Question

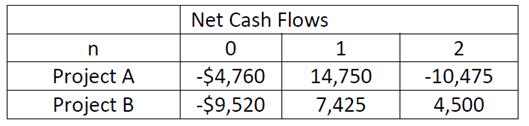

Consider the following two investment projects and an MARR of 9%. Remember that Excel may not be used for any part of this question. (a)

Consider the following two investment projects and an MARR of 9%. Remember that Excel may not be used for any part of this question.

(a) Classify each investment as either a simple or non-simple.

(b) Find all possible i* values for each project

(c) Use the RIC method to find the true IRR for Project A

(d) What can be said about the true IRR for Project B, based upon the results of parts (a) and (b) [do not perform any calculations to answer this question]

(e) Consider each individual project and determine if these projects (when considered individually) are good or bad investments. Use an MIRR approach.

Net Cash Flows 1 2 Project A Project B -$4,760 -$9,520 14,750 -10,475 7,425 4,500

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Engineering Economics

Authors: Chan S. Park

3rd edition

132775425, 132775427, 978-0132775427

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App