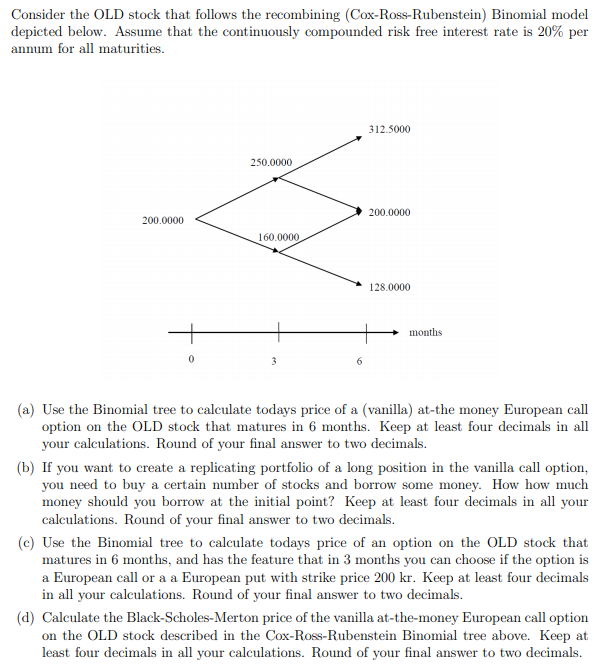

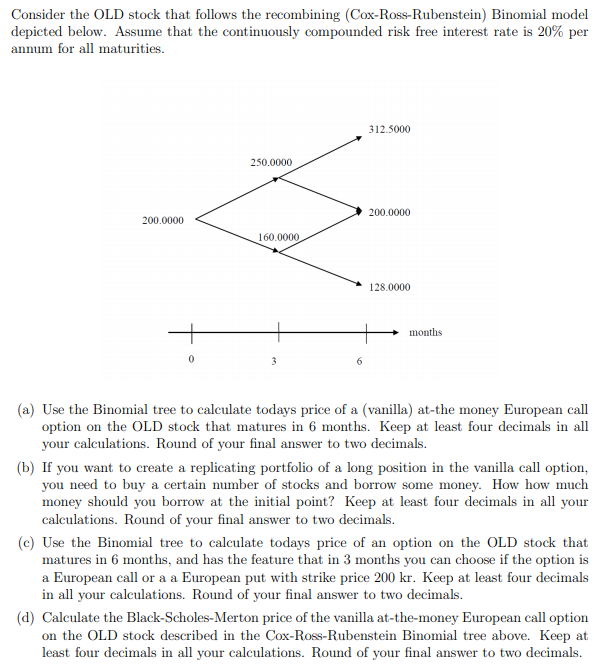

Consider the OLD stock that follows the recombining (Cox-Ross-Rubenstein) Binomial model depicted below. Assume that the continuously compounded risk free interest rate is 20% per annum for all maturities. 312.5000 250.0000 200.0000 200.0000 160.0000 128.0000 months 3 6 (a) Use the Binomial tree to calculate todays price of a (vanilla) at the money European call option on the OLD stock that matures in 6 months. Keep at least four decimals in all your calculations. Round of your final answer to two decimals. (b) If you want to create a replicating portfolio of a long position in the vanilla call option, you need to buy a certain number of stocks and borrow some money. How how much money should you borrow at the initial point? Keep at least four decimals in all your calculations. Round of your final answer to two decimals. (C) Use the Binomial tree to calculate todays price of an option on the OLD stock that matures in 6 months, and has the feature that in 3 months you can choose if the option is a European call or a a European put with strike price 200 kr. Keep at least four decimals in all your calculations. Round of your final answer to two decimals. (d) Calculate the Black-Scholes-Merton price of the vanilla at-the-money European call option on the OLD stock described in the Cox-Ross-Rubenstein Binomial tree above. Keep at least four decimals in all your calculations. Round of your final answer to two decimals. Consider the OLD stock that follows the recombining (Cox-Ross-Rubenstein) Binomial model depicted below. Assume that the continuously compounded risk free interest rate is 20% per annum for all maturities. 312.5000 250.0000 200.0000 200.0000 160.0000 128.0000 months 3 6 (a) Use the Binomial tree to calculate todays price of a (vanilla) at the money European call option on the OLD stock that matures in 6 months. Keep at least four decimals in all your calculations. Round of your final answer to two decimals. (b) If you want to create a replicating portfolio of a long position in the vanilla call option, you need to buy a certain number of stocks and borrow some money. How how much money should you borrow at the initial point? Keep at least four decimals in all your calculations. Round of your final answer to two decimals. (C) Use the Binomial tree to calculate todays price of an option on the OLD stock that matures in 6 months, and has the feature that in 3 months you can choose if the option is a European call or a a European put with strike price 200 kr. Keep at least four decimals in all your calculations. Round of your final answer to two decimals. (d) Calculate the Black-Scholes-Merton price of the vanilla at-the-money European call option on the OLD stock described in the Cox-Ross-Rubenstein Binomial tree above. Keep at least four decimals in all your calculations. Round of your final answer to two decimals