Answered step by step

Verified Expert Solution

Question

1 Approved Answer

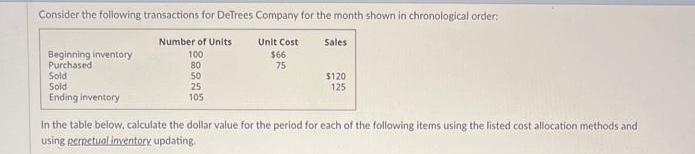

Consider the following transactions for DeTrees Company for the month shown in chronological order: Beginning inventory Purchased Sold Sold Ending inventory Number of Units

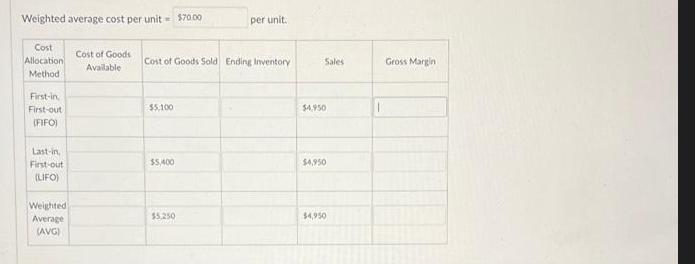

Consider the following transactions for DeTrees Company for the month shown in chronological order: Beginning inventory Purchased Sold Sold Ending inventory Number of Units 100 80 50 25 105 Unit Cost $66 75 Sales $120 125 in the table below, calculate the dollar value for the period for each of the following items using the listed cost allocation methods and using perpetual inventory updating. Weighted average cost per unit = $70.00 Cost Allocation Method First-in First-out (FIFO) Last-in, First-out (LIFO) Weighted Average (AVG) Cost of Goods Available Cost of Goods Sold Ending Inventory $5,100 $5,400 per unit. $5.250 Sales $4,950 $4,950 $4,950 Gross Margin

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Using perpetual inventory updating we can calculate the cost of goods sold and ending inventory as follows Cost of goods sold Beginning invento...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started