Answered step by step

Verified Expert Solution

Question

1 Approved Answer

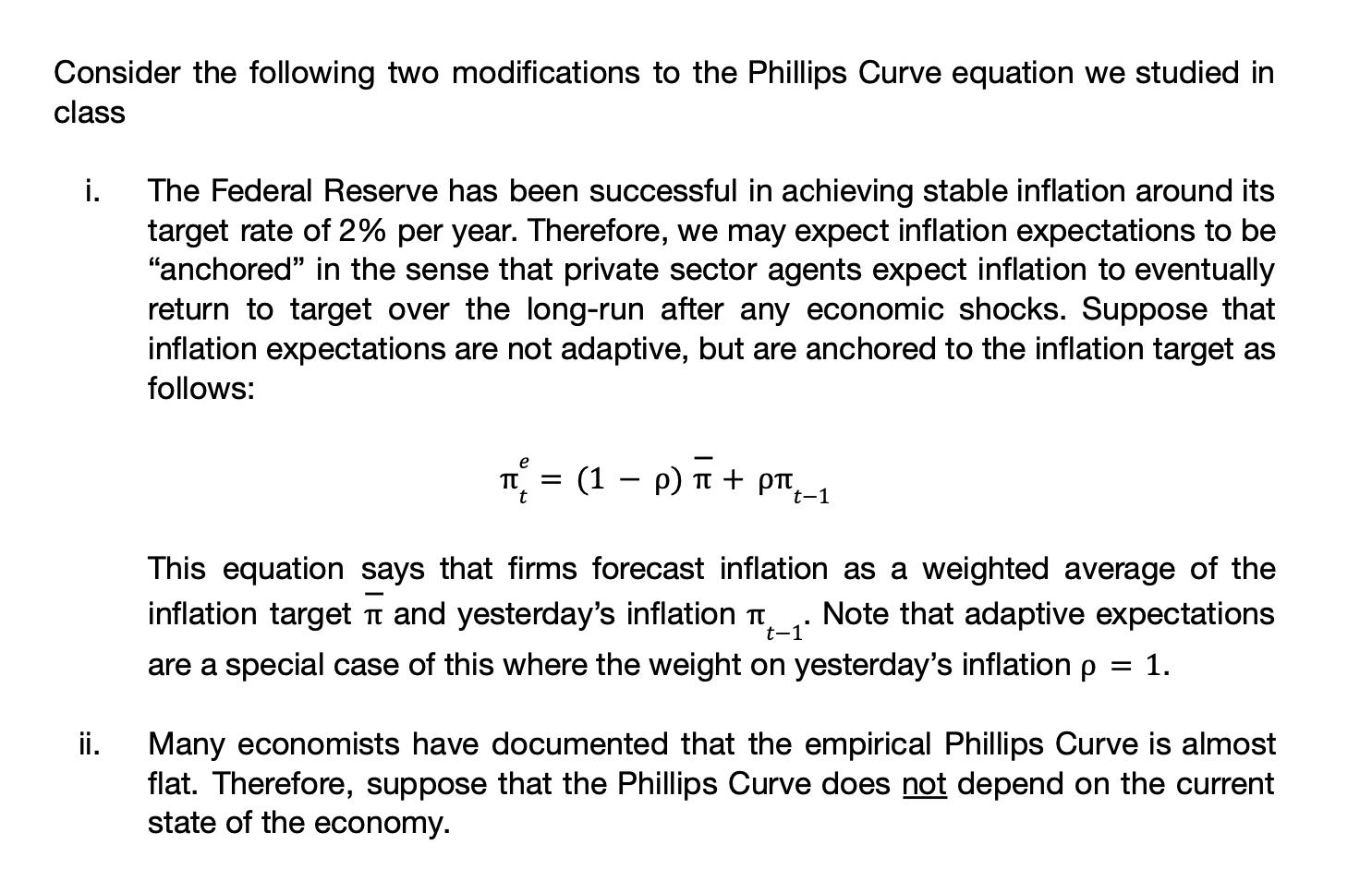

Consider the following two modifications to the Phillips Curve equation we studied in class i. The Federal Reserve has been successful in achieving stable

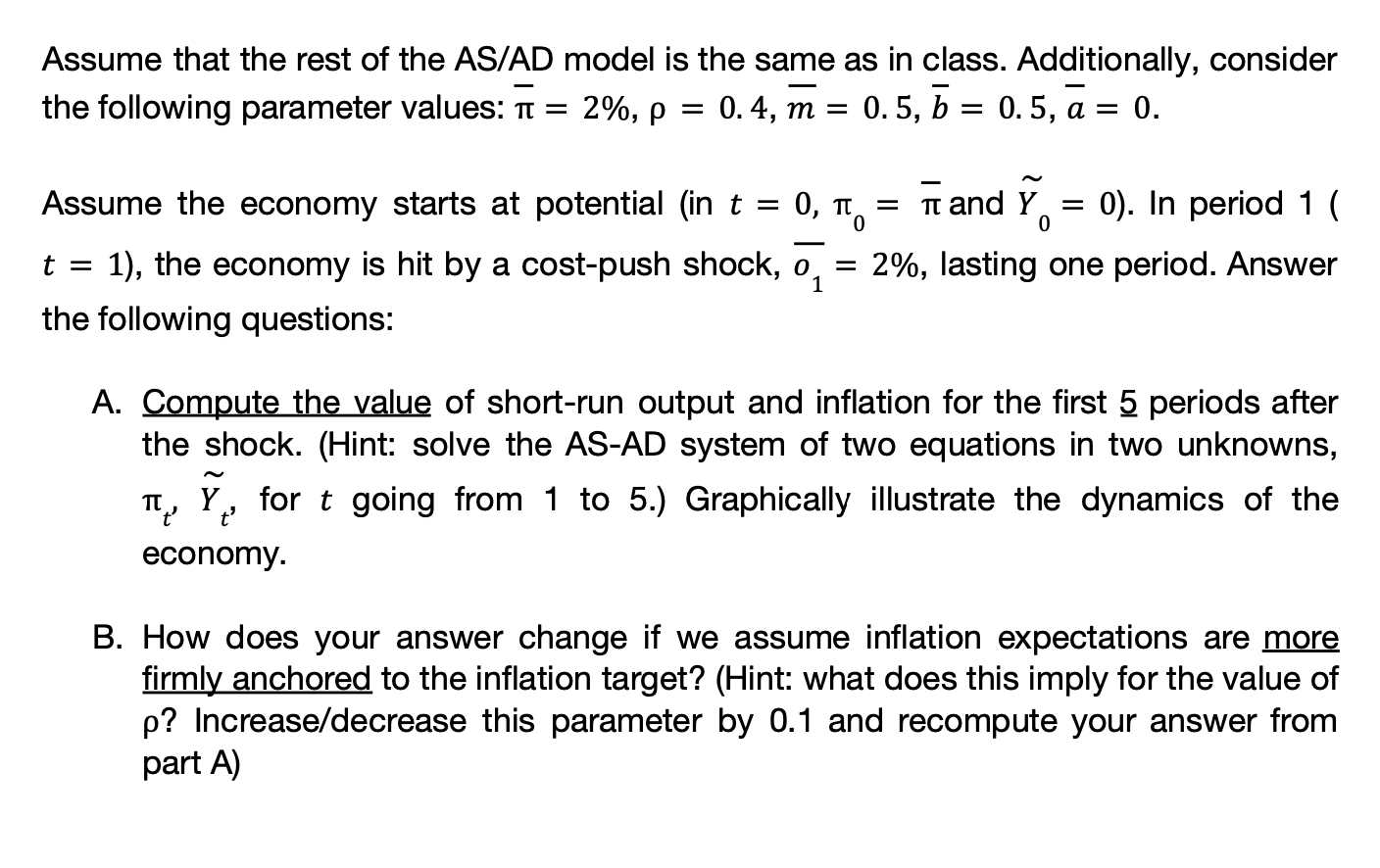

Consider the following two modifications to the Phillips Curve equation we studied in class i. The Federal Reserve has been successful in achieving stable inflation around its target rate of 2% per year. Therefore, we may expect inflation expectations to be "anchored" in the sense that private sector agents expect inflation to eventually return to target over the long-run after any economic shocks. Suppose that inflation expectations are not adaptive, but are anchored to the inflation target as follows: e t = (1 - p) + p -1 ii. This equation says that firms forecast inflation as a weighted average of the inflation target and yesterday's inflation Note that adaptive expectations are a special case of this where the weight on yesterday's inflation p t-1 = 1. Many economists have documented that the empirical Phillips Curve is almost flat. Therefore, suppose that the Phillips Curve does not depend on the current state of the economy. Assume that the rest of the AS/AD model is the same as in class. Additionally, consider = 0.4, m = 0.5, b = 0.5, a = 0. the following parameter values: = 2%, p Assume the economy starts at potential (in t = = 0. 1), the economy is hit by a cost-push shock, o, the following questions: = = and Y 0). In period 1 ( = 01 2%, lasting one period. Answer A. Compute the value of short-run output and inflation for the first 5 periods after the shock. (Hint: solve the AS-AD system of two equations in two unknowns, ~ for t going from 1 to 5.) Graphically illustrate the dynamics of the economy. B. How does your answer change if we assume inflation expectations are more firmly anchored to the inflation target? (Hint: what does this imply for the value of p? Increase/decrease this parameter by 0.1 and recompute your answer from part A)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started