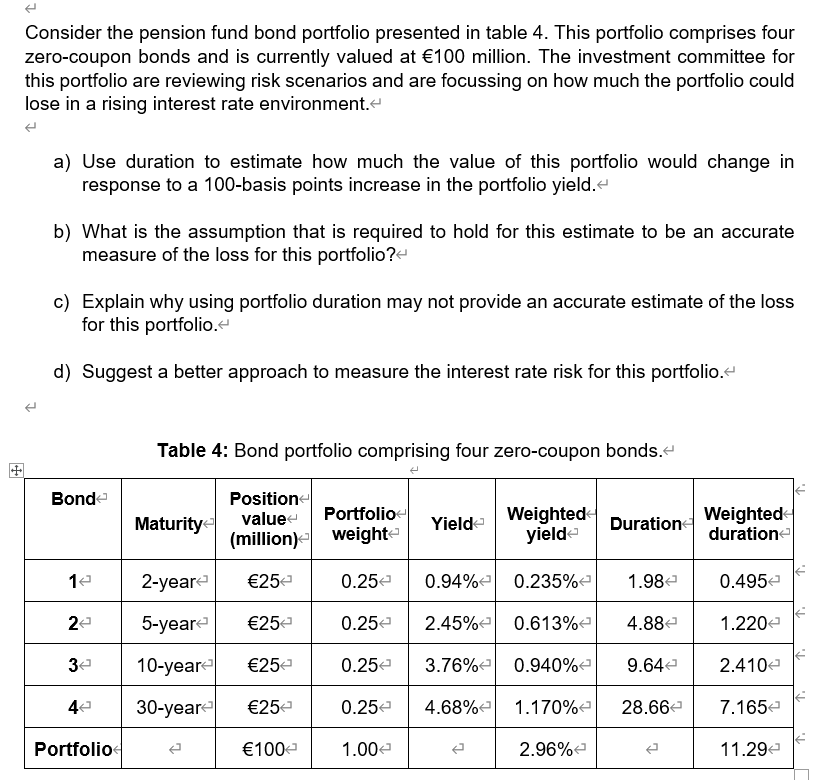

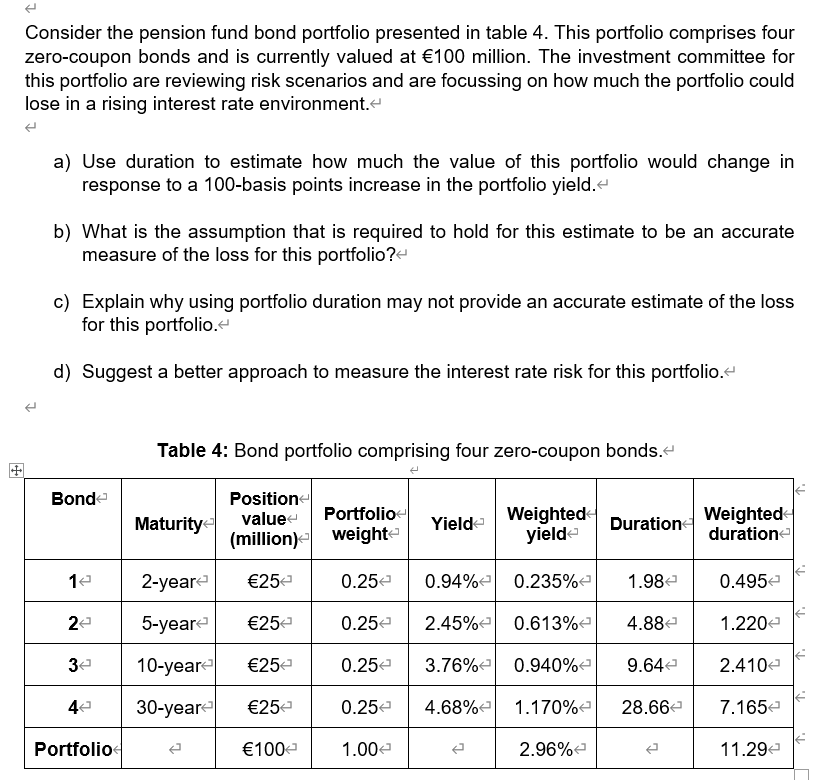

Consider the pension fund bond portfolio presented in table 4. This portfolio comprises four zero-coupon bonds and is currently valued at 100 million. The investment committee for this portfolio are reviewing risk scenarios and are focussing on how much the portfolio could lose in a rising interest rate environment. a) Use duration to estimate how much the value of this portfolio would change in response to a 100-basis points increase in the portfolio yield. b) What is the assumption that is required to hold for this estimate to be an accurate measure of the loss for this portfolio? c) Explain why using portfolio duration may not provide an accurate estimate of the loss for this portfolio. d) Suggest a better approach to measure the interest rate risk for this portfolio.

table 4. This portfolio comprises four zero-coupon bonds and is currently valued at 100 million. The investment committee for this portfolio are reviewing risk scenarios and are focussing on how much the portfolio could lose in a rising interest rate environment. a) Use duration to estimate how much the value of this portfolio would change in response to a 100-basis points increase in the portfolio yield. b) What is the assumption that is required to hold for this estimate to be an accurate measure of the loss for this portfolio? c) Explain why using portfolio duration may not provide an accurate estimate of the loss for this portfolio. d) Suggest a better approach to measure the interest rate risk for this portfolio.

Consider the pension fund bond portfolio presented in table 4. This portfolio comprises four zero-coupon bonds and is currently valued at 100 million. The investment committee for this portfolio are reviewing risk scenarios and are focussing on how much the portfolio could lose in a rising interest rate environment. a) Use duration to estimate how much the value of this portfolio would change in response to a 100-basis points increase in the portfolio yield. b) What is the assumption that is required to hold for this estimate to be an accurate measure of the loss for this portfolio? c) Explain why using portfolio duration may not provide an accurate estimate of the loss for this portfolio. d) Suggest a better approach to measure the interest rate risk for this portfolio. Table 4: Bond portfolio comprising four zero-coupon bonds. Bond Maturity Duration Weighted duration Position value Portfolio Yield Weighted (million) weight yielde 252 0.250 0.94% 0.235%- 252 0.252 2.45% 0.613% 12 2-year 1.982 0.4952 2 5-year- 4.882 1.2202 32 10-year- 252 0.25e 3.76% 0.940% 9.642 2.4102 42 30-year- 252 0.25 4.68% 1.170% 28.66 7.165 Portfolio 1004 1.002 2.96% 11.29 Consider the pension fund bond portfolio presented in table 4. This portfolio comprises four zero-coupon bonds and is currently valued at 100 million. The investment committee for this portfolio are reviewing risk scenarios and are focussing on how much the portfolio could lose in a rising interest rate environment. a) Use duration to estimate how much the value of this portfolio would change in response to a 100-basis points increase in the portfolio yield. b) What is the assumption that is required to hold for this estimate to be an accurate measure of the loss for this portfolio? c) Explain why using portfolio duration may not provide an accurate estimate of the loss for this portfolio. d) Suggest a better approach to measure the interest rate risk for this portfolio. Table 4: Bond portfolio comprising four zero-coupon bonds. Bond Maturity Duration Weighted duration Position value Portfolio Yield Weighted (million) weight yielde 252 0.250 0.94% 0.235%- 252 0.252 2.45% 0.613% 12 2-year 1.982 0.4952 2 5-year- 4.882 1.2202 32 10-year- 252 0.25e 3.76% 0.940% 9.642 2.4102 42 30-year- 252 0.25 4.68% 1.170% 28.66 7.165 Portfolio 1004 1.002 2.96% 11.29

table 4. This portfolio comprises four zero-coupon bonds and is currently valued at 100 million. The investment committee for this portfolio are reviewing risk scenarios and are focussing on how much the portfolio could lose in a rising interest rate environment. a) Use duration to estimate how much the value of this portfolio would change in response to a 100-basis points increase in the portfolio yield. b) What is the assumption that is required to hold for this estimate to be an accurate measure of the loss for this portfolio? c) Explain why using portfolio duration may not provide an accurate estimate of the loss for this portfolio. d) Suggest a better approach to measure the interest rate risk for this portfolio.

table 4. This portfolio comprises four zero-coupon bonds and is currently valued at 100 million. The investment committee for this portfolio are reviewing risk scenarios and are focussing on how much the portfolio could lose in a rising interest rate environment. a) Use duration to estimate how much the value of this portfolio would change in response to a 100-basis points increase in the portfolio yield. b) What is the assumption that is required to hold for this estimate to be an accurate measure of the loss for this portfolio? c) Explain why using portfolio duration may not provide an accurate estimate of the loss for this portfolio. d) Suggest a better approach to measure the interest rate risk for this portfolio.