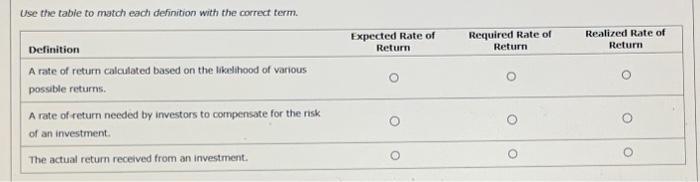

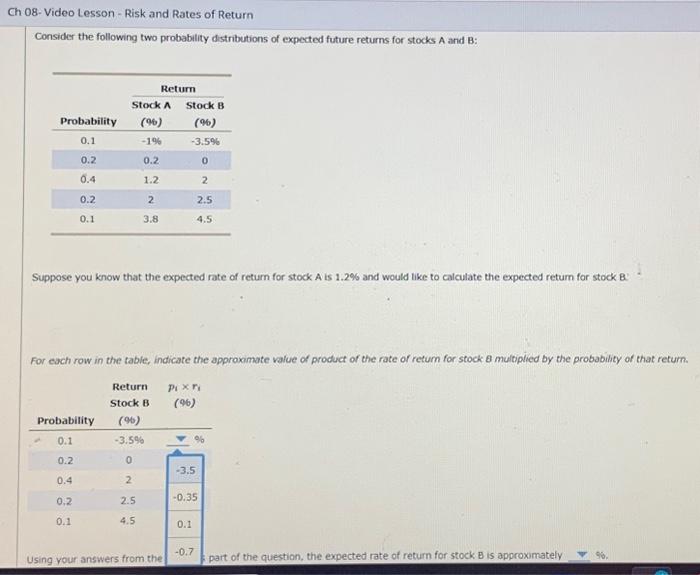

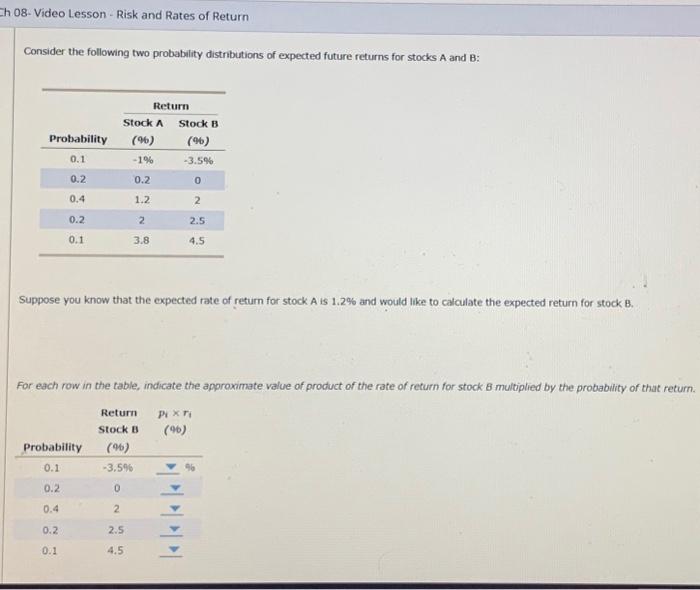

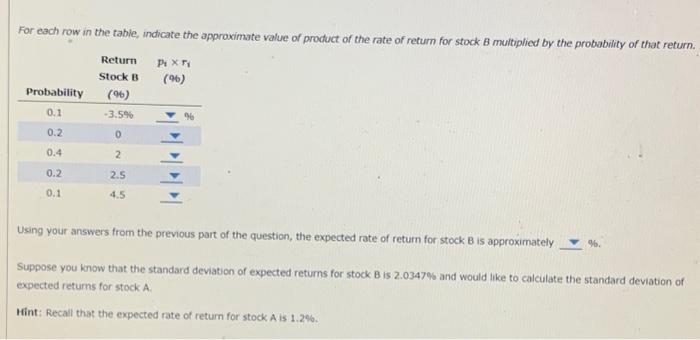

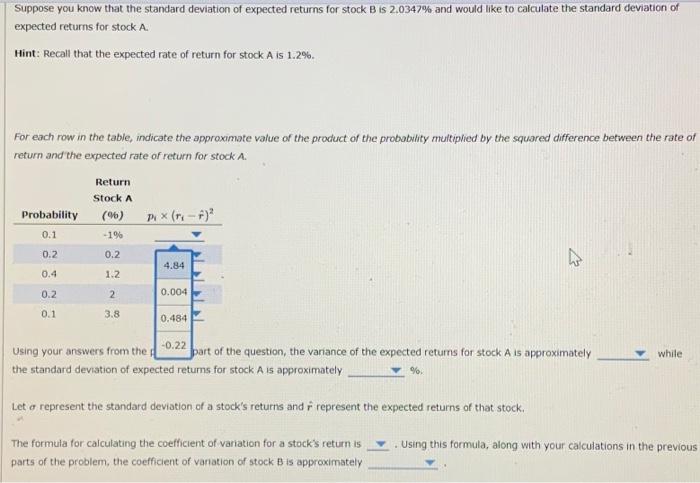

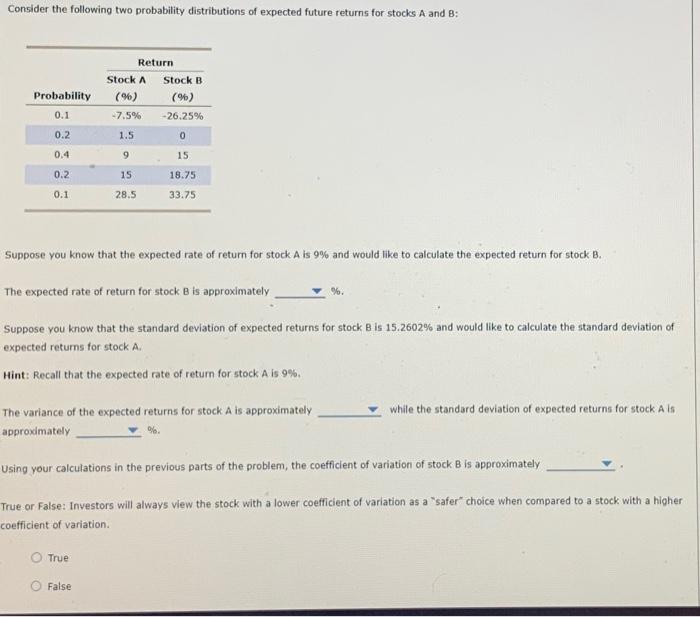

Consider the following two probability distributions of expected future returns for stocks A and B: Suppose you know that the expected rate of return for stock A is 1.2% and would like to calculate the expected retum for stock 8 Use the table to match each definition with the correct term. Consider the following two probability distributions of expected future returns for stocks A and B: Suppose you know that the expected rate of return for stock A is 9% and would like to calculate the expected return for stock B. The expected rate of return for stock B is approximately %. Suppose you know that the standard deviation of expected returns for stock B is 15.2602% and would like to calculate the standard deviation of expected returns for stock A. Hint: Recall that the expected rate of return for stock A is 9%. The variance of the expected returns for stock A is approximately while the standard deviation of expected returns for stock A is approximately \%. Using your calculations in the previous parts of the problem, the coefficient of variation of stock B is approximately True or False: Investors will always view the stock with a lower coefficient of variation as a "safer" choice when compared to a stock with a higher coefficient of variation. True False For each row in the table, indicate the approximate value of product of the rate of return for stock B multiplied by the probability of that return. Using your answers from the previous part of the question, the expected rate of return for stock B is approximately \%. Suppose you know that the standard deviation of expected retums for stock B is 2.0347% and would like to calculate the standard deviation of expected returns for stock A. Hint: Recall that the expected rate of retum for stock A is 1.2%. Suppose you know that the standard deviation of expected returns for stock B is 2.0347% and would like to calculate the standard deviation of expected returns for stock A. Hint: Recall that the expected rate of return for stock A is 1.2%. For each row in the table, indicate the approximate value of the product of the probability multiplied by the squared difference between the rate of return and the expected rate of return for stock A. while the standard deviation of expected returns for stock A is approximately %. Let represent the standard deviation of a stock's returns and r^ represent the expected returns of that stock. The formula for calculating the coefficient of variation for a stock's return is - Using this formula, along with your calculations in the previous parts of the problem, the coefficient of vanation of stock B is approximately Consider the following two probability distributions of expected future returns for stocks A and B: Suppose you know that the expected rate of return for stock A is 1.2% and would like to calculate the expected return for stock B. True or False: The expected return for a stock indicates the level of risk of the investment. True False