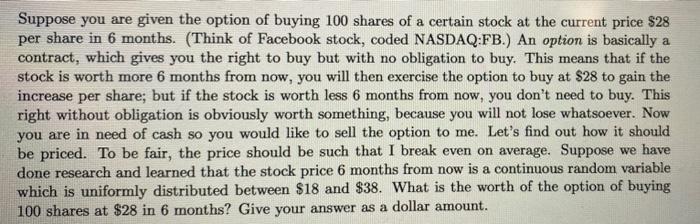

Suppose you are given the option of buying 100 shares of a certain stock at the current price $28 per share in 6 months. (Think of Facebook stock, coded NASDAQ:FB.) An option is basically a contract, which gives you the right to buy but with no obligation to buy. This means that if the stock is worth more 6 months from now, you will then exercise the option to buy at $28 to gain the increase per share; but if the stock is worth less 6 months from now, you don't need to buy. This right without obligation is obviously worth something, because you will not lose whatsoever. Now you are in need of cash so you would like to sell the option to me. Let's find out how it should be priced. To be fair, the price should be such that I break even on average. Suppose we have done research and learned that the stock price 6 months from now is a continuous random variable which is uniformly distributed between $18 and $38. What is the worth of the option of buying 100 shares at $28 in 6 months? Give your answer as a dollar amount. Suppose you are given the option of buying 100 shares of a certain stock at the current price $28 per share in 6 months. (Think of Facebook stock, coded NASDAQ:FB.) An option is basically a contract, which gives you the right to buy but with no obligation to buy. This means that if the stock is worth more 6 months from now, you will then exercise the option to buy at $28 to gain the increase per share; but if the stock is worth less 6 months from now, you don't need to buy. This right without obligation is obviously worth something, because you will not lose whatsoever. Now you are in need of cash so you would like to sell the option to me. Let's find out how it should be priced. To be fair, the price should be such that I break even on average. Suppose we have done research and learned that the stock price 6 months from now is a continuous random variable which is uniformly distributed between $18 and $38. What is the worth of the option of buying 100 shares at $28 in 6 months? Give your answer as a dollar amount