Answered step by step

Verified Expert Solution

Question

1 Approved Answer

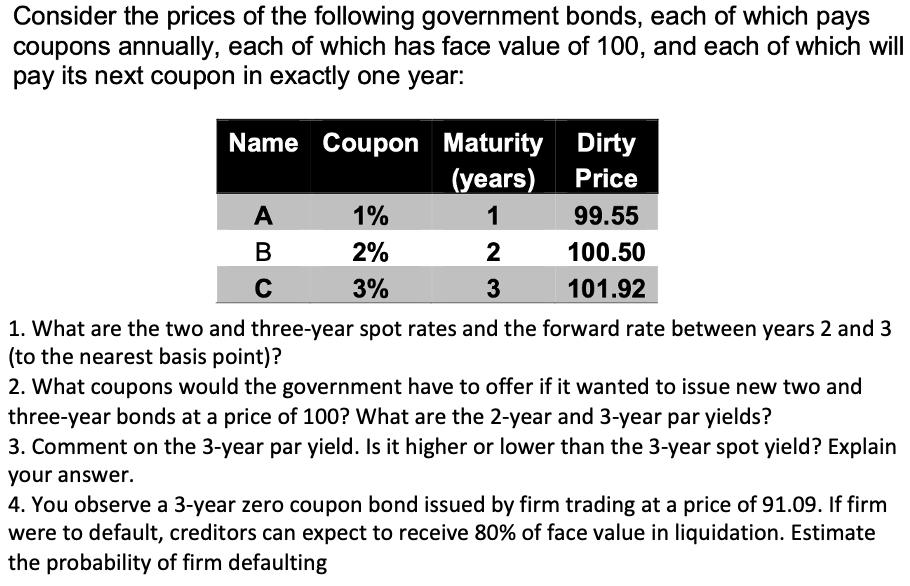

Consider the prices of the following government bonds, each of which pays coupons annually, each of which has face value of 100, and each

Consider the prices of the following government bonds, each of which pays coupons annually, each of which has face value of 100, and each of which will pay its next coupon in exactly one year: Name Coupon A B C 1% 2% 3% Maturity (years) 1 2 3 Dirty Price 99.55 100.50 101.92 1. What are the two and three-year spot rates and the forward rate between years 2 and 3 (to the nearest basis point)? 2. What coupons would the government have to offer if it wanted to issue new two and three-year bonds at a price of 100? What are the 2-year and 3-year par yields? 3. Comment on the 3-year par yield. Is it higher or lower than the 3-year spot yield? Explain your answer. 4. You observe a 3-year zero coupon bond issued by firm trading at a price of 91.09. If firm were to default, creditors can expect to receive 80% of face value in liquidation. Estimate the probability of firm defaulting

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 What are the two and three year spot rates and the forward rate between years 2 and 3 to the nearest basis point ANS WER Two year spot rate 1 95 Thr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started