Answered step by step

Verified Expert Solution

Question

1 Approved Answer

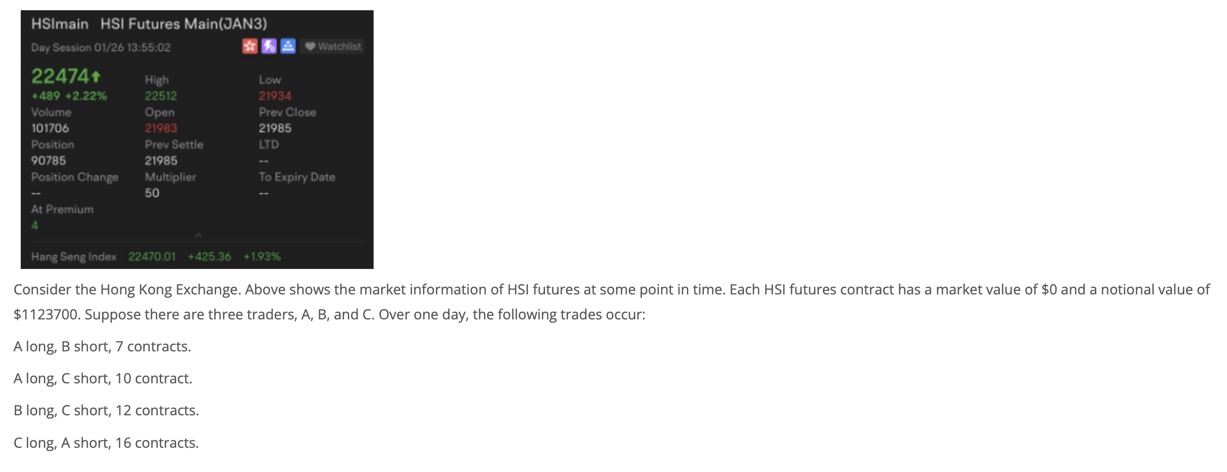

Consider the Hong Kong Exchange. Above shows the market information of HSI futures at some point in time. Each HSI futures contract has a market

Consider the Hong Kong Exchange. Above shows the market information of HSI futures at some point in time. Each HSI futures contract has a market value of $ and a notional value of

$ Suppose there are three traders, A B and C Over one day, the following trades occur:

A long, B short, contracts.

A long, C short, contract.

B long, C short, contracts.

C long, A short, contracts.

After the ABC trades, what are the updated trading volume, open interest, and the notional values of trading volume and open interest on the day in the market, assuming that traders A B and C had no position before the trades?

What is the updated trading volume number of contracts in the market? What is the updated open interest number of contracts in the market? What is the updated notional values of trading volume? What is the updated notional value of open interest in the market?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started