Question

Consider the following two savings plans that you think about starting at the age of 21. Option 1: Save $2,000 a year for 10

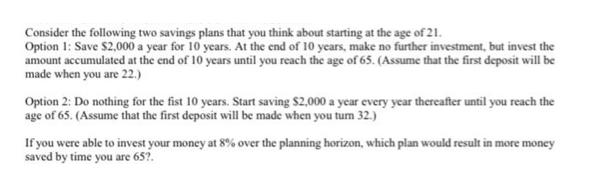

Consider the following two savings plans that you think about starting at the age of 21. Option 1: Save $2,000 a year for 10 years. At the end of 10 years, make no further investment, but invest the amount accumulated at the end of 10 years until you reach the age of 65. (Assume that the first deposit will be made when you are 22.) Option 2: Do nothing for the fist 10 years. Start saving $2,000 a year every year thereafter until you reach the age of 65. (Assume that the first deposit will be made when you turn 32.) If you were able to invest your money at 8% over the planning horizon, which plan would result in more money saved by time you are 65?.

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To compare the two savings plans we need to calculate the amount accumulated at the age of 65 for ea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Financial Planning

Authors: Randy Billingsley, Lawrence J. Gitman, Michael D. Joehnk

15th Edition

978-0357438480, 0357438485

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App