Question

Consider the long run situation in the market where there is strong price competition, barber shops can change the square footage in their shop, and

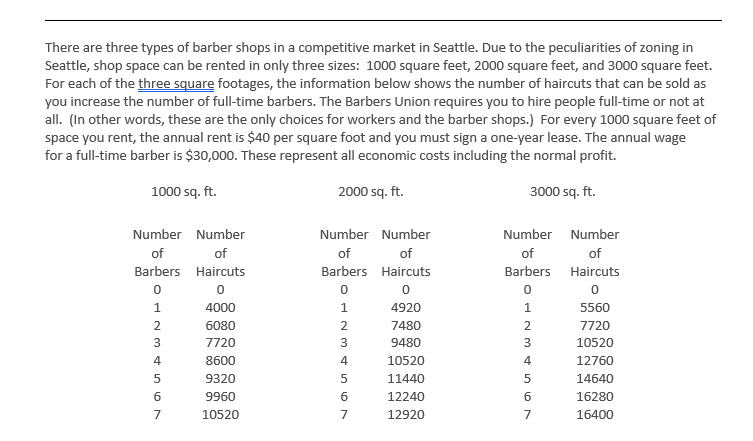

Consider the long run situation in the market where there is strong price competition, barber shops can change the square footage in their shop, and barber shops enter and exit the market. What do you anticipate will be the price in the long run? Based on that price, what will be the shop's optimal choice of shop size and number of barbers in the shop in the long run?Explain your logic.(4 points)

Net Price in Long Run equilibrium_______________.

Profit maximizing square footage in Long run equilibrium________________.

Profit maximizing number of workers in long run equilibrium _____________.

Explanation for your choices:

Answer:

Optimal workers for 1000 square feet is 2

Optimal workers for 2000 square feet is 3

Optimal workers for 3000 square feet is 5

Maximum profit for 1000 square feet is $9,440

Maximum profit for 2000 square feet is $640

Maximum profit for 3000 square feet is-$6,480 (minimum loss)

Explanation:

At profit maximization level, MC equals MR.

As long as the revenue from using another barber (MR) is greater than the cost of using that barber (MC), the shop will increase its profit by using more barbers to do more haircuts

Annual wage per barber = $30,000

Price per haircut = $18

Rent per square feet = $40

Size of shop = 1000, 2000, 3000 sq feet

Total Cost = (Rent per square feet * Size of shop) + (Annual wage per barber * Number of barbers)

Total Revenue = Number of Haircuts * Price per haircut

Marginal Cost = Total cost with n barbers - Total Cost with n-1 barbers

Marginal Revenue = Total Revenue with n barbers - Total Revenue with n-1 barbers

Size 1000 square feet

Updated the table below

Marginal Revenue with 2 barbers > Marginal Cost with 2 barbers

Marginal Revenue with 3 barbers

Optimal workers for 1000 square feet is 2

Maximum profit for 1000 square feet = Total Revenue with 2 barbers - Total Cost with 2 barbers

= $109,440 - $100,000 =$9,440

Maximum profit for 1000 square feet is $9,440

Size 2000 square feet

Updated the table below

Marginal Revenue with 3 barbers > Marginal Cost with 3 barbers

Marginal Revenue with 4 barbers

Optimal workers for 2000 square feet is 3

Maximum profit for 2000 square feet = Total Revenue with 3 barbers - Total Cost with 3 barbers

= $170,640 - $170,000 =$640

Maximum profit for 2000 square feet is $640

Size 3000 square feet

Updated the table below

Marginal Revenue with 5 barbers > Marginal Cost with 5 barbers

Marginal Revenue with 6 barbers

Optimal workers for 3000 square feet is 5

Maximum profit for 3000 square feet = Total Revenue with 5 barbers - Total Cost with 5 barbers

= $263,520 - $270,000 = -$6,480

Maximum profit for 3000 square feet is-$6,480 (minimum loss)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started