Answered step by step

Verified Expert Solution

Question

1 Approved Answer

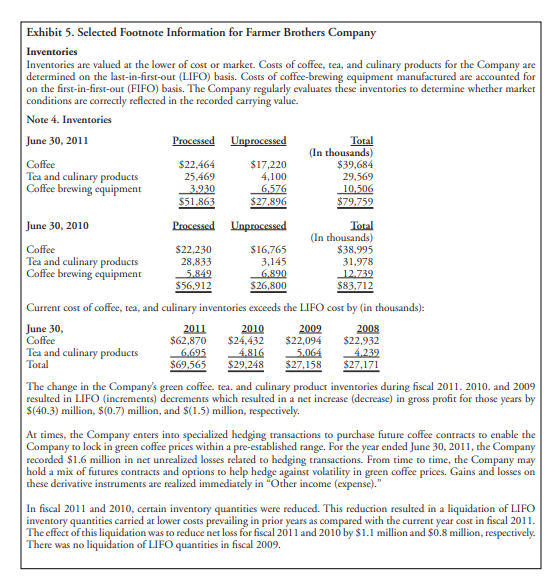

Consider the information about Farmer Brothers LIFO reserve in the footnotes. What would the companys income before taxes be in 2011, 2010, and 2009 if

Consider the information about Farmer Brothers LIFO reserve in the footnotes. What would the companys income before taxes be in 2011, 2010, and 2009 if the company had instead used FIFO, which approximates the current cost?

Exhibit 5. Selected Footnote Information for Farmer Brothers Company Inventories Inventories are valued at the lower of cost or market. Costs of coffee, tea, and culinary products for the Company are determined on the last-in-first-out (LIFO) basis. Costs of coffee-brewing equipment manufactured are accounted for on the first-in-first-out (FIFO) basis. The Company regularly evaluates these inventories to determine whether market conditions are correctly reflected in the recorded carrying value. Note 4. Inventories June 30, 2011 Processed Unprocessed Total (In thousands) Coffee $22,464 $17,220 $39,684 Tea and culinary products 25,469 4,100 29,569 Coffee brewing equipment 3.930 6,576 10,506 $51,863 $27,896 $79,759 June 30, 2010 Processed Unprocessed Total (In thousands) Coffee $22,230 $16,765 $38,995 Tea and culinary products 28,833 3,145 31,978 Coffee brewing equipment 5.849 6.890 12.739 $56,912 $26,800 $83,712 Current cost of coffee, tea, and culinary inventories exceeds the LIFO cost by (in thousands): June 30, 2011 2008 Coffee $62,870 $22,932 Tea and culinary products Total 2010 2009 $24,432 $22,094 4.816 5,064 $29,248 $27,158 6.695 4.239 $69,565 $27,171 The change in the Company's green coffee, tea, and culinary product inventories during fiscal 2011, 2010, and 2009 resulted in LIFO (increments) decrements which resulted in a net increase (decrease) in gross profit for those years by $(40.3) million, $(0.7) million, and $(1.5) million, respectively. At times, the Company enters into specialized hedging transactions to purchase future coffee contracts to enable the Company to lock in green coffee prices within a pre-established range. For the year ended June 30, 2011, the Company recorded $1.6 million in net unrealized losses related to hedging transactions. From time to time, the Company may hold a mix of futures contracts and options to help hedge against volatility in green coffee prices. Gains and losses on these derivative instruments are realized immediately in "Other income (expense)." In fiscal 2011 and 2010, certain inventory quantities were reduced. This reduction resulted in a liquidation of LIFO inventory quantities carried at lower costs prevailing in prior years as compared with the current year cost in fiscal 2011. The effect of this liquidation was to reduce net loss for fiscal 2011 and 2010 by $1.1 million and $0.8 million, respectively. There was no liquidation of LIFO quantities in fiscal 2009. Exhibit 5. Selected Footnote Information for Farmer Brothers Company Inventories Inventories are valued at the lower of cost or market. Costs of coffee, tea, and culinary products for the Company are determined on the last-in-first-out (LIFO) basis. Costs of coffee-brewing equipment manufactured are accounted for on the first-in-first-out (FIFO) basis. The Company regularly evaluates these inventories to determine whether market conditions are correctly reflected in the recorded carrying value. Note 4. Inventories June 30, 2011 Processed Unprocessed Total (In thousands) Coffee $22,464 $17,220 $39,684 Tea and culinary products 25,469 4,100 29,569 Coffee brewing equipment 3.930 6,576 10,506 $51,863 $27,896 $79,759 June 30, 2010 Processed Unprocessed Total (In thousands) Coffee $22,230 $16,765 $38,995 Tea and culinary products 28,833 3,145 31,978 Coffee brewing equipment 5.849 6.890 12.739 $56,912 $26,800 $83,712 Current cost of coffee, tea, and culinary inventories exceeds the LIFO cost by (in thousands): June 30, 2011 2008 Coffee $62,870 $22,932 Tea and culinary products Total 2010 2009 $24,432 $22,094 4.816 5,064 $29,248 $27,158 6.695 4.239 $69,565 $27,171 The change in the Company's green coffee, tea, and culinary product inventories during fiscal 2011, 2010, and 2009 resulted in LIFO (increments) decrements which resulted in a net increase (decrease) in gross profit for those years by $(40.3) million, $(0.7) million, and $(1.5) million, respectively. At times, the Company enters into specialized hedging transactions to purchase future coffee contracts to enable the Company to lock in green coffee prices within a pre-established range. For the year ended June 30, 2011, the Company recorded $1.6 million in net unrealized losses related to hedging transactions. From time to time, the Company may hold a mix of futures contracts and options to help hedge against volatility in green coffee prices. Gains and losses on these derivative instruments are realized immediately in "Other income (expense)." In fiscal 2011 and 2010, certain inventory quantities were reduced. This reduction resulted in a liquidation of LIFO inventory quantities carried at lower costs prevailing in prior years as compared with the current year cost in fiscal 2011. The effect of this liquidation was to reduce net loss for fiscal 2011 and 2010 by $1.1 million and $0.8 million, respectively. There was no liquidation of LIFO quantities in fiscal 2009Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started