Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following two stocks. Stock BBT has an expected return of 19% and a standard deviation of 23%. Stock DIS has an expected

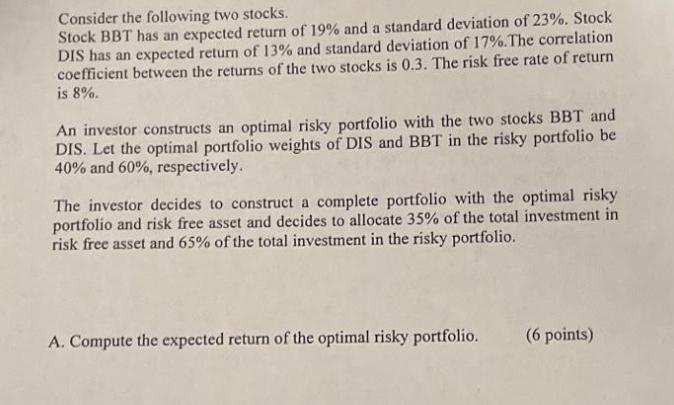

Consider the following two stocks. Stock BBT has an expected return of 19% and a standard deviation of 23%. Stock DIS has an expected return of 13% and standard deviation of 17%. The correlation coefficient between the returns of the two stocks is 0.3. The risk free rate of return is 8%. An investor constructs an optimal risky portfolio with the two stocks BBT and DIS. Let the optimal portfolio weights of DIS and BBT in the risky portfolio be 40% and 60%, respectively. The investor decides to construct a complete portfolio with the optimal risky portfolio and risk free asset and decides to allocate 35% of the total investment in risk free asset and 65% of the total investment in the risky portfolio. A. Compute the expected return of the optimal risky portfolio. (6 points) B. Compute the standard deviation of the optimal risky portfolio. (8 points) 98.1 C. What fractions of the complete portfolio C are invested in DIS and BBT? (6 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A To compute the expected return of the optimal risky portfolio you can use the weighted average of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started