Answered step by step

Verified Expert Solution

Question

1 Approved Answer

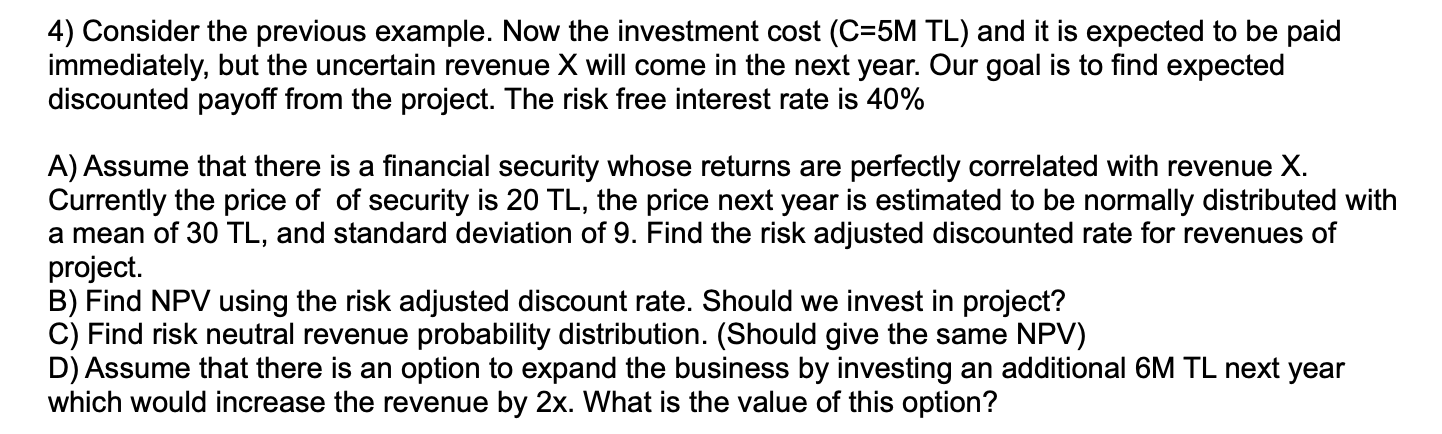

Consider the previous example. Now the investment cost ( C = 5 M T L and it is expected to be paid immediately, but the

Consider the previous example. Now the investment cost and it is expected to be paid

immediately, but the uncertain revenue will come in the next year. Our goal is to find expected

discounted payoff from the project. The risk free interest rate is

A Assume that there is a financial security whose returns are perfectly correlated with revenue

Currently the price of of security is the price next year is estimated to be normally distributed with

a mean of and standard deviation of Find the risk adjusted discounted rate for revenues of

project.

B Find NPV using the risk adjusted discount rate. Should we invest in project?

C Find risk neutral revenue probability distribution. Should give the same NPV

D Assume that there is an option to expand the business by investing an additional TL next year

which would increase the revenue by What is the value of this option?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started