Answered step by step

Verified Expert Solution

Question

1 Approved Answer

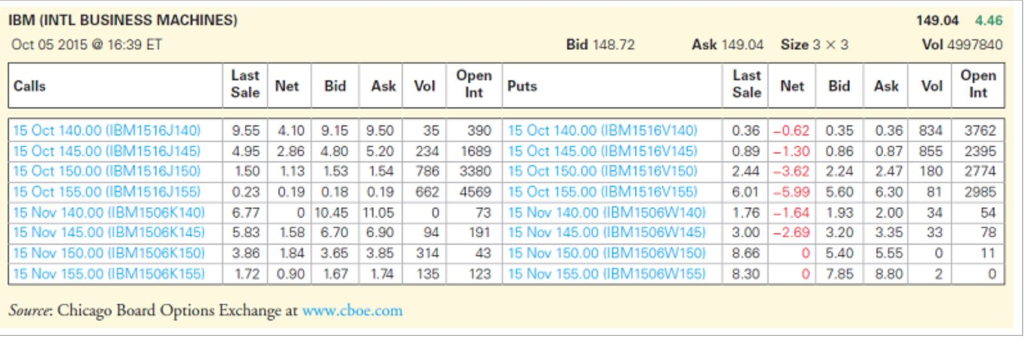

Consider the October 2015 IBM call and put options in the table, Ignoring any interest you might earn over the remaining few days' life of

Consider the October 2015 IBM call and put options in the table,  Ignoring any interest you might earn over the remaining few days' life of the options:

Ignoring any interest you might earn over the remaining few days' life of the options:

a. Compute the break-even IBM stock price for each option (i.e., the stock price at which your total profit from buying and then exercising the option would be zero).

b. Which call option is the most likely to have a return of negative 100 %?

c. If IBM's stock price is $156 on the expiration day, which option will have the highest return?

IBM (INTL BUSINESS MACHINES) Oct 05 2015 16:39 ET Calls 149.04 4.46 Vol 4997840 Ask 149.04 Size 3 x 3 Bid 148.72 Last Sale Net Bid Ask Volpen Open Puts Last Sale NetBid Ask Vol pen Puts 5 Oct 140.00 (IBM1516J140) 9.55 4.10 9.15 9.50 35 390 15 Oct 140.00 (1BM1516V140)0.36-0.62 0.35 0.36 834 3762 5 Oct 145.00 (IBMI 516J145) | 4.95 | 2.86 4.80 5.20 | 234 . 1689 | 15 Oct 145.00 (ieM 1516V145) | 0.89 |-1.30 | 0.86 . .871 855 2395 15 Oct 150.00 (IBM1516J150) 1.50 1.13 1.53 1.54 786 3380 15 Oct 150.00 (IBM1516V150) 2.443.62 2.24 2.47 1802774 5 Oct 155.00 (IBM1516 155)0.23 0.19 0.18 0.19 662 4569 15 Oct 155.00 (BM1516V155) 6.01 -5.99 5.60 6.30 81 2985 5 Nov 140.00 (IBM1506K140) 6.77 0 10.45 11.05 0 73 15 Nov 140.00 (IBM 1506W140) 1.76-1.64 1.93 2.00 34 54 15 Nov 145.00 (IBM1506K145) | 5.83 | 1.58 | 6.70 | 6.90 | 94 191 | 15 Nov 145.00 (IBM 1506W145) | 3.00 |-2.69 | 3.20 | 3.35 | 33 | 78 15 Nov 150.00 (IBM 1506K150) | 3.86 | 184 | 3.65 . 3.85 | 314 , 43 | 15 Nov 15000 (IBM1506W 150) | 8.66 | O 5.40 | 5.55 | 0 | 1 1 15 Nov 155.00 (IBM1506K155) | 1.72 0.90 | 1.67 1.74 | 135 123 | 15 Nov 155.00 (IBM 1506W155) 8.30 | 5 Nov 155.00 IBM1506K155) 1.72 0.9 167 1.74 135 Source: Chicago Board Options Exchange at www.cboe.com 123 15 Nov 155.00 (BM1506W155)8.30 0| 7.85| 8.80| 2 IBM (INTL BUSINESS MACHINES) Oct 05 2015 16:39 ET Calls 149.04 4.46 Vol 4997840 Ask 149.04 Size 3 x 3 Bid 148.72 Last Sale Net Bid Ask Volpen Open Puts Last Sale NetBid Ask Vol pen Puts 5 Oct 140.00 (IBM1516J140) 9.55 4.10 9.15 9.50 35 390 15 Oct 140.00 (1BM1516V140)0.36-0.62 0.35 0.36 834 3762 5 Oct 145.00 (IBMI 516J145) | 4.95 | 2.86 4.80 5.20 | 234 . 1689 | 15 Oct 145.00 (ieM 1516V145) | 0.89 |-1.30 | 0.86 . .871 855 2395 15 Oct 150.00 (IBM1516J150) 1.50 1.13 1.53 1.54 786 3380 15 Oct 150.00 (IBM1516V150) 2.443.62 2.24 2.47 1802774 5 Oct 155.00 (IBM1516 155)0.23 0.19 0.18 0.19 662 4569 15 Oct 155.00 (BM1516V155) 6.01 -5.99 5.60 6.30 81 2985 5 Nov 140.00 (IBM1506K140) 6.77 0 10.45 11.05 0 73 15 Nov 140.00 (IBM 1506W140) 1.76-1.64 1.93 2.00 34 54 15 Nov 145.00 (IBM1506K145) | 5.83 | 1.58 | 6.70 | 6.90 | 94 191 | 15 Nov 145.00 (IBM 1506W145) | 3.00 |-2.69 | 3.20 | 3.35 | 33 | 78 15 Nov 150.00 (IBM 1506K150) | 3.86 | 184 | 3.65 . 3.85 | 314 , 43 | 15 Nov 15000 (IBM1506W 150) | 8.66 | O 5.40 | 5.55 | 0 | 1 1 15 Nov 155.00 (IBM1506K155) | 1.72 0.90 | 1.67 1.74 | 135 123 | 15 Nov 155.00 (IBM 1506W155) 8.30 | 5 Nov 155.00 IBM1506K155) 1.72 0.9 167 1.74 135 Source: Chicago Board Options Exchange at www.cboe.com 123 15 Nov 155.00 (BM1506W155)8.30 0| 7.85| 8.80| 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started