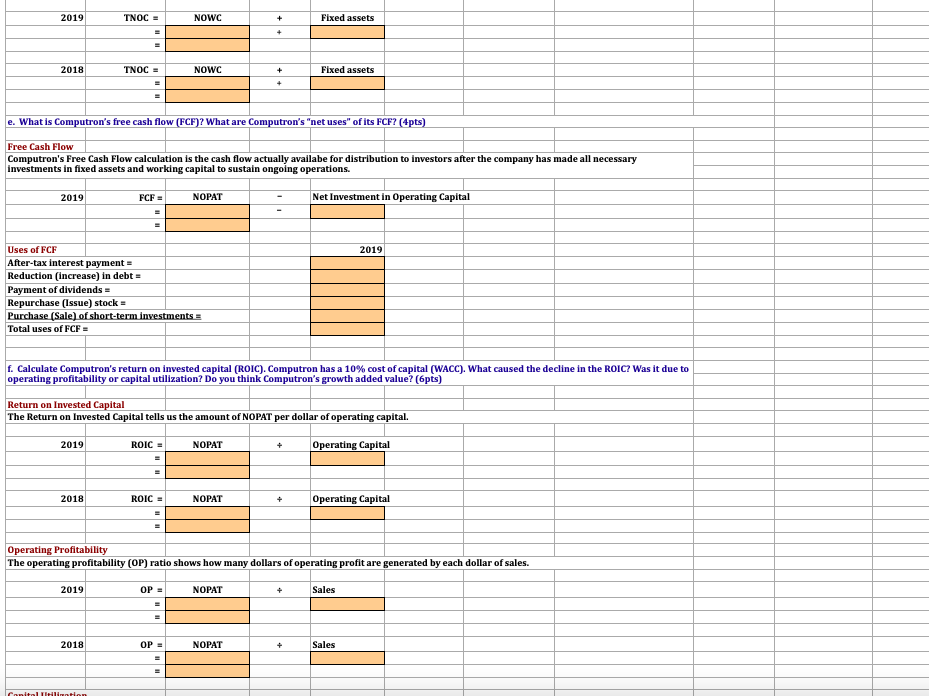

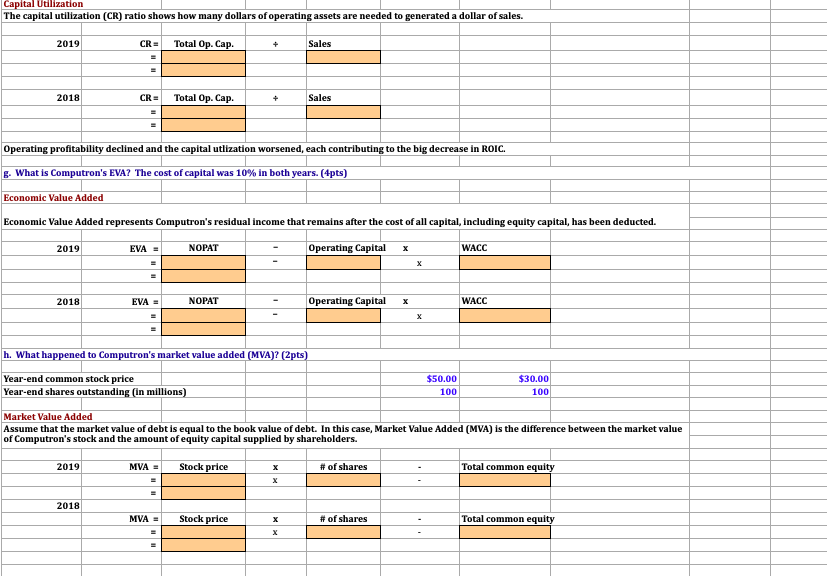

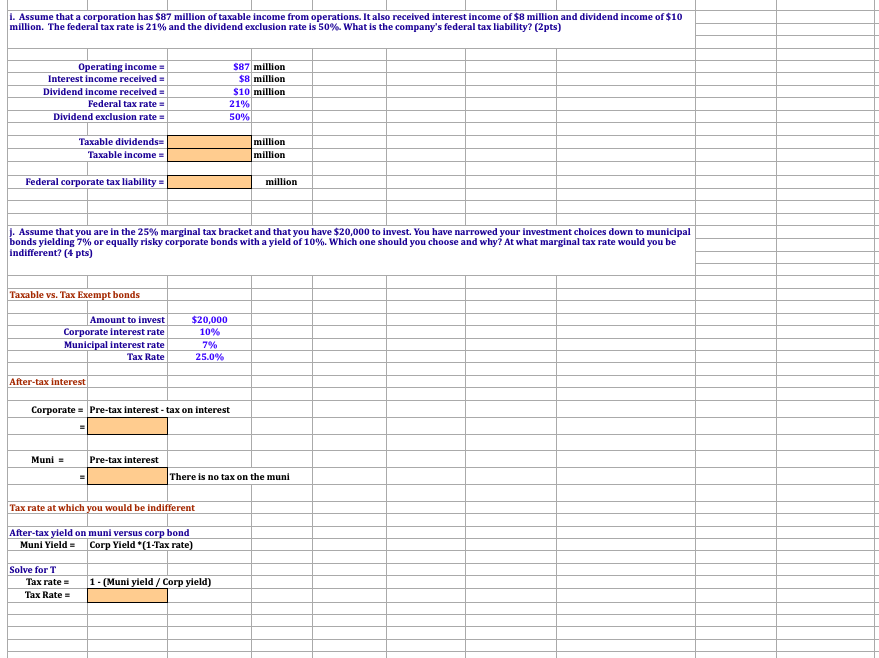

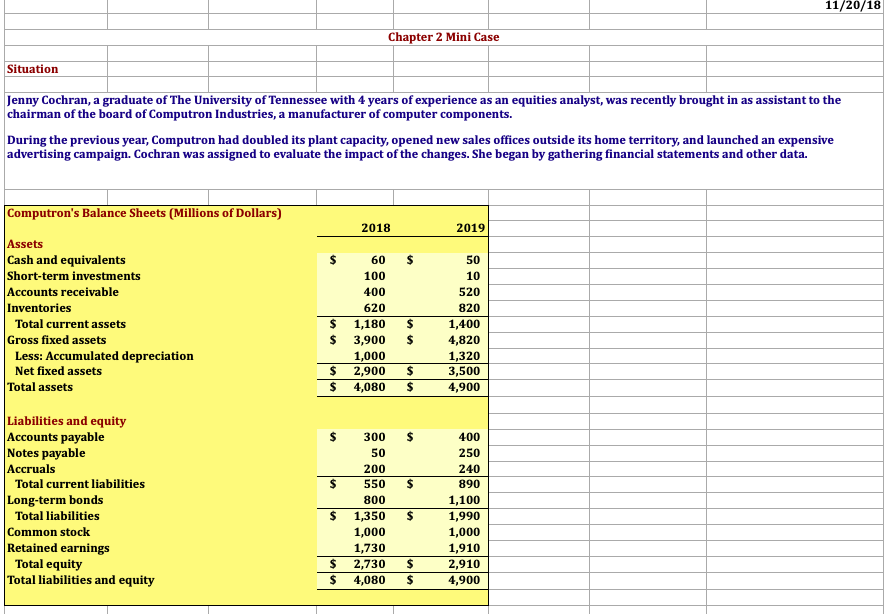

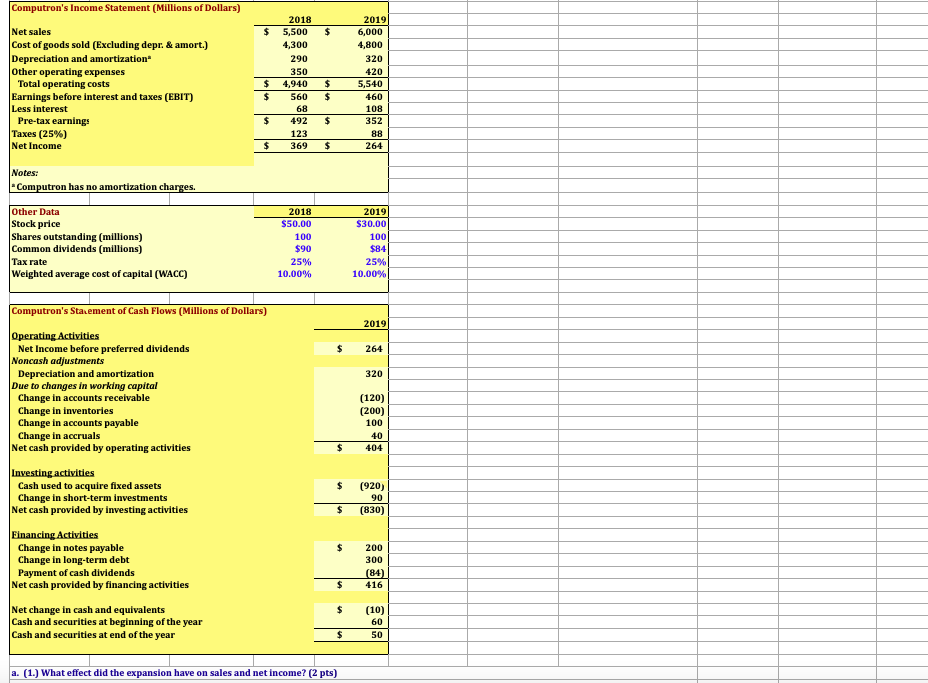

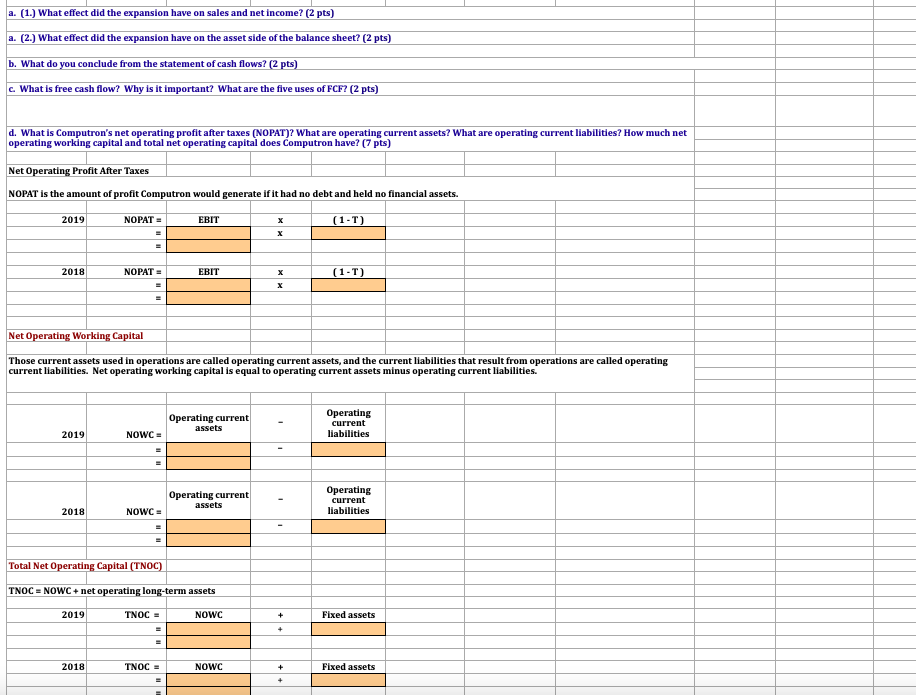

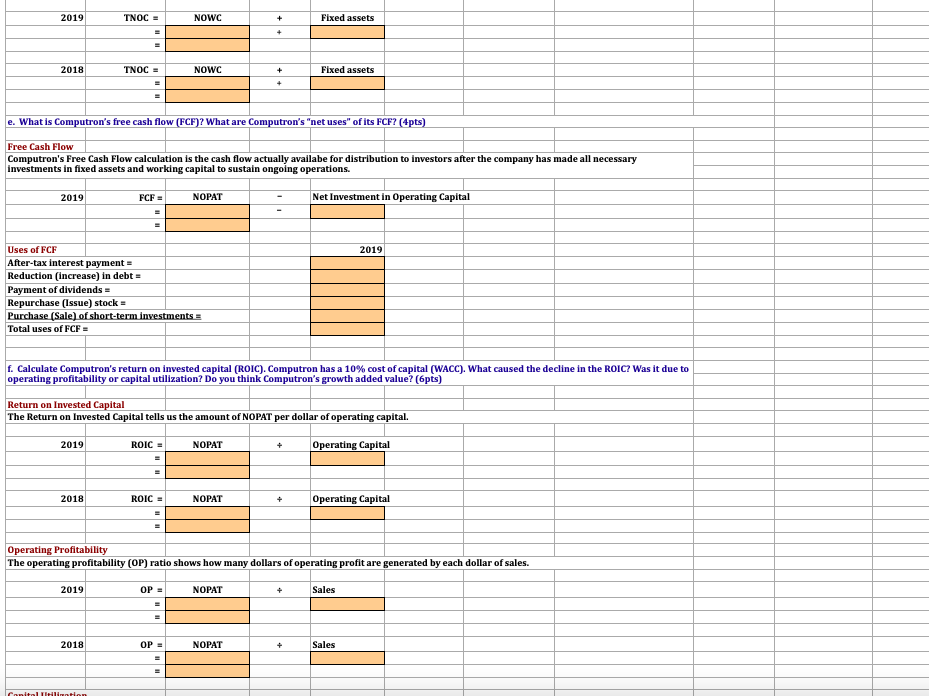

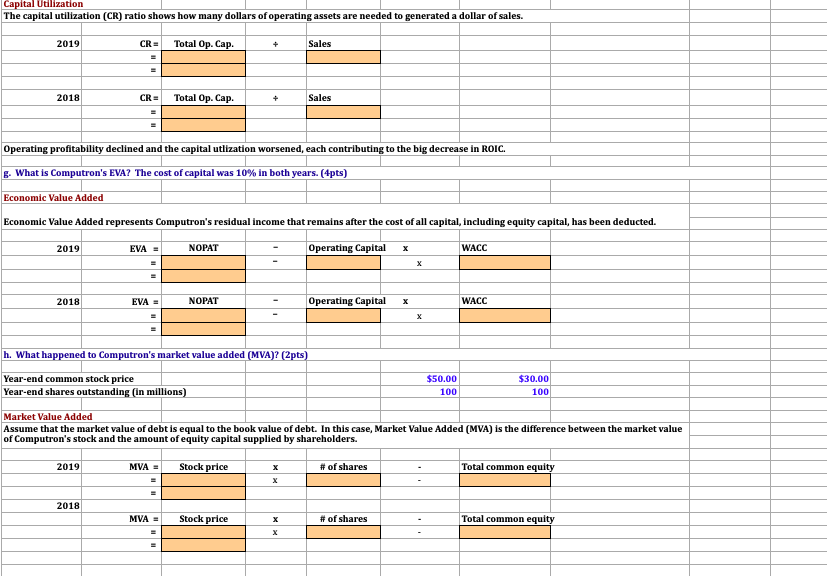

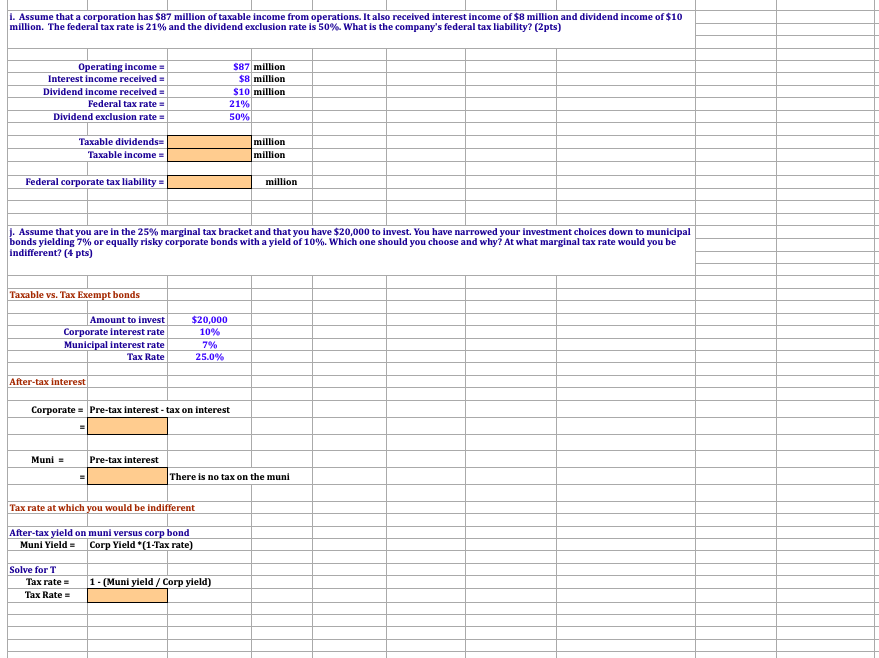

Jenny Cochran, a graduate of The University of Tennessee with 4 years of experience as an equities analyst, was recently brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components. During the previous year, Computron had doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. Cochran was assigned to evaluate the impact of the changes. She began by gathering financial statements and other data. Computron's Income Statement (Millions of Dollars) Net sales Cost of goods sold (Excluding depr. \& amort.) Depreciation and amortization " Other operating expenses Total operating costs Earnings before interest and taxes (EBIT) Less interest Pre-tax earnings Taxes (25%) Net Income \begin{tabular}{rrrr|} & 2018 & & 2019 \\ \hline$ & 5,500 & $ & 6,000 \\ & 4,300 & & 4,800 \\ & 290 & & 320 \\ & 350 & & 420 \\ \hline$ & 4,940 & $ & 5,540 \\ \hline$ & 560 & $ & 460 \\ & 68 & & 108 \\ \hline$ & 492 & $ & 352 \\ & 123 & & 88 \\ \hline$ & 369 & $ & 264 \\ \hline \end{tabular} Notes: "Computron has no amortization charges. Computron's Starement of Cash Flows (Millions of Dollars) Operating Activities Net Income before preferred dividends Noncash adjustments Depreciation and amortization Due to changes in working capital Change in accounts receivable Change in inventories Change in accounts payable Change in accruals Net cash provided by operating activities Investing activities Cash used to acquire fixed assets Change in short-term investments Net cash provided by investing activities 2019 Financing Activities Change in notes payable Change in long-term debt Payment of cash dividends Net cash provided by financing activities Net change in cash and equivalents Cash and securities at beginning of the year Cash and securities at end of the year a. (1.) What effect did the expansion have on sales and net income? (2 pts) a. (1.) What effect did the expansion have on sales and net income? (2 pts) a. (2.) What effect did the expansion have on the asset side of the balance sheet? ( 2 pts) b. What do you conclude from the statement of cash flows? ( 2 pts) c. What is free cash flow? Why is it important? What are the five uses of FCF? ( 2 pts) d. What is Computron's net operating profit after taxes (NOPAT)? What are operating current assets? What are operating current liabilities? How much net operating working capital and total net operating capital does Computron have? ( 7 pts) Net Operating Profit After Taxes NOPAT is the amount of profit Computron would generate if it had no debt and held no financial assets. Net Operating Working Capital Those current assets used in operations are called operating current assets, and the current liabilities that result from operations are called operating current liabilities. Net operating working capital is equal to operating current assets minus operating current liabilities. e. What is Computron's free cash flow (FCF)? What are Computron's "net uses" of its FCF? (4pts) Free Cash Flow Computron's Free Cash Flow calculation is the cash flow actually availabe for distribution to investors after the company has made all necessary investments in fixed assets and working capital to sustain ongoing operations. f. Calculate Computron's return on invested capital (ROIC). Computron has a 10% cost of capital (WACC). What caused the decline in the RoIC? Was it due to operating profitability or capital utilization? Do you think Computron's growth added value? (6pts) Return on Invested Capital The Return on Invested Capital tells us the amount of NOPAT per dollar of operating capital. Operating Profitability The operating profitability (OP) ratio shows how many dollars of operating profit are generated by each dollar of sales. Capital Utilization The capital utilization (CR) ratio shows how many dollars of operating assets are needed to generated a dollar of sales. Operating profitability declined and the capital utlization worsened, each contributing to the big decrease in RoIC. g. What is Computron's EVA? The cost of capital was 10% in both years. (4pts) Economic Value Added Economic Value Added represents Computron's residual income that remains after the cost of all capital, including equity capital, has been deducted. \begin{tabular}{r|r|r|r|r|r|r|r|} \hline & & & & & \\ \hline 2019 & EVA & = & NOPAT & & Operating Capital x & \multicolumn{1}{|c|}{ WACC } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} h. What happened to Computron's market value added (MVA)? (2pts) \begin{tabular}{|l|l|r|r|r|} \hline Year-end common stock price & & $50.00 & $30.00 \\ \hline Year-end shares outstanding (in millions) & 100 & 100 \\ \hline \end{tabular} Market Value Added Assume that the market value of debt is equal to the book value of debt. In this case, Market Value Added (MVA) is the difference between the market value of Computron's stock and the amount of equity capital supplied by shareholders. i. Assume that a corporation has $87 million of taxable income from operations. It also received interest income of $8 million and dividend income of $10 million. The federal tax rate is 21% and the dividend exclusion rate is 50%. What is the company's federal tax liability? (2pts) j. Assume that you are in the 25% marginal tax bracket and that you have $20,000 to invest. You have narrowed your investment choices down to municipal bonds yielding 7% or equally risky corporate bonds with a yield of 10%. Which one should you choose and why? At what marginal tax rate would you be indifferent? (4 pts) Jenny Cochran, a graduate of The University of Tennessee with 4 years of experience as an equities analyst, was recently brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components. During the previous year, Computron had doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. Cochran was assigned to evaluate the impact of the changes. She began by gathering financial statements and other data. Computron's Income Statement (Millions of Dollars) Net sales Cost of goods sold (Excluding depr. \& amort.) Depreciation and amortization " Other operating expenses Total operating costs Earnings before interest and taxes (EBIT) Less interest Pre-tax earnings Taxes (25%) Net Income \begin{tabular}{rrrr|} & 2018 & & 2019 \\ \hline$ & 5,500 & $ & 6,000 \\ & 4,300 & & 4,800 \\ & 290 & & 320 \\ & 350 & & 420 \\ \hline$ & 4,940 & $ & 5,540 \\ \hline$ & 560 & $ & 460 \\ & 68 & & 108 \\ \hline$ & 492 & $ & 352 \\ & 123 & & 88 \\ \hline$ & 369 & $ & 264 \\ \hline \end{tabular} Notes: "Computron has no amortization charges. Computron's Starement of Cash Flows (Millions of Dollars) Operating Activities Net Income before preferred dividends Noncash adjustments Depreciation and amortization Due to changes in working capital Change in accounts receivable Change in inventories Change in accounts payable Change in accruals Net cash provided by operating activities Investing activities Cash used to acquire fixed assets Change in short-term investments Net cash provided by investing activities 2019 Financing Activities Change in notes payable Change in long-term debt Payment of cash dividends Net cash provided by financing activities Net change in cash and equivalents Cash and securities at beginning of the year Cash and securities at end of the year a. (1.) What effect did the expansion have on sales and net income? (2 pts) a. (1.) What effect did the expansion have on sales and net income? (2 pts) a. (2.) What effect did the expansion have on the asset side of the balance sheet? ( 2 pts) b. What do you conclude from the statement of cash flows? ( 2 pts) c. What is free cash flow? Why is it important? What are the five uses of FCF? ( 2 pts) d. What is Computron's net operating profit after taxes (NOPAT)? What are operating current assets? What are operating current liabilities? How much net operating working capital and total net operating capital does Computron have? ( 7 pts) Net Operating Profit After Taxes NOPAT is the amount of profit Computron would generate if it had no debt and held no financial assets. Net Operating Working Capital Those current assets used in operations are called operating current assets, and the current liabilities that result from operations are called operating current liabilities. Net operating working capital is equal to operating current assets minus operating current liabilities. e. What is Computron's free cash flow (FCF)? What are Computron's "net uses" of its FCF? (4pts) Free Cash Flow Computron's Free Cash Flow calculation is the cash flow actually availabe for distribution to investors after the company has made all necessary investments in fixed assets and working capital to sustain ongoing operations. f. Calculate Computron's return on invested capital (ROIC). Computron has a 10% cost of capital (WACC). What caused the decline in the RoIC? Was it due to operating profitability or capital utilization? Do you think Computron's growth added value? (6pts) Return on Invested Capital The Return on Invested Capital tells us the amount of NOPAT per dollar of operating capital. Operating Profitability The operating profitability (OP) ratio shows how many dollars of operating profit are generated by each dollar of sales. Capital Utilization The capital utilization (CR) ratio shows how many dollars of operating assets are needed to generated a dollar of sales. Operating profitability declined and the capital utlization worsened, each contributing to the big decrease in RoIC. g. What is Computron's EVA? The cost of capital was 10% in both years. (4pts) Economic Value Added Economic Value Added represents Computron's residual income that remains after the cost of all capital, including equity capital, has been deducted. \begin{tabular}{r|r|r|r|r|r|r|r|} \hline & & & & & \\ \hline 2019 & EVA & = & NOPAT & & Operating Capital x & \multicolumn{1}{|c|}{ WACC } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} h. What happened to Computron's market value added (MVA)? (2pts) \begin{tabular}{|l|l|r|r|r|} \hline Year-end common stock price & & $50.00 & $30.00 \\ \hline Year-end shares outstanding (in millions) & 100 & 100 \\ \hline \end{tabular} Market Value Added Assume that the market value of debt is equal to the book value of debt. In this case, Market Value Added (MVA) is the difference between the market value of Computron's stock and the amount of equity capital supplied by shareholders. i. Assume that a corporation has $87 million of taxable income from operations. It also received interest income of $8 million and dividend income of $10 million. The federal tax rate is 21% and the dividend exclusion rate is 50%. What is the company's federal tax liability? (2pts) j. Assume that you are in the 25% marginal tax bracket and that you have $20,000 to invest. You have narrowed your investment choices down to municipal bonds yielding 7% or equally risky corporate bonds with a yield of 10%. Which one should you choose and why? At what marginal tax rate would you be indifferent? (4 pts)