Question

Consider the market for reserves. The initial supply and demand for reserves RES s and RES 0 D are as drawn in the figure below

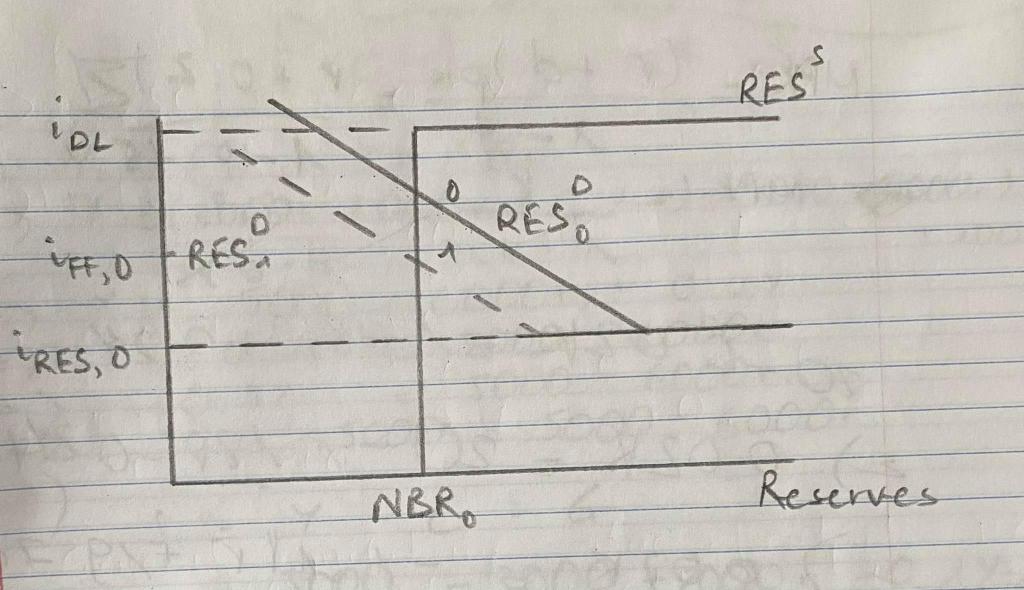

Consider the market for reserves. The initial supply and demand for reserves RESs and RES0D are as drawn in the figure below (solid lines), for the initial level of non-borrowed reserves NBR0, discount rate iDL and interest on reserves ires,0.

Point 0 identifies the initial equilibrium federal funds rate iFF,0 and level of total reserves RES0

a) Explain why the supply curve becomes horizontal at iDL.

Decrease in Demand for Reserves: Suppose from now on that banks decide to increase their loans and hence the demand for reserves decreases. This corresponds to the shift of the RESD to the dashed curve in the figure on the left (RES1D). In this case, the new equilibrium would be at point 1. However, the Fed wants to keep iFF at exactly its original level iFF,0.

b) Suppose the Fed does not want to change the discount rate iDL. Explain how the Fed can achieve its goal via Open Market Operation or changing the interest rate on reserves. Qualitatively, draw in the figure how each instrument would change either the supply or the demand for reserves. Explain carefully how each instrument shifts the curves.

c) Compare the total reserves and the NBR (which case har more NBR relative to the total reserves) under the 2 possible cases your described in part (b).

d) If in the scenario above, the Fed decides to use only Open Market Operations to keep the federal funds rate at iFF,0, what does the change in NBR imply about the size of the Feds holdings of Treasury bonds (or other asses used in IMOs) and about the size of the Feds balance sheet?

RES IDL RES, Aft0 FRES ARES, O NBRO Reserves RES IDL RES, Aft0 FRES ARES, O NBRO ReservesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started