Question

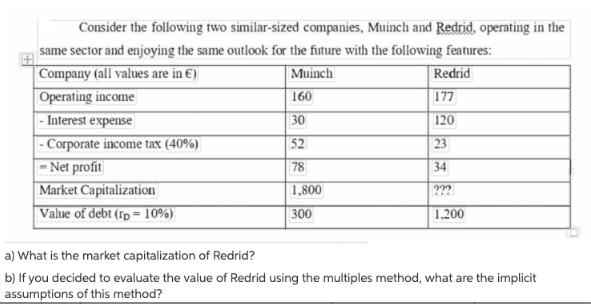

Consider the following two similar-sized companies, Muinch and Redrid, operating in the same sector and enjoying the same outlook for the future with the

Consider the following two similar-sized companies, Muinch and Redrid, operating in the same sector and enjoying the same outlook for the future with the following features: Company (all values are in ) Muinch Operating income 160 - Interest expense - Corporate income tax (40%) -Net profit Market Capitalization Value of debt (rp=10%) 30 52 78 1,800 300 Redrid 177 120 23 34 229 1333 1.200 a) What is the market capitalization of Redrid? b) If you decided to evaluate the value of Redrid using the multiples method, what are the implicit assumptions of this method?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The market capitalization of Redrid can be calculated using the net profit multiple PricetoEarnings or PE ratio and is given by the formula Market C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App