Question

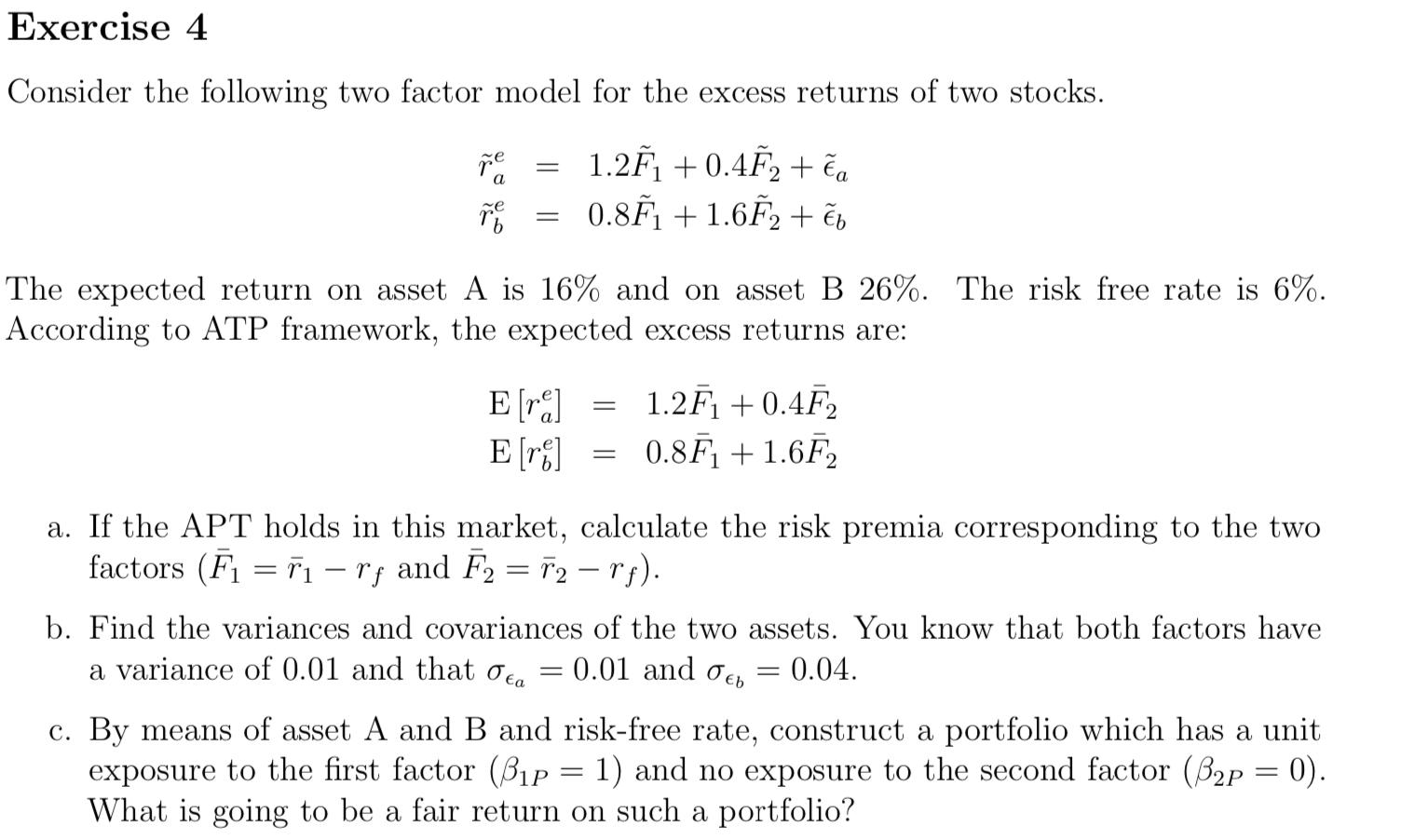

Consider the following two factor model for the excess returns of two stocks. 1.2F +0.4F + a 0.8F1 + 1.6F2+ eb e a e

Consider the following two factor model for the excess returns of two stocks. 1.2F +0.4F + a 0.8F1 + 1.6F2+ eb e a e = = The expected return on asset A is 16% and on asset B 26%. The risk free rate is 6%. According to ATP framework, the expected excess returns are: E [re] E [r] = = = 1.2F +0.4F 0.8F + 1.6F2 a. If the APT holds in this market, calculate the risk premia corresponding to the two factors (F = 7 r and F = T2 rf). b. Find the variances and covariances of the two assets. You know that both factors have a variance of 0.01 and that ota 0.01 and deb 0.04. = c. By means of asset A and B and risk-free rate, construct a portfolio which has a unit exposure to the first factor (3p = 1) and no exposure to the second factor (3p = 0). What is going to be a fair return on such a portfolio?

Step by Step Solution

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Analysis Valuation Using Financial Statements

Authors: Paul M. Healy

5th edition

1111972303, 978-1111972301

Students also viewed these Physics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App