Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following transactions for Brown's Music (Click the icon to view the transactions.) Journalize all transactions for Brown's Music. Round all amounts to the

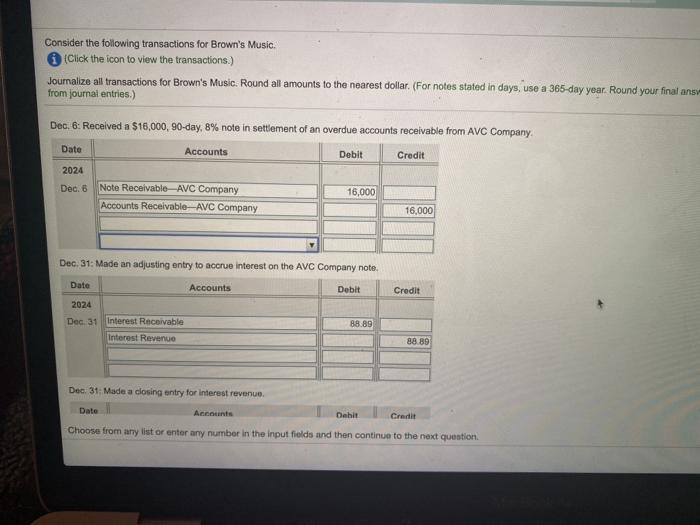

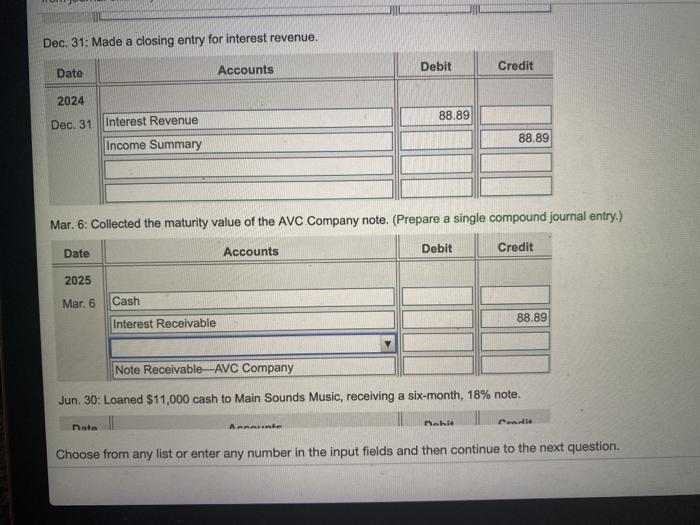

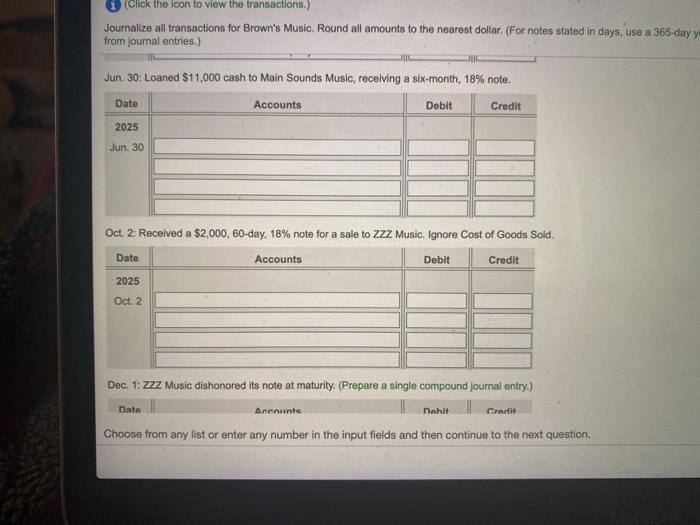

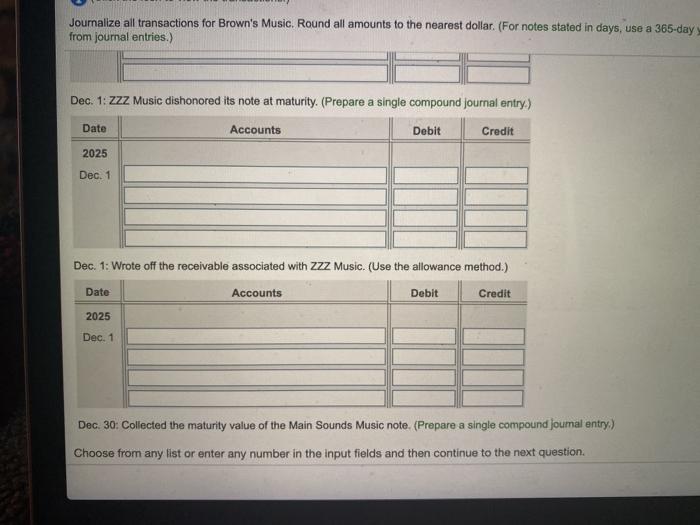

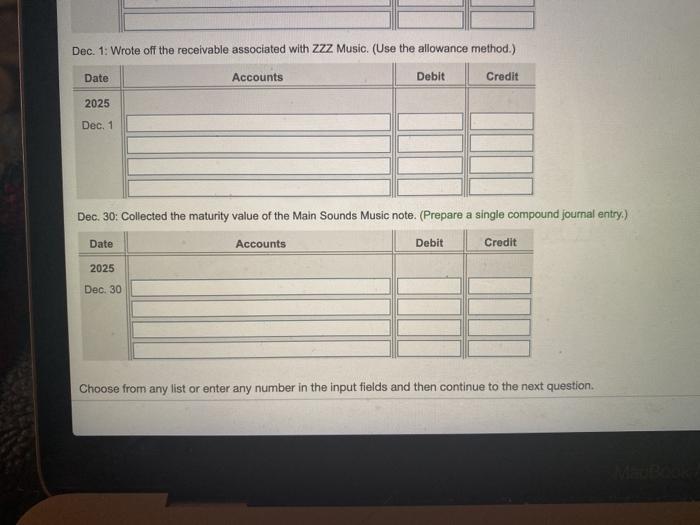

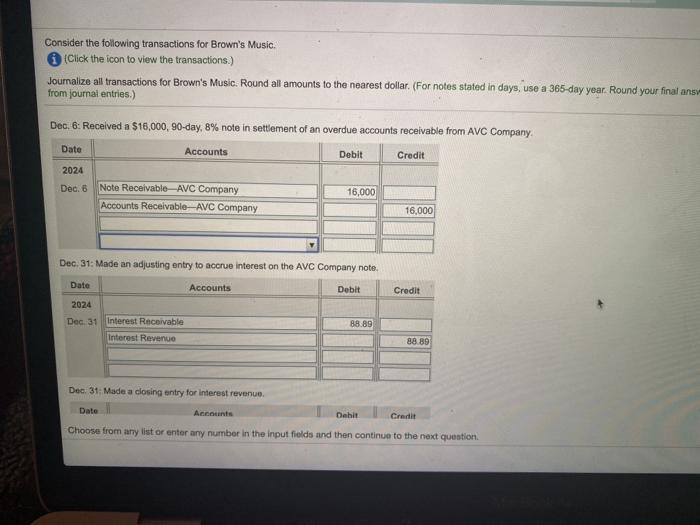

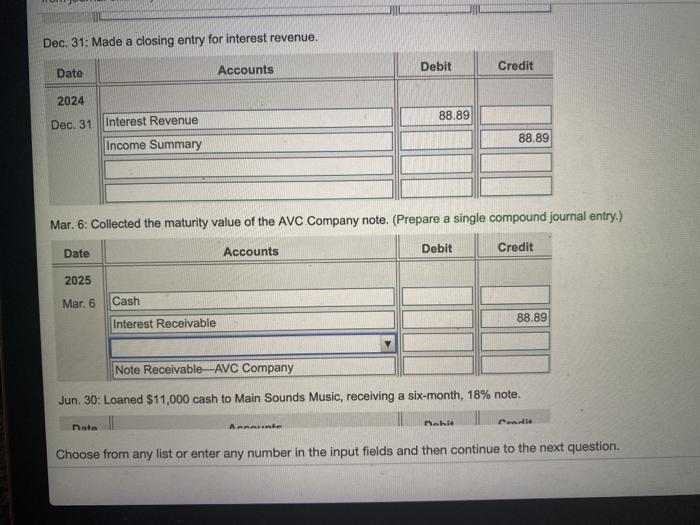

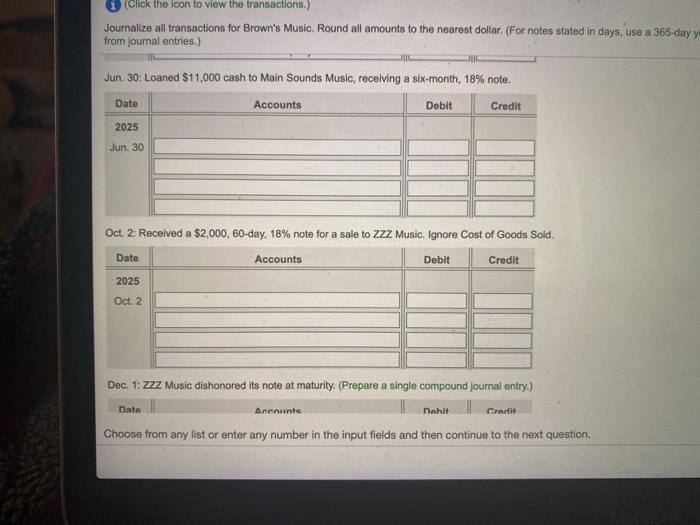

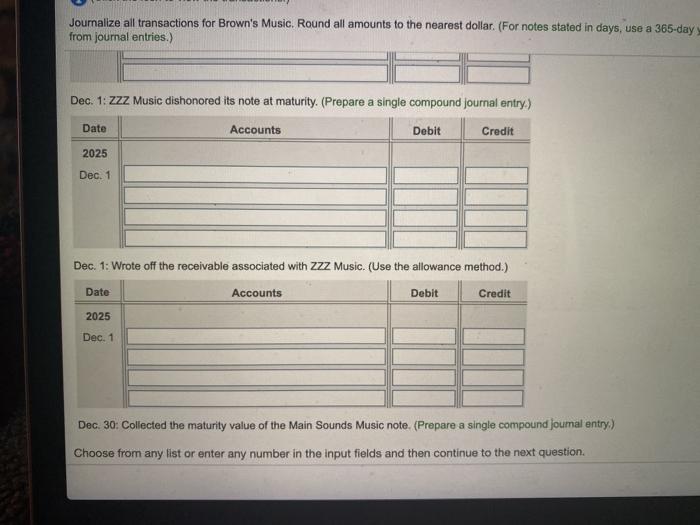

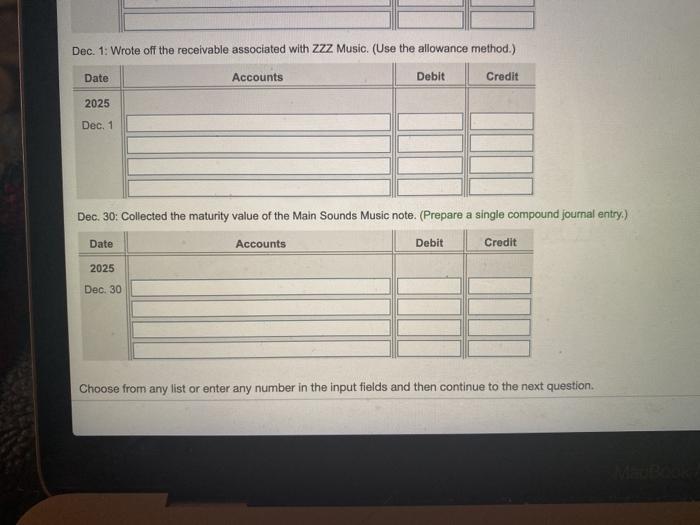

Consider the following transactions for Brown's Music (Click the icon to view the transactions.) Journalize all transactions for Brown's Music. Round all amounts to the nearest dollar. (For notes stated in days, use a 365-day year. Round your final ans from journal entries.) Dec. 6: Received a $16,000, 90-day, 8% note in settlement of an overdue accounts receivable from AVC Company Date Accounts Debit Credit 2024 Dec. 8 Note Receivable AVC Company Accounts Receivable-AVC Company 16,000 16,000 Dec. 31: Made an adjusting entry to accrue interest on the AVC Company note. Date Accounts Debit Credit 2024 Dec 31 Interest Receivable Interest Revenue 88.89 88.89 Dec. 31 Made a closing entry for interest revenue Date Accounts Dahit Credit Choose from any list or enter any number in the input fields and then continue to the next question Dec. 31: Made a closing entry for interest revenue. Debit Credit Date Accounts 2024 88.89 Dec. 31 Interest Revenue Income Summary 88.89 Mar. 6: Collected the maturity value of the AVC Company note. (Prepare a single compound journal entry.) Accounts Debit Date Credit 2025 Mer. 6 Cash 88.89 Interest Receivable Note Receivable AVC Company Jun 30: Loaned $11,000 cash to Main Sounds Music, receiving a six-month, 18% note. Cette Data Dahid ---++-+ Choose from any list or enter any number in the input fields and then continue to the next question. (Click the icon to view the transactions.) Journalize all transactions for Brown's Music. Round all amounts to the nearest dollar (For notes stated in days, use a 365-day y from journal entries.) Jun 30: Loaned $11,000 cash to Main Sounds Music, receiving a six-month, 18% note. Date Accounts Debit Credit 2025 Jun 30 Oct. 2: Received a $2,000, 60-day, 18% note for a sale to ZZZ Music. Ignore Cost of Goods Sold. Date Accounts Debit Credit 2025 Oct 2 Dec. 1: ZZZ Music dishonored its note at maturity. (Prepare a single compound journal entry) Ancount Choose from any list or enter any number in the input fields and then continue to the next question. Data Dahlt Credit Journalize all transactions for Brown's Music. Round all amounts to the nearest dollar. (For notes stated in days, use a 365-day from journal entries.) Dec. 1: ZZZ Music dishonored its note at maturity. (Prepare a single compound journal entry) Date Accounts Debit Credit 2025 Dec. 1 Dec. 1: Wrote off the receivable associated with ZZZ Music. (Use the allowance method.) Date Accounts Debit Credit 2025 Dec. 1 Dec. 30: Collected the maturity value of the Main Sounds Music note. (Prepare a single compound joumal entry) Choose from any list or enter any number in the input fields and then continue to the next question. Dec. 1: Wrote off the receivable associated with ZZZ Music (Use the allowance method.) Date Accounts Debit Credit 2025 Dec. 1 Dec. 30: Collected the maturity value of the Main Sounds Music note. (Prepare a single compound journal entry) Date Accounts Debit Credit 2025 Dec. 30 Choose from any list or enter any number in the input fields and then continue to the next

Consider the following transactions for Brown's Music (Click the icon to view the transactions.) Journalize all transactions for Brown's Music. Round all amounts to the nearest dollar. (For notes stated in days, use a 365-day year. Round your final ans from journal entries.) Dec. 6: Received a $16,000, 90-day, 8% note in settlement of an overdue accounts receivable from AVC Company Date Accounts Debit Credit 2024 Dec. 8 Note Receivable AVC Company Accounts Receivable-AVC Company 16,000 16,000 Dec. 31: Made an adjusting entry to accrue interest on the AVC Company note. Date Accounts Debit Credit 2024 Dec 31 Interest Receivable Interest Revenue 88.89 88.89 Dec. 31 Made a closing entry for interest revenue Date Accounts Dahit Credit Choose from any list or enter any number in the input fields and then continue to the next question Dec. 31: Made a closing entry for interest revenue. Debit Credit Date Accounts 2024 88.89 Dec. 31 Interest Revenue Income Summary 88.89 Mar. 6: Collected the maturity value of the AVC Company note. (Prepare a single compound journal entry.) Accounts Debit Date Credit 2025 Mer. 6 Cash 88.89 Interest Receivable Note Receivable AVC Company Jun 30: Loaned $11,000 cash to Main Sounds Music, receiving a six-month, 18% note. Cette Data Dahid ---++-+ Choose from any list or enter any number in the input fields and then continue to the next question. (Click the icon to view the transactions.) Journalize all transactions for Brown's Music. Round all amounts to the nearest dollar (For notes stated in days, use a 365-day y from journal entries.) Jun 30: Loaned $11,000 cash to Main Sounds Music, receiving a six-month, 18% note. Date Accounts Debit Credit 2025 Jun 30 Oct. 2: Received a $2,000, 60-day, 18% note for a sale to ZZZ Music. Ignore Cost of Goods Sold. Date Accounts Debit Credit 2025 Oct 2 Dec. 1: ZZZ Music dishonored its note at maturity. (Prepare a single compound journal entry) Ancount Choose from any list or enter any number in the input fields and then continue to the next question. Data Dahlt Credit Journalize all transactions for Brown's Music. Round all amounts to the nearest dollar. (For notes stated in days, use a 365-day from journal entries.) Dec. 1: ZZZ Music dishonored its note at maturity. (Prepare a single compound journal entry) Date Accounts Debit Credit 2025 Dec. 1 Dec. 1: Wrote off the receivable associated with ZZZ Music. (Use the allowance method.) Date Accounts Debit Credit 2025 Dec. 1 Dec. 30: Collected the maturity value of the Main Sounds Music note. (Prepare a single compound joumal entry) Choose from any list or enter any number in the input fields and then continue to the next question. Dec. 1: Wrote off the receivable associated with ZZZ Music (Use the allowance method.) Date Accounts Debit Credit 2025 Dec. 1 Dec. 30: Collected the maturity value of the Main Sounds Music note. (Prepare a single compound journal entry) Date Accounts Debit Credit 2025 Dec. 30 Choose from any list or enter any number in the input fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started