Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the given set of comps for a shoe manufacturer a number of years ago. Which of the following statements is true? I) The data

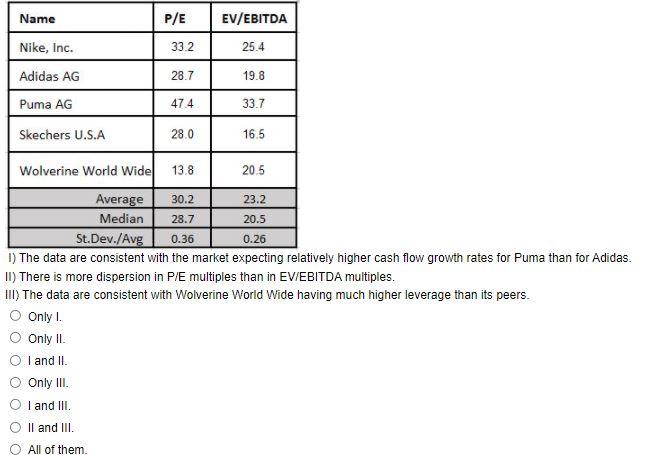

Consider the given set of comps for a shoe manufacturer a number of years ago. Which of the following statements is true?

I) The data are consistent with the market expecting relatively higher cash flow growth rates for Puma than for Adidas.

II) There is more dispersion in P/E multiples than in EV/EBITDA multiples.

III) The data are consistent with Wolverine World Wide having much higher leverage than its peers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started