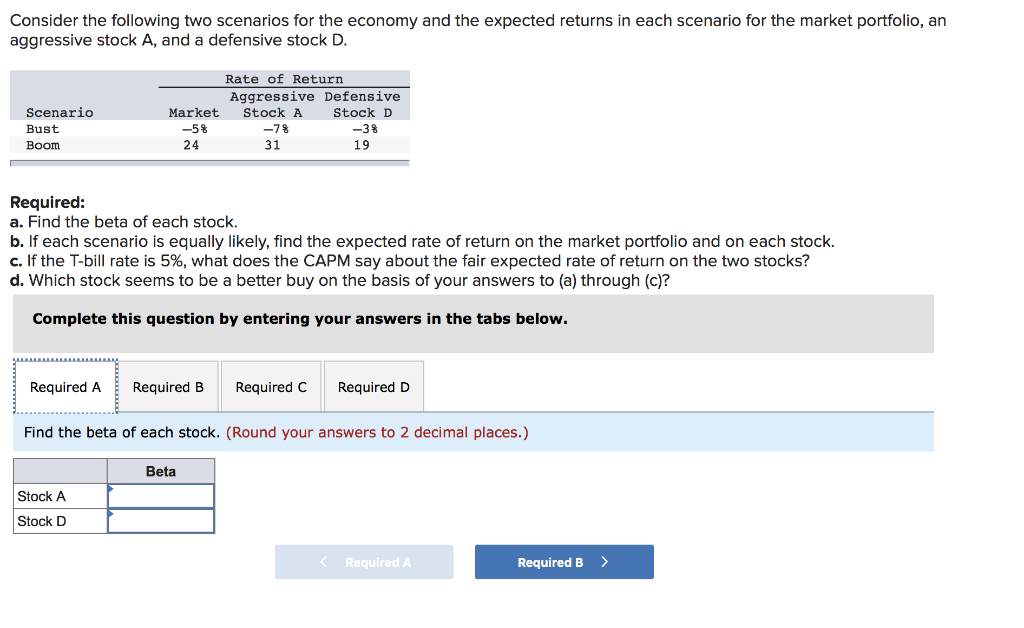

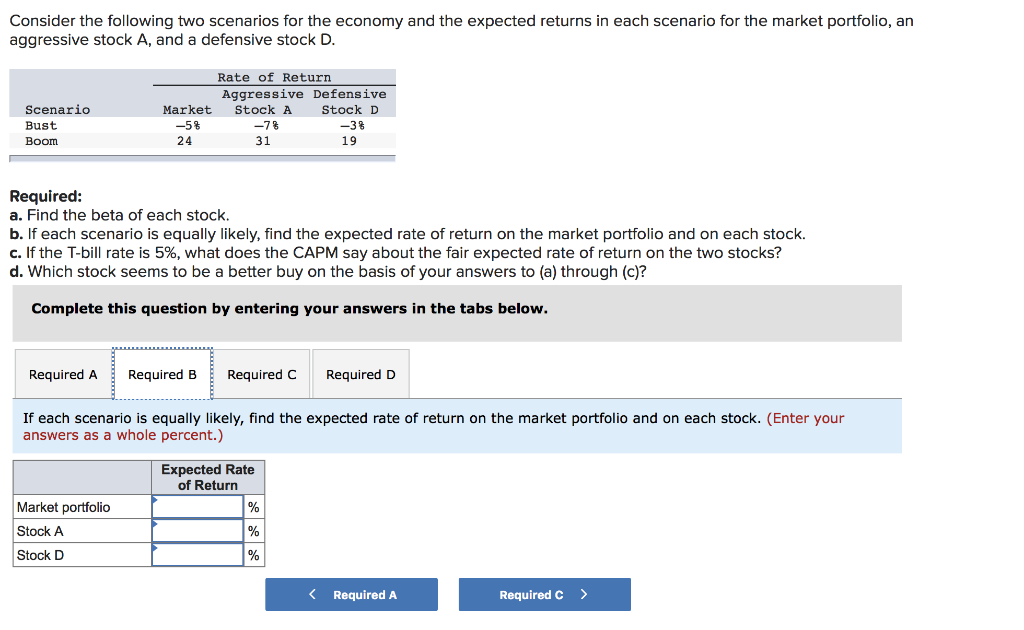

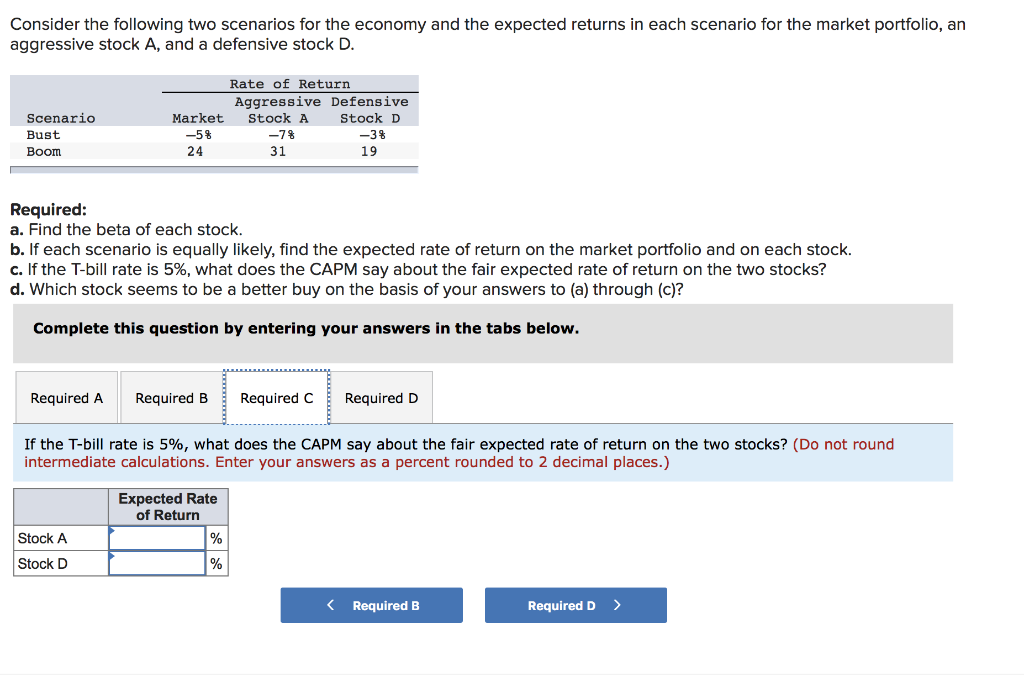

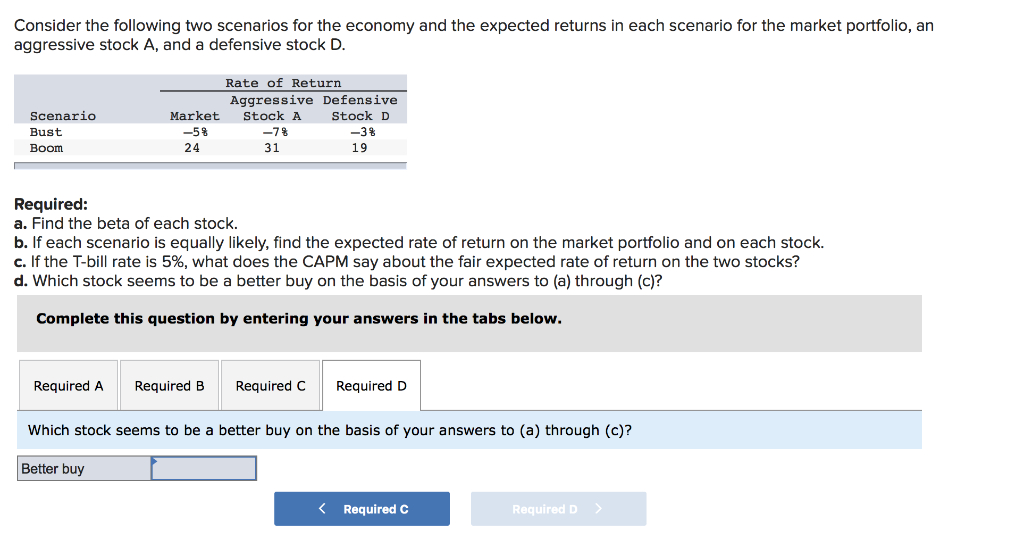

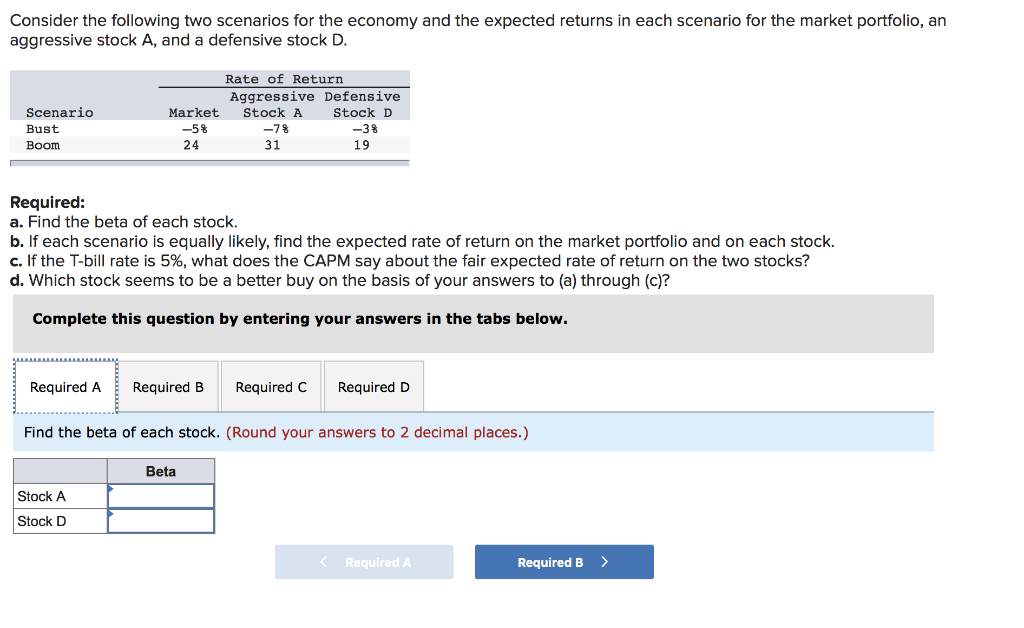

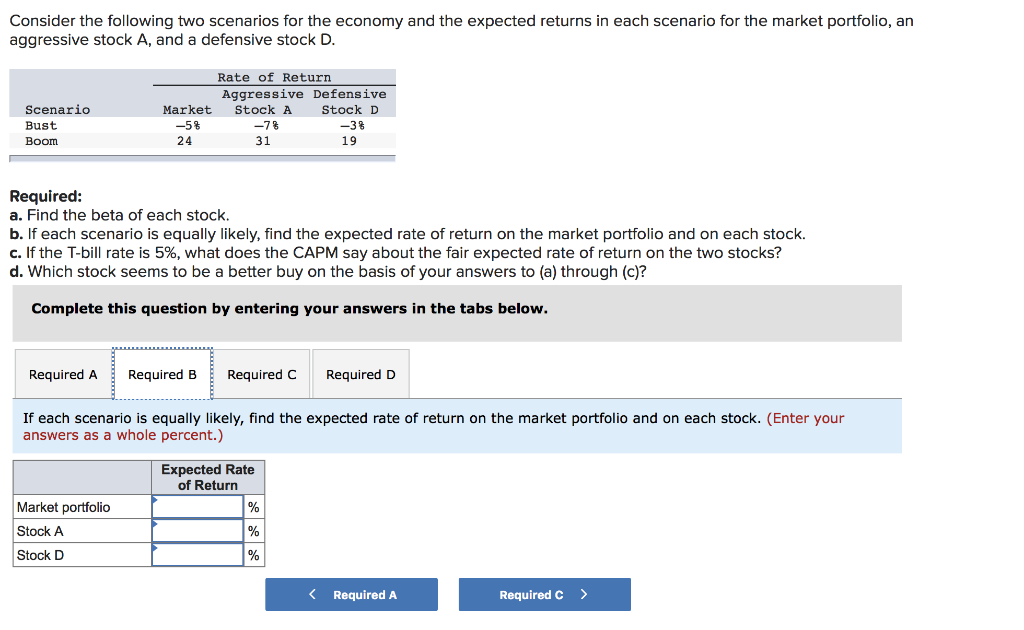

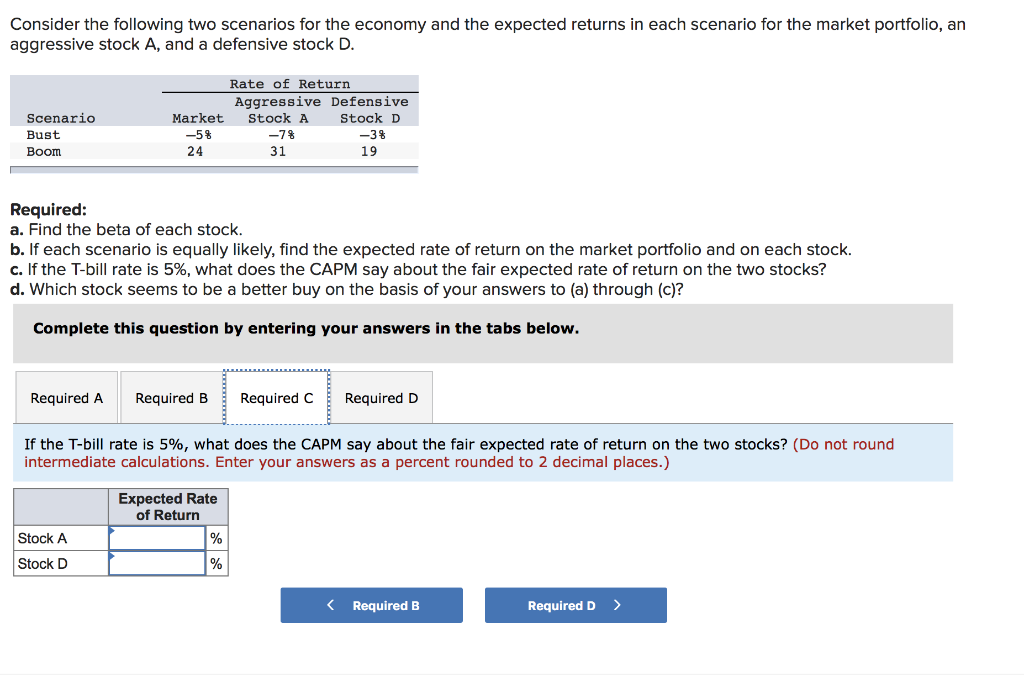

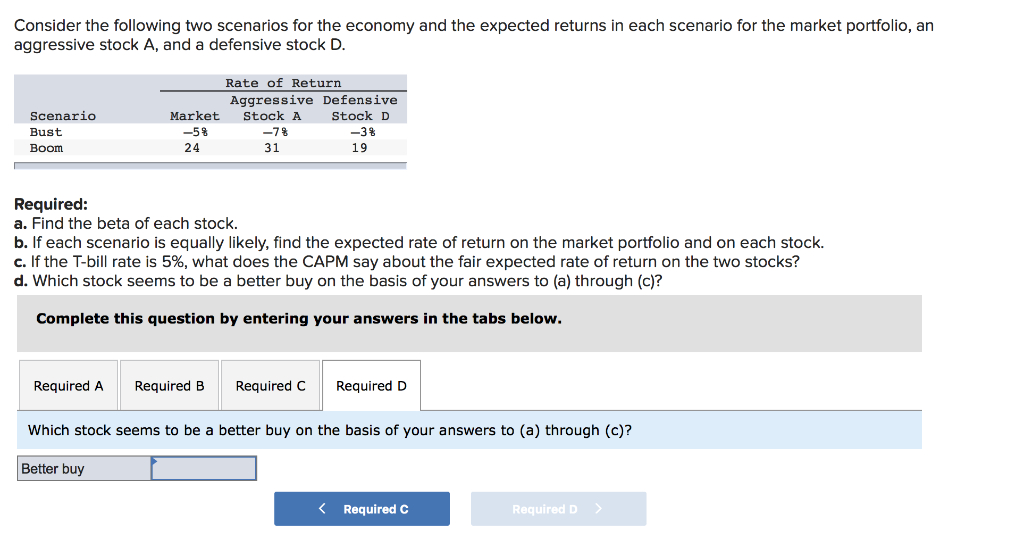

Consider the following two scenarios for the economy and the expected returns in each scenario for the market portfolio, an aggressive stock A, and a defensive stock D. Scenario Rate of Return Aggressive Defensive Market Stock A Stock D -7% -38 24 31 19 Bust -58 Boom Required: a. Find the beta of each stock. b. If each scenario is equally likely, find the expected rate of return on the market portfolio and on each stock. c. If the T-bill rate is 5%, what does the CAPM say about the fair expected rate of return on the two stocks? d. Which stock seems to be a better buy on the basis of your answers to (a) through (c)? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Find the beta of each stock. (Round your answers to 2 decimal places.) Beta Stock A Stock D Consider the following two scenarios for the economy and the expected returns in each scenario for the market portfolio, an aggressive stock A, and a defensive stock D. Scenario Bust Rate of Return Aggressive Defensive Market Stock A Stock D -5% -78 -34 24 31 19 Boom Required: a. Find the beta of each stock. b. If each scenario is equally likely, find the expected rate of return on the market portfolio and on each stock. c. If the T-bill rate is 5%, what does the CAPM say about the fair expected rate of return on the two stocks? d. Which stock seems to be a better buy on the basis of your answers to (a) through (c)? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D If each scenario is equally likely, find the expected rate of return on the market portfolio and on each stock. (Enter your answers as a whole percent.) Expected Rate of Return Market portfolio % Stock A % Stock D % Consider the following two scenarios for the economy and the expected returns in each scenario for the market portfolio, an aggressive stock A, and a defensive stock D. Scenario Bust Rate of Return Aggressive Defensive Market Stock A Stock D -5% -7% -3% 24 31 19 Boom Required: a. Find the beta of each stock. b. If each scenario is equally likely, find the expected rate of return on the market portfolio and on each stock. c. If the T-bill rate is 5%, what does the CAPM say about the fair expected rate of return on the two stocks? d. Which stock seems to be a better buy on the basis of your answers to (a) through (c)? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D If the T-bill rate is 5%, what does the CAPM say about the fair expected rate of return on the two stocks? (Do not round intermediate calculation Enter your answers as a percent rounded to 2 decimal places.) Expected Rate of Return Stock A % % Stock D Consider the following two scenarios for the economy and the expected returns in each scenario for the market portfolio, an aggressive stock A, and a defensive stock D. Scenario Rate of Return Aggressive Defensive Market Stock A Stock D -5% -78 -3% 24 31 19 Bust Boom Required: a. Find the beta of each stock. b. If each scenario is equally likely, find the expected rate of return on the market portfolio and on each stock. c. If the T-bill rate is 5%, what does the CAPM say about the fair expected rate of return on the two stocks? d. Which stock seems to be a better buy on the basis of your answers to (a) through (c)? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Which stock seems to be a better buy on the basis of your answers to (a) through (c)? Better buy