Question

Consider the graph above. Suppose that the discount factor is 0.85. What is the optimal present value for the initial node A ? (Assume that

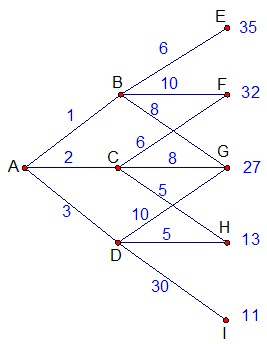

Consider the graph above. Suppose that the discount factor is 0.85. What is the optimal present value for the initial node A? (Assume that cash flows occur at the beginning of periods.)

Highlight the optimal path in the graph.

| A. | 31.56 | |

| B. | 35.63 | |

| C. | 36.45 | |

| D. | 38.91 | |

| E. | None of the above. |

2. A company has $10M to invest. There are three possible alternatives of investment: The ith alternative requires an investment of Ci and gives benefits with a present value of Pi. The following table provides values, in millions of dollar, of Ci and Pi for the alternatives.

| Alternative,i | Investment Ci | Present Value of Benefits Pi |

| 1 | 4 | 7 |

| 2 | 7 | 14 |

| 3 | 6 | 11 |

Suppose you make a decision based on the benefit-cost ratio analysis. Then you will invest in alternative (or alternatives):

| A. | 2 only | |

| B. | 3 only | |

| C. | 1 only | |

| D. | 1, 2 and 3 | |

| E. | 1 and 3 only | |

| F. | 2 and 3 only |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started